Engro Polymer & Chemicals Limited (EPCL) is the sole manufacturer of PVC resin in Pakistan. Besides this, the company also produces Chlor Alkali products like Caustic Soda, Sodium Hypochlorite and Hydrochloric Acid.

It is a subsidiary of Engro Corporation, involved in the manufacturing, marketing, and distribution of PVC under the brand name ‘SABZ’ and other quality Chlor-Vinyl allied products.

Engro Polymer and Chemicals is Pakistan’s multi-billion-dollar company, which saw the highest every profitability since its establishment in 1997. In its IPO, Rs. 3 billion shares were issued, and the company’s IPO was oversubscribed by 5.4 times.

Its PVC plant has a capacity of 295 Kilo Tons per Annum (KTA) (after expansion) while EDC and VCM have the respective capacities of 127 and 204 KTA.

Read More: Engro taking the lead on sustainability

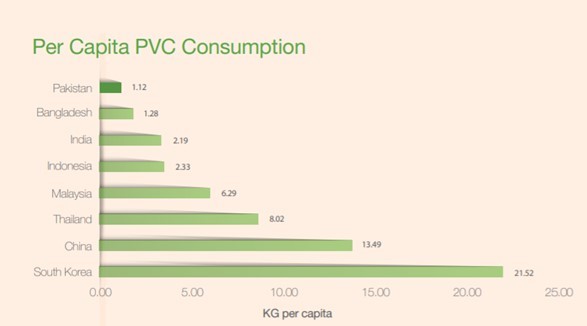

South Asia has been one of the crucial markets in the vinyl world due to its supply deficits both for PVC and feedstocks. With the high population growth, the market of PVC is expected to grow, especially in the construction sector.

Especially, keeping in mind the government’s focus on affordable housing, expected improvement in economic growth the country’s per capita PVC consumption is expected to increase in the years to come and converge towards international levels.

Keeping the same view in mind, AKD Securities has also predicted an upward trend in the price of EPCL, due to increased PVC Ethylene margins and EPCL’s new expansion of 50 percent of the existing plant’s capacity.

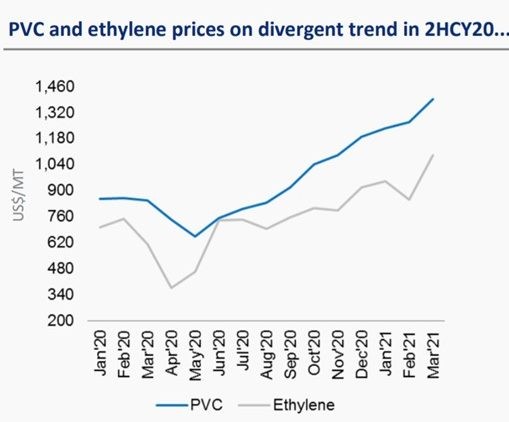

According to the AKD analysis, “the PVC ethylene margins have recently surpassed ~US$1,000/MT in Mar’21 on the back of force majeure declared by PVC capacities in the US and, soft ethylene prices amid a recent wave of global capacity expansion resulting in excess ethylene supply.”

All of this is coming at an optimum time for EPCL as its new expansion of PVC capacity by 100K tons that went online on 1st Match and debottlenecking exercise for VCM (Vinyl Chloride Monomer), a gas used in the production of PVC will enable the company to meet the demand in the market.

EPCL being the sole supplier in Pakistan caters to 70 percent of local PVC demand. The supply sector has been hugely hurt due to lockdown around the world driving the prices of PVC up. This has thus led to a bull cycle in PVC prices which are up 100/30% FYTD/CYTD.

However, global ethylene production capacity has gone up in the past and is expected to grow by 2023. This has kept the ethylene prices in check. According to AKD, the ethylene prices are up only 31/13% FYTD/CYTD lagging a 45/25% FYTD/CYTD increase in global crude oil prices. Global oil price is forecasted to stay in the range of US$55-60 over the next two years.

According to AKD securities, with the current expansion by EPCL, it is able to cater to 100% of the local demand in the coming times, while still operating at 90 percent capacity.

AKD has forecasted a 4% increase in PVC demand in the local market in CY21-23F, given the incentives by the government and other factors of the economy.

Read More: Ghias Khan on how Engro aims to help Pakistan expand economic growth by 2030

It is also worth mentioning that besides PVC, the Engro Polymer & Chemicals Limited is also venturing into Linear Alkyl Benzene Sulphonic Acid (24K MT capacity of LABSA – used to produce household detergents) and Hydrogen peroxide (27K MT capacity – used in bleaching processes in textile, pulp, and paper industries).