Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan are all landlocked but historically tied to the Silk Road trade routes. The Central Asian region-comprising Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan-is a diverse region with geographic extremes and severe temperature oscillations.

Historically, Central Asia has been the center of ‘the Great Game’ between the British and the Russian Empires. Central Asia, the heart of Eurasia, pregnant with rich natural resources, is now strategically important, with China and Russia in the vicinity and Washington calling Central Asia as America’s ‘final frontier.’

Central Asia has a mix of upper, middle, and low-income countries. Kazakhstan has the world’s largest reserves of chromite, zinc, and lead. Kazakhstan also is in the top ten suppliers of iron ore, gold, copper, and manganese. Turkmenistan has almost 5 percent of the world’s natural gas.

Pakistan’s annual trade turnover with Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan is under a billion dollars a year, less than one percent of Pakistan’s global trade volume. The prime minister’s adviser on commerce, Abdul Razak Dawood, has plans to enhance the annual trade turnover to $1.5 billion a year.

Read more: Finding Pakistan’s missing exports

“We are too restricted to a few countries-North America, European Union and China,” said Dawood. “But there is a much bigger world.” Yes, there’s a ‘much bigger world,’ but does the world need what Pakistan produces? Secondly, are we competitive in delivering what the world needs? Almost three-quarters of our entire export supply chain is cotton related-cotton fields, cotton ginning factories, spinning capacity, weaving, printing, and our readymade garments industry.

We are the 4th largest producer of cotton after China, the US, and India. Around 1.3 million Pakistani farmers cultivate cotton on an area of more than 6 million acres. We have more than a thousand ginning factories and nearly 500 spinning units. Our textile industry has a total processing capacity of 5.2 billion square meters of cloth.

Pakistan’s textile industry employs 30 percent of the 72 million national labor force and accounts for more than 50 percent of all exports. Our regular buyers are global brands including H&M, Nike, Adidas, Puma, Levis, and Target. Our largest export destination is the United States that takes in 19 percent of all our exports.

China, at 8.4 percent, is the 2nd largest export destination. Collectively, the US, the UK, Germany, the Netherlands, Spain, Italy, Belgium, France, Canada, Poland, Portugal, and Australia take in 54 percent of all our exports (Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan did not even make it to the table because of low trade volumes).

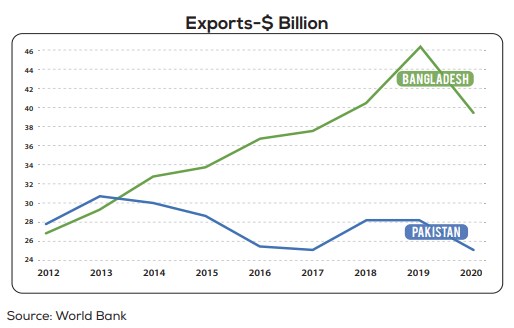

Over the past decade, Pakistan’s textile exports have faced competition from Bangladesh, India, China, and Vietnam. Over the past decade, “Pakistan’s share of global textile exports decreased from 2.2 percent to 1.7 percent; Bangladesh’s share increased from 1.9 percent to 3.3 percent and India’s share went up from 3.4 percent to 4.7 percent.”

Energy Costs: The first challenge

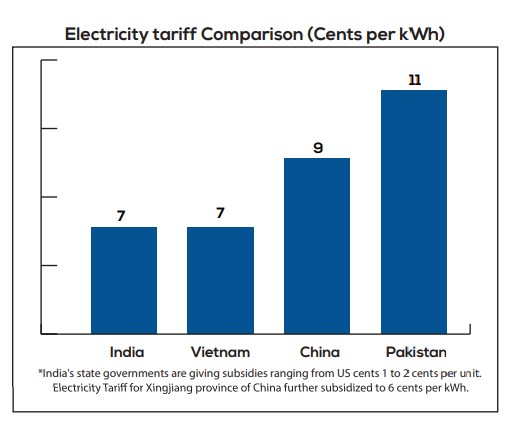

According to the All Pakistan Textile Mills Association (APTMA), “Energy cost is more than 30 percent of the total conversion cost in spinning, weaving and processing industries.” Industrial gas tariff in “Pakistan is 100 percent higher whereas electricity tariff is 50 percent higher compared to regional competitors.”

Read more: Regional Connectivity: Vital Element of Economic and National Security

Furthermore, “electricity is burdened with various surcharges which represents excessive line losses, theft and system inefficiencies.” Pakistan’s textile exporters suggest “that gas and electricity tariffs should be in-line with the competitor economies e.g. Bangladesh, India and Vietnam.” The same lobbies state that “while the supply of energy has improved… cost per unit has not come down.”

Obviously, the textile industry “can not pass on system inefficiencies to its international buyers.” In Pakistan, the average electricity bill of a spinning unit has gone up from Rs 2.5 million a month to Rs 7.5 million a month. Pakistan now has the highest rate of taxation on electricity-as high as 55 percent. The highest rate outside of Pakistan is around 20 percent.

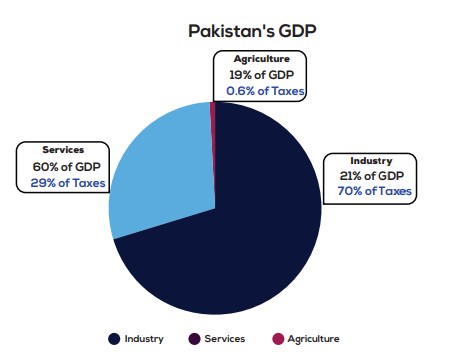

Distortions in the tax system: The second challenge

Pakistan’s tax regime has an anti-industry bias. The industrial sector is 21 percent of the GDP, but it contributes 70 percent of the taxes. The agriculture sector is 19 percent of the GDP but only contributes 0.6 percent of the taxes.

Last year, the Federal Board of Revenue (FBR) “admitted in a closed-door meeting that the quantum of refund claims has increased to Rs 578 billion.” The export lobby suggests that “general sales (GST) and other tax related rebates must be provided on all exports through an automatic adjustment.”

Exchange rate regime: The third challenge

Textile exporters believe that “an overvalued exchange rate should be allowed to gradually adjust to its equilibrium value. This will benefit the key export-oriented industries in the longer run.” They further suggest that the “management of exchange rate policy should also take into account the fast changing value of currencies in the competitor economies.”

Customs processing: The fourth challenge

According to the World Bank, the efficiency of the customs clearance process (1=low to 5=high) Pakistan stands at 2.662 and India at 3.17 (Singapore is at 4.179). Exporters insist that the “time taken for custom clearance must be reduced in order to facilitate exports, especially for perishable items. In case of delays in clearance of perishable items, there must be a mechanism of public-private risk sharing. The customs software at land route trading posts often suffers due to lack of efficient internet connectivity. This allows officials to resort to manual customs processing in turn also opening the doors for rent seeking.”

Cartel pricing: The fifth challenge

The electricity cartel, the sugar cartel, the fertilizer cartel, and the automotive cartel; these cartels are holding Pakistan’s competitiveness hostage. As per a UN report, Pakistan’s elite takes away $17.4 billion a year, every year, in underserved ‘economic privileges.’ Unless cartel pricing is snatched away from cartels, Pakistan’s industry will be unable to produce an exportable surplus that is competitively priced in the global marketplace.

Research and development (R&D): The sixth challenge

Neither the public nor the private sector spends much on R&D. Our entire cotton sector suffers from “low yields, poor quality, inefficient farming methods, and postharvest losses.” In 2021, Pakistan, the 4th largest cotton producer, became a major importer of cotton. Experts claim that “climate change and different biotic stresses are causing reduction in cotton production.”

The answer lies in R&D, “cotton biotechnology, acquiring cotton leaf curl virus-resistant insect-resistant, and improving fiber quality…..the use of molecular markers and gene cloning for cotton germplasm improvement.”

In December 2020, a co-publication titled ‘Pakistan Reviving Growth through Competitiveness’ by the Asian Development Bank and the Islamic Development Bank identified seven ‘critical constraints’-low investment, high cost of finance; poor financial intermediation; low physical capital; low human capital; weak institutions and macroeconomic risks.

Read more: Circular Debt: Pakistan’s Bleeding Wound? Tabish Gauhar Explains

According to the ADB, “Pakistan’s overall ranking for innovation capability on the Global Competitiveness Index is quite low (79th out of 141), but it does reasonably well on entrepreneurial culture (59th out of 141).” Pakistan and Uzbekistan have agreed to “finalise bilateral Preferential Trade Agreement (PTA).”

Pakistan has free trade agreements with Sri Lanka, China, and Malaysia. Pakistan has bilateral investment agreements with Australia, Azerbaijan, Mauritius, Bahrain, Bangladesh, Morocco, Belarus, Netherlands, Oman, Philippines, Bosnia, Portugal, Bulgaria, Qatar, Cambodia, Romania, China, Singapore, Czech Republic, South Korea, Denmark, Spain, Egypt, Sri Lanka, France, Sweden, Germany, Switzerland, Indonesia, Syria, Iran, Tajikistan, Italy, Tunisia, Japan, Turkey, Kazakhstan, Turkmenistan, Kuwait, UAE, Kyrgyz Republic, United Kingdom, Lebanon, Uzbekistan, Laos, and Yemen.

Nothing substantial has come out of these agreements. According to the Asian Development Bank, “Pakistan’s failure to export more and better goods is the result of many shortcomings. To remedy this, greater policy attention and investment needs to be given to industries where the country has a long-established presence.”

Pakistan has invested hundreds of billions into developing a cotton-related export supply chain for the past seven decades. Yes, over the long term, we must also try and establish non-traditional export destinations.

Read more: Pakistan’s electricity dynamics: Status quo & future direction

However, our real focus in the immediate to the medium-term should be to make Pakistan more competitive in our traditional, textile-dominated export destinations- the US, the UK, Germany, the Netherlands, Spain, Italy, Belgium, France, Canada, Poland, Portugal, and Australia. That’s where our competitive advantage lies. That’s where our focus can actually make a difference, sooner rather than later.

Dr. Farrukh Saleem, an economist, is a prominent public policy commentator in Pakistan. He has worked extensively with international development organizations and has been associated with Center for Research & Security Studies (CRSS). His columns have appeared in The News and The Dawn and he has been a TV Anchor with 92 News. He did his doctorate from Western Illinois University, United States.

The views expressed in the article are the author’s own and do not necessarily reflect the editorial policy of Global Village Space.