Dr Nadeem ul Haque, currently Vice Chancellor of Pakistan Institute of Development Economics (PIDE) at Quaid-i-Azam University, Islamabad, has previously served as the deputy chairman of the Planning Commission of Pakistan. Dr. Haq also worked for IMF for 24 years. Mr Shahid Sattar, now Executive Director & Secretary General of All Pakistan Textile Mills Association (APTMA), largest exporting group in the country, has previously served as Member Planning Commission of Pakistan and an advisor to the Ministry of Finance, Ministry of Petroleum, Ministry of Water & Power.

In a joint piece of far-reaching significance, these two minds argue that all governments—whether democratic or not—have been given to short term economic management, sacrificing long term growth prospects. Projects have been preferred to policy. Projects too have been chosen for populist reasons rather than the needs of sustained economic progress. Public sector entities (PSE), ministries, Public Sector Development Programs (PSDP) and agencies have been extensively used for political purposes. No wonder that expenditures were out of control and forced the governments into the poisonous embrace of donors – that resulted in total surrender of policymaking to expediency.

Governments have neglected Growth

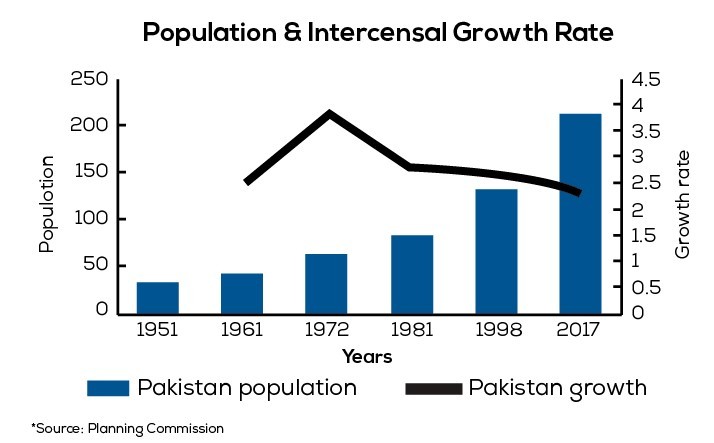

Pakistan requires an economy to grow consistently at 7-8 per cent for the coming 30 years if our youth bulge is to be employed. 10 years ago, we made this point in the Planning Commission Framework of economic growth of 2011. The potential of our youth is being wasted as this truth is really not becoming an accepted theme in the media and popular discourse.

Read more: What’s driving Pakistan’s stock exchange?

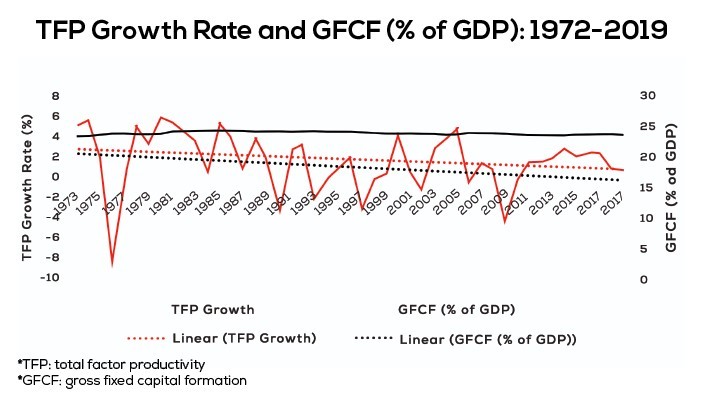

What should be done to make this happen? Let us review the past and then see where we should go. Over the last 4 decades, Pakistan’s average GDP growth has remained on average about 5% and its average investment rate around 15%. Growth, productivity and even investment not only remained much lower than our neighbors, but has also shown a declining trend.

There has to be widespread recognition that business as usual will not allow us to meet the needs of our growing population. As a result, social indicators that we lament—poverty, malnutrition, health and welfare outcomes—will all continue to deteriorate. Donor dependence All governments—whether democratic or not have been given to short term economic management, sacrificing long term growth prospects. Projects have been preferred to policy.

Projects to have been chosen for populist reasons rather than the needs of sustained economic progress. Public Sector Entities (PSEs), ministries, Public Sector Development Program (PSDP) and agencies have been used for political purposes. It is no wonder that expenditures were out of control and forced the governments into the fold of donors.

Read more: Pakistan’s inflation rate to decrease by 4.8 percent: IMF

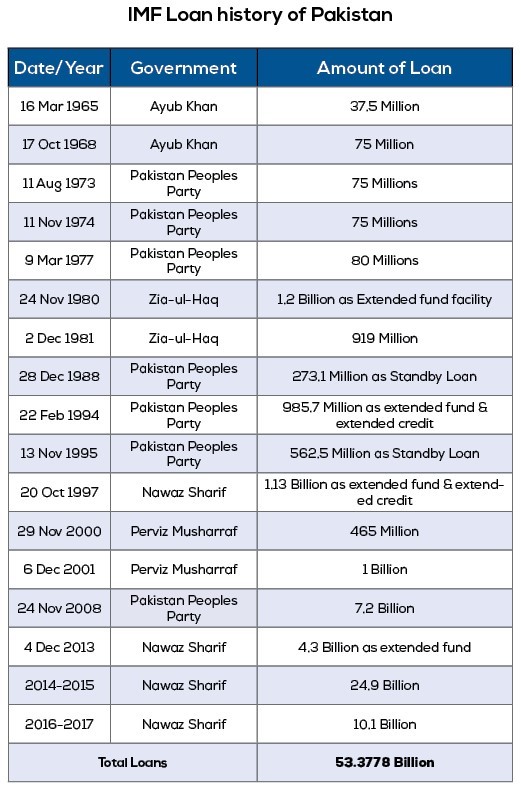

Through our history, we have been in the emergency ward of the world—the IMF. Most of every decade has been in an IMF program ceding policy to the IMF—a testimony to every government’s inability to frame long-term policy for a stable growing economy.

Rather than focus on required policy and reform, all governments have sought to finance away our problems. Donor assistance, and now even loans are sought regardless of cost and long-term consequences. Donor consultants have made most of our economic laws which have been passed without adequate scrutiny to lead to increasing issues and problems.

Uncontrolled debts and fake reforms

PSEs losses are mounting. Energy sector debts have been piling up for the last decade or more. Contingent liabilities are rising in agricultural transactions which continue despite research advising governments to discontinue these activities. Import policy designed to protect cars and other products has not only hurt industrial development but also adversely affect ed exports. Case in point is the long-running subsidy on resin for polyester which has prevented the growth of polyesters and blended products.

To obtain more loans, Pakistani governments have stopped making and owning policy. Energy sector unbundling, competition law, public financial management law, civil service capacity building, tax reforms, education reforms, mortgage laws and many other responsibilities have been outsourced to the donors with our past administrations being an unwilling and unengaged partner. No wonder the results have been insipid.

Low and declining investment rates

Chasing policies and loans from abroad have created a lackluster administration with many adverse effects. Unable to control expenditures and acceding to wasteful demands, the pressure has been placed on taxation. Pressured by IMF and various donors but lacking the research capacity to make a good policy, governments have resorted again and again to adopt arbitrary and whimsical taxes.

Read more: A look back at Pakistan’s exports in 2020

Volatile tax policy combined with deteriorating administration continued to remain short of covering the uncontrollable and rising expenditures. Rather than research and reform tax policy and administration for efficiency and growth-friendliness, donors and the policymakers chose to vilify the Pakistani citizenry as tax thieves.

There has been a constant stream of accusations leading to increased documentation to place greater costs on businesses and transactions. To make matters worse, tax authorities hold back tax rebates to meet incredible commitments on revenue collection to the IMF. This is nothing but further taxation on business. Starving a business of its much needed funds could even be an existential threat.

Read more: Pakistan’s way forward out of recurring economic crises

Similarly, when the energy system, because of policy and administrative failures, runs deficits, the response is to pass on the prices to the consumer. Now Pakistan’s energy prices are highest in the region, a huge burden on domestic business. This does not seem to worry any government. Instead, they look to the foreign investor. In the past, foreign investment has been attracted without thought to negotiation, fine print or consequences. This lax attitude led to losses on RekoDiq, IPPs, Karke etc.

Uncompetitive Internationally

By now it should be obvious how for decades, growth employment and longer-term policy has never been of concern to any Pakistani government. Crisis mode has prevailed in the power circles. In addition, the easy option of accepting donor prescriptions has led to eroding all capacity for good governance at home. Not surprisingly, exports have struggled with high energy costs, policy uncertainties, lack of liquidity from withheld tax refunds. This is clearly visible in the performance of exports in relation to GDP in the last 3 decades.

Read more: Pakistan’s economic prosperity: What could be possible spoilers?

Occasionally, they grow but then they fall back; presumably country’s growth is choked off by costs that government policy places on the exports. The country’s inward-oriented trade policies have served as a substantial roadblock to integration in regional and global value chains. While modern-day production networks rely on components of final goods being able to move with ease through multiple countries, protectionism has made this process inefficient and costly in Pakistan.

Tariffs and other duties on imports ultimately serve as a tax on exports; as on intermediate inputs, these can be up to four times higher than in East Asia. Furthermore, average tariffs on final goods in Pakistan are 50 percent higher than the average for South Asia, and almost three times as high as the average for East Asia. (World Bank)

Pakistan: Coming decades

Let us face it, the economy is not the primary concern of anyone in the country. The media is a clear indicator of this. Economic programs on tv happen very infrequently and often draw no audience. Newspapers and TV cover the economy as government and donor pronouncements and as uncovering of corruption scandals. Media wakes up at the budget time or when a government pronouncement is to be made.

Civil society is also more concerned with rights, civil-military divide and foreign policy issues. Deeper issues of policy, productivity and investment receive no attention.

If Pakistan is to achieve the growth acceleration required by the demographic picture above, trends described above have to change. This means the way we do business in the government and the business must change. The policy will have to be taken seriously by all—government civil society, media, the private sector, courts as well as the army.

In 2011, the Planning Commission made a “Framework for Economic Growth (FEG)” after many consultations with academia. Though approved by the NEC, it was ignored by all else. FEG analysis was also presented extensively in the book “Looking Back: How Pakistan Became an Asian Tiger in 2050 (LB2050)).”

Read more: Unlocking Dead Capital to unleash the Asian Tiger in Pakistan

The central proposition of the FEG was that for Pakistan to transform its society and economy to become an Asian Tiger growing at 7-8%, extensive reform must be made in our governance and policymaking processes, our market development, the way we manage our cities and our public and private sector and how our community and society is evolving. The FEG is captured in this logo

- Simply put economic activity and investment happens in the markets and the cities under the umbrella of a watchful government concerned for the welfare of all. Welfare is made through not only government policy but also in communities and social organizations.

- At the heart of society is a thoughtful, watchful and concerned government—emphasis on “thoughtful, watchful and concerned.” Hence the main set of required are reforms in making such a government. In particular, we need to bring back thought and policy to the government by curtailing the outsourcing of policy to donors. The government must build up policymaking research capacity and process.

- Investment and economic activities require well-functioning and well-regulated markets where competition for the provision of goods and services happens curtailing malfeasance. Such markets promote entrepreneurship and innovation which is at the core of all development. Once again this requires “thoughtful, watchful and concerned” government and regulation.

- Investment opportunities abound in cities. Industry, commerce, innovation, markets, entertainment health and a myriad of other activities all take place in self-aware and self-governing, market-friendly cities. Yet our cities are managed in systems designed in colonial times, overregulated, with no identity and governed from afar. A simple example of this is the question that we have frequently asked: “why are there no tower cranes in our cities?” This is clearly an indication of the overregulation of our cities.

- Communities and civil societies are very important to underpin social policy and foster social entrepreneurship. Again, suspicious and over-powering governance has stifled community. Inadequate and uncertain governance, law and order and justice system have further undermined the development of trust and social capital in our community.

Looking at this little synopsis of the FEG, which we think is still applicable to our situation. At the heart of our analysis lie the following terms “thoughtful, watchful and concerned”, overregulation, suspicious government, modernizing systems and laws. This will require a huge “thought and debate effort” in the country. Here media, all levels of government, civil societies, universities and many other societal organizations must come together. A vigorous debate based on research and thought must take place.

Read more: “Remarkable turnaround” in economy despite Covid-19: PM Khan

In our view, if this is done the future of Pakistan is bright. There is enough pent-up opportunity that it will be unleashed fast. Growth will pick up very quickly. Estimates and scenarios of how this could happen are presented in FEG and LB2050. But it will require hard work and considerable thoughtful leadership.

We hope this will happen soon. The opportunity of youth must be cashed fast. Or it could become a substantial social cost and destabilizing fact through disaffection and lack of opportunity.