In recent years the concept of “Debt Trap” has been the highlight of the international media and think tank circles. It is no secret that China’s rise as a global economic power is seen as a ticking bomb by most western countries that are competing with it in trade and economy. Concepts and theories like these are deliberately developed for the containment of China. The debt trap theory is associated with an Indian academic named Brahma Chellaney who first coined the term in the year 2017.

Within 12 months it became the most popular subject of discussion among international media organizations targeting China’s economic interests. According to this theory, the creditor extends an excessive amount of money in the form of a loan to the debtor with nefarious intentions to extract the debtor’s economic and political concessions if the debtor for financial reasons is unable to repay the loans back.

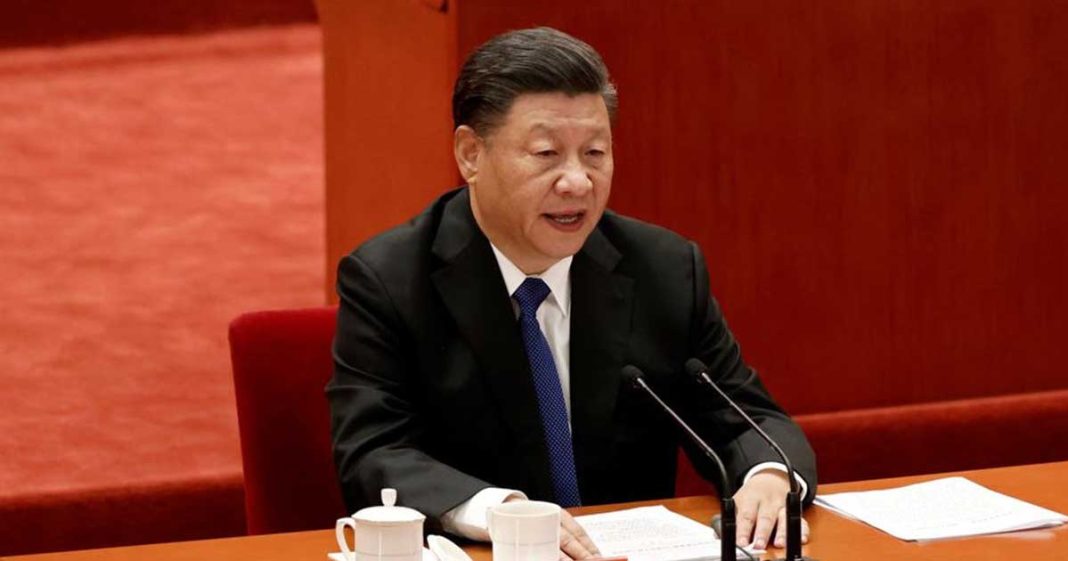

Read more: Chinese President Xi warns against Cold War in Asia-Pacific

What is the Chinese ‘Debt Trap Diplomacy’?

China is accused of pursuing a diplomatic policy of debt trap, which means luring poor countries into high-interest loan deals for building unsustainable infrastructure projects and when there is a financial crisis for repaying back the loan, China can seize their assets which include infrastructure, land, ports and even interfere and influence their internal politics and military affairs to achieve its strategic geopolitical goals. This theory also suggests that the conditions of loans are deliberately not made public due to them being villainous in nature. It is associated with Chinese diplomacy and international projects linked to the Belt and Road Initiative (BRI).

According to the advocates of this theory, China lends money to developing countries that are not able to repay unsustainable amounts of loans which forces them to give strategic leverage to China. Nonetheless, after close analysis of this concept with an unbiased and objective mindset, in context with John Perkins’ book ‘Confessions of an Economic Hitman’, the theory of debt trap seems more relevant to the practices conducted by the International Monetary Fund (IMF) and World Bank rather than China’s economic initiatives.

Read more: Good news: UK allows Pakistani travellers with Chinese vaccines

Theory entirely debunked

Multiple types of research have been conducted on this particular topic and have entirely debunked the whole myth of ‘China’s debt trap diplomacy’ once and for all. According to an international political economic professor at Johns Hopkins University named Deborah Brävtigam, this theory is more likely to be a “meme” as it is developed due to “human negativity bias” based on fear of China. In a research conducted in 2019 by Prof Deborah Brävtigam, the paper found that most of the countries that signed loan deals with China were on a voluntary basis and they had a rather positive experience working with their Chinese partners.

Prof Deborah also states that the theory lacks substantive evidence. According to a report by Lowy Institute in 2019, the study finds that China was neither the primary driver nor responsible for the rising debt risks in the Pacific region which she is accused of. In another article by Lowy Institute in 2020 stated that Sri Lanka’s Hambantota International port is portrayed as an example of China’s debt trap project but in reality, it is nothing but a myth. Facts indicate that Hambantota International port was proposed by the former Sri Lankan president Mahinda Rajapaksa and not by the Chinese as some people give the impression.

Another study by China-Africa Research Institute in 2020 showed that China is willing to restructure and renegotiate the terms and conditions of the existing loans and that China has not seized any assets of Sri Lanka let alone the Hambantota International port.

Myths and facts face to face

With Sri Lanka, Malaysia is also often shown as the “victim” of BRI’s debt trap projects, in fact, most of the controversial projects under BRI were initiated by the recipient governments rather than the Chinese. And the debt problems that arose in these countries were mainly the product of corruption and misconduct by government elites and western dominated capital markets.

Read more: Pakistani envoy invites Chinese NEV enterprises to invest in Pakistan

Another accusation that critics of BRI make in the context of the Hambantota International port is that there is a strong possibility that China may use the strategic location of the port to dock their naval warships and vessels which is seen as an obvious threat to the Americans in the Indian ocean but in reality, both the Chinese government and the Sri Lankan government have an agreement that the port will not be used for docking Chinese naval vessels or other military purposes instead the port will house Sri Lankan southern naval command.

Lowy Institute’s study also points out that “the recipient governments want projects that will serve their own interests and agendas, shaped by their need and greed. Political elites of a government may often use infrastructure projects to gain political support and obtain kickbacks”. In addition to that weak government institutions and corruption further, contribute as an obstacle for a project to be successful. As a result of these hiccups, China’s role in BRA’s financing is often seen as a negative one.

Is Pakistan caught in the Chinese debt trap as well?

Rhodium Group, another research institute’s study frequently indicated an outcome in favor of the recipient rather than China. In 2019 the same research institution conducted an analysis of 40 Chinese debt re-negotiations and found that “the seizure of country’s assets was a very rare occurrence” the most common outcome was a debt write-off. In the context of Pakistan, the critics of BRI are also strong critics of Pakistan-China cooperation in BRI’s flagship program the China-Pakistan-Economic-Corridor (CPEC).

e often hear accusations that China is also debt trapping Pakistan with unsustainable projects and high interest rate loans in regards to CPEC which Pakistan is unable to pay back because of its fragile economic situation and seizure of assets by the Chinese might be the ultimate outcome. An American research lab called AidData also made similar remarks in their recent report claiming that Pakistan has a China debt problem, there are hidden loans and that CPEC lacks transparency. Dismissing these remarks, Pakistan’s Minister of Planning and Development Asad Umar stated that Pakistan has no “China debt” problem. He further added that the loans taken for CPEC for private power projects were relatively cheaper than the loans Pakistan had taken from international agencies such as Asian Development Bank and World Bank and that there are no hidden debts in the context of CPEC as claimed in the report.

Read more: Pakistan has potential to grow and export good quality tea: Chinese expert

In simple words, the following are the two reasons that indicate the myth of China’s debt-trap diplomacy in the context of BRI. The BRI is an economic project and a few hiccups and setbacks in an economic or infrastructure project cannot in any way lead to China’s hegemonic and geo-political ambitions if any. Almost all the projects under the BRI are recipient-driven therefore it is not possible for China to dictate to other countries unilaterally what should and what shouldn’t be built on the recipient’s territory. This gives us the conclusion that the whole rhetoric propagating China’s debt-trap diplomacy was based on the fear of China’s economic emergence in the world and that there is no substantial evidence to support this concept making it a mere hoax.

The writer has a master’s degree in Mass Communication from the National University of Modern Languages, Islamabad who writes on geopolitics, international developments and strategic affairs with a special focus on Af-Pak affairs, Asia and the Middle East. He can be reached at asim.khanpakistan@