The fixed tax regime is due to expire by December 2021. It was introduced in April 2020 to mitigate the effect of the global Corona pandemic and to support and increase the economic activity in Pakistan. In a multipronged approach tackling the devastating economic impact of the pandemic, Prime Minister Imran Khan introduced a fixed tax regime along with an amnesty scheme.

Read More: Amnesty Scheme should be extended

Last year, meeting the demands of the construction sector, the PM extended the fixed tax regime till December 2021, under Tax Laws (Amendment) Ordinance, 2020, but under pressure from the IMF, did not extend the amnesty scheme, which expired in June 2021.

The new provision section 100D was introduced in the Income Tax Ordinance, 2001 (the ‘Ordinance’); further, necessary Rules to that effect have been enacted by insertion of the Eleventh Schedule to the Ordinance. They prescribed a schedule-based fixed tax regime for Builders and Developers, where they registered as such with the FBR on a project to project basis, based on the project area regarding their income from the sale of building or sale of plots, for the tax year 2020 and onwards.

The fixed tax regime differentiates between the rural and urban areas and within urban areas (Lahore, Karachi, Islamabad, etc.). As per this regime, taxes have been significantly reduced for all types of construction, and the government introduced a fixed tax for the construction of a square foot area.

For example, 1 square foot constructed area – you would pay Rs.125 sqft. So, for example, if you built two 10 marla houses, and 5000 square feet area each – and sold them– means you would pay fixed tax for both only Rs.1,250,000. However, for low-cost housing units under the Naya Pakistan housing scheme, 90 percent of taxes have been waived off, and the investor is left to pay only 10 percent of the tax.

Read More: Why the Naya Pakistan Housing Scheme is a game changer

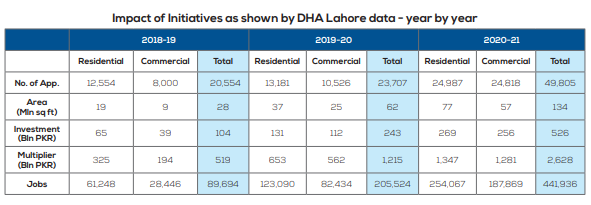

The difference with this particular scheme has been that individuals could only benefit from the fixed tax regime and amnesty if they invested in the construction sector, and it was not a general amnesty. With these exemptions introduced by the government, the construction sector naturally saw an uptick in investments and, to date, projects worth Rs. 1172 Bn have been registered on the FBR portal.

With the increase in investments from the private sector to promote the construction activity, the expected economic turnover as a consequence of these projects is estimated to be around Rs 5,859 Bn, with its impact ranging from promotion of the 71 allied industries to job employment.