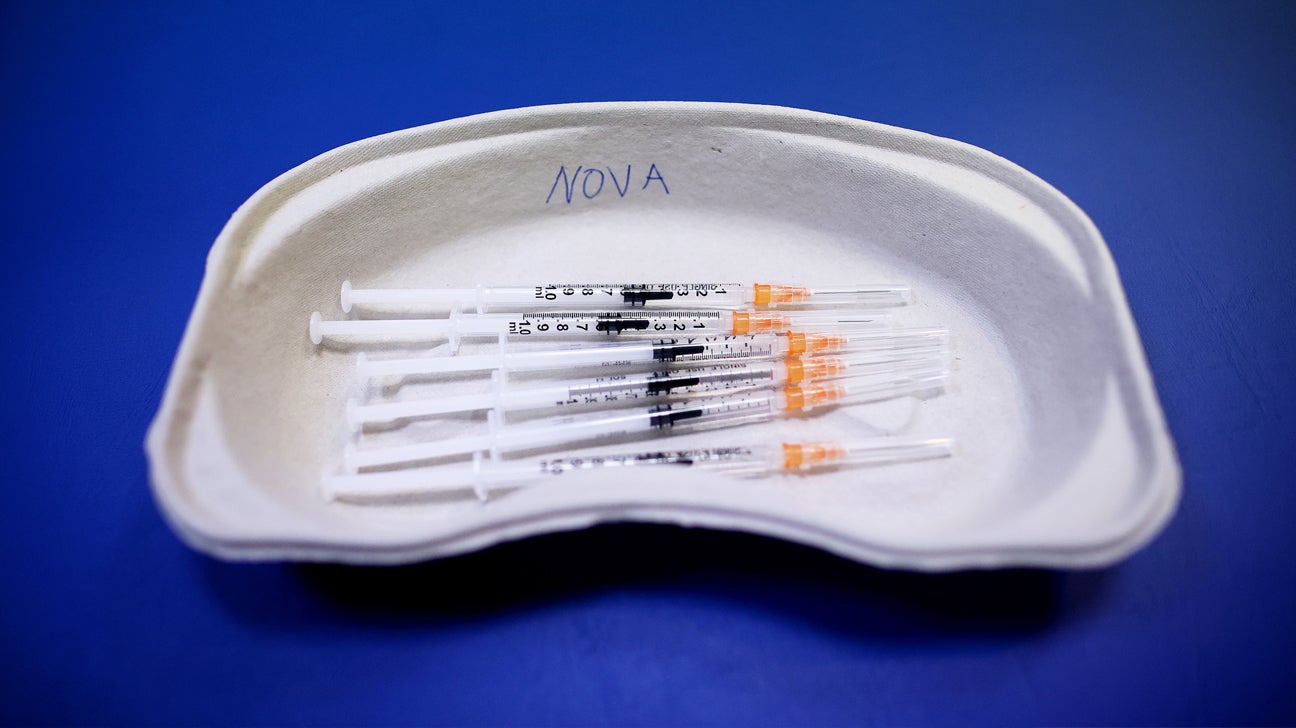

Sanofi and Novavax Inc. have reached a licensing agreement that requires the marketing of a vaccine capable of protecting against both influenza and the Covid-19 virus. According to a statement published on Friday, Novavax was set to receive $700 million in milestones related to research, regulatory matters, and launch. In addition, they were going to receive advance payments of $500 million. As part of the agreement, Sanofi will also acquire a minority stock interest in Novavax, accounting for around five percent of the company’s shares.

Sanofi and Novavax Inc. have reached a licensing agreement that requires the marketing of a vaccine capable of protecting against both influenza and the Covid-19 virus. According to a statement published on Friday, Novavax was set to receive $700 million in milestones related to research, regulatory matters, and launch. In addition, they were going to receive advance payments of $500 million. As part of the agreement, Sanofi will also acquire a minority stock interest in Novavax, accounting for around five percent of the company’s shares.

This licensing agreement has had a positive impact on Novavax’s stock value. Following the pre-market activity in New York, Novavax shares increased by as much as 49 percent. This increase is significant considering the decline in stock value the company experienced over the past year, reaching around fifty percent.

The collaboration between Sanofi and Novavax brings together two major players in the vaccine industry who unfortunately missed the opportunity to rapidly develop and commercialize Covid-19 vaccines during the pandemic. Unlike more agile messenger-RNA developers like Pfizer, BioNTech, and Moderna, Sanofi and Novavax struggled with unsuccessful attempts and suffered significant losses in sales, amounting to tens of billions of dollars.

Starting from next year, Sanofi will have exclusive rights to promote sales of Novavax’s Covid-19 injectable globally, with the exception of India, Japan, and South Korea, where Novavax has already negotiated advance purchase arrangements. Additionally, Sanofi is the only pharmaceutical company allowed to use Novavax’s protein-based Covid injection alongside its own flu immunization. This combination is expected to provide patients with enhanced convenience and protection against two respiratory viruses.

In return, Sanofi will be granted a license to use Novavax’s Matrix-M adjuvant in future vaccine formulations. However, this license is not exclusive to Sanofi, as Novavax will retain the right to independently fund the development of its own combination Covid-19 vaccine in the future.

The agreement has also had a positive impact on Sanofi’s stock, with a small increase during early trading in Paris. Nevertheless, the stock had experienced a decline of almost five percent over the previous twelve months.

For Novavax, this licensing agreement comes at a crucial time as the company is currently undergoing a reorganization due to a challenging 2023. They even issued a going concern warning regarding their ability to continue operating. However, this agreement allows Novavax to continue conducting business, which is a significant advantage.

In terms of financials, Novavax reported a net loss of $148 million for the first quarter, a considerable decrease from the $294 million loss they experienced during the same period the previous year. Despite these challenges, the company now has the opportunity to benefit from the partnership with Sanofi.

In conclusion, the licensing agreement between Sanofi and Novavax represents a significant collaboration in the vaccine industry. It not only provides Sanofi with exclusive rights to promote Novavax’s Covid-19 injectable globally but also allows for the use of Novavax’s Matrix-M adjuvant in future vaccine formulations. For Novavax, this agreement comes at a crucial time and offers them the opportunity to continue conducting business.