Pakistan has been convulsed by power outages since 1990s and this has hampered the growth of the manufacturing and services sector along with disrupting the routine lives of the citizens. According to the report released by Macro Economic Insights, this electricity crisis is estimated to have cost the economy at least 2 per cent of GDP annually in terms of lost output –and a further 1.2 per cent of GDP each year, on average, in terms of fiscal costs to the budget between FY2007 to FY2019. From an economic perspective, it is distressing to see the circular debt that stood at Rs.1.2 trillion in 2018 presently stand at a giant Rs.2.3 trillion (December 2020). The report explains how having excess installed capacity and not enough cash flow in the system to run it gives rise to the ‘circular debt’ issue.

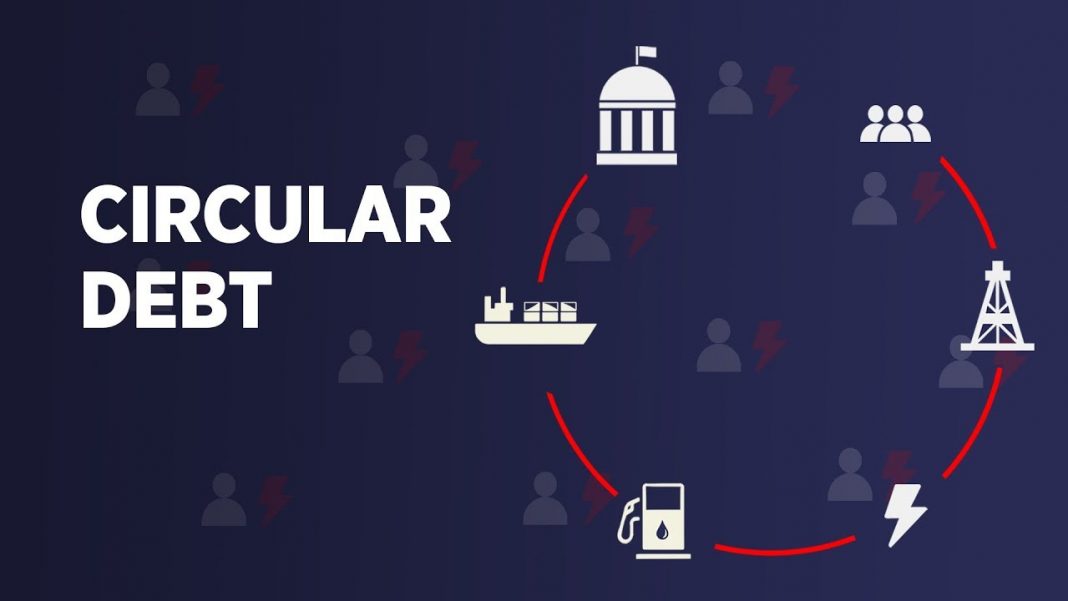

The circular debt issue in Pakistan’s energy supply chain refers to cash flow shortfall incurred in the power sector from the non-payment of obligations by consumers, distribution companies, and the government. Keeping in mind, its magnitude and its effects on other facets of the economy, this issue can be termed as one of Pakistan’s foremost macro-economic challenges, said the report.

According to a study by the World Bank, 66.7% of the businesses in Pakistan consider electricity shortages as a more significant obstacle to sustainability than corruption (11.7%) and crime/terrorism (5.5 %).

Read More: Energy Security key for Pakistan’s progress

Pakistan’s power crisis has cost US$82billion in lost GDP between 2007 and 2020. In per capita terms, the power crisis has cost each Pakistani Rs. 43,504 during this period, with Rupee per capita GDP lower by 23 per cent as a result, revealed the Macro Economic Insights report. It further said that the buildup of circular debt has impacted new investment and job creation and has also hurt the industry and exports. It stated that the lower GDP growth cost approximately 0.9 to 1.6 million jobs a year, on average, between 2007 and 2018. At the lower-bound, this amounts to a cumulative 10.9million jobs that could have been saved and/or created during the 12-year period.

Financial system at risk due to circular debt

The Macro Economic Insights report also underlined the structural causes for the rising circular debt. It said that the high cost of electricity generation; tariff anomalies, including a significant difference between cost-recovery and notified tariffs; stubbornly high transmission and distribution losses coupled with low recoveries; unaddressed governance issues in the sector are all to blame for this burgeoning circular debt that has emerged in the power sector.

Read More: National grid station to provide electricity for CPIC projects

The report stated that this issue has led to the destabilization Pakistan’s fiscal management and has imposed prohibitive opportunity costs in terms of pre-empting government spending on infrastructure and social expenditure. It further revealed that the fiscal costs to the budget have amounted to a further 1.2 per cent of GDP each year, on average, between FY2007 to FY2019. Total budgetary support to the power sector has amounted to Rs. 3,202 billion (US$31.4billion at the average exchange rate). The combined welfare costs of the power crisis are likely to be significantly higher. The Macro Economic Insights report dubbed it as a threat to the country’s economic security.

Mitigation Measures

This issue faced by the incumbent government has now aggravated to an extent where the national exchequer can lose billions of dollars in case of default of capacity payments to IPP’s.

The report stated that a comprehensive roadmap for dealing with the electricity circular debt issue has been provided on a number of occasions in the recent past by a government-appointed committee (2015), the industry regulator (NEPRA) in its state of the industry reports and most recently, by the report of the government-appointed Committee for power sector audit, circular debt resolution and future roadmap (March 2020).

These recommendations include deferring planned new generation capacity, retiring older GENCOs, prioritizing supply of natural gas to efficient plants within IPPs by curtailing supply to CPPs and inefficient GENCOs, eliminating tariff subsidies for higher-income groups in the short run. In the medium term, the suggestions are to increase the share of renewable energy (RE) in the generation mix, integrate the CPPA-Gand KE systems, make WAPDA independent of any political influence, introduce smart metering, encourage better regulatory action by NEPRA, restructure/privatize DISCOs and make provinces a part of the solution. Coming to the long run, it was recommended to transition from the current single-buyer model to a competitive multi-player market.

Read More: Privatization of DISCOs- PEPCO forms a committee

The report however says that a resolution is not in sight as the circular debt stock is conservatively projected to increase to over Rs. 4,900 billion by FY2025 (an increase of 2.04 times from current level) under the best-case scenario which includes strong reforms. Unless more concerted and robust measures are taken by the present government, electricity circular debt stock would continue to rise significantly over the next several years, it added.