According to Nadeem Akhtar, a political analyst, “Double-digit growth in India and China were unimaginable 40 years back. It was only when they finally embraced the market economy and opened up for international trade the pace of development gained momentum. Pakistani economy has to break free of the political shackles for the sake of the future of the teeming millions.”

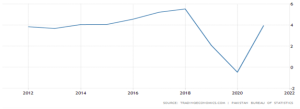

The economy of Pakistan has been hovering at a growth rate of about 4%, which is well below the rate required for meaningful economic growth. The country is experiencing a rapidly increasing population which, unfortunately, have not been exploited to their true potential. In order to create employment opportunities for this growing population, there is a need for growth to be sustained at approximately 7-8% for at least another decade. Therefore, issues that have kept the growth rate in the country undesirably low need to be actively addressed and solutions must be sought.

Read more: Trade Credit: A Basic Building Block for Industry

GDP growth rate of Pakistan from the period 2012-2021

Economic performance in the country can be characterized by structural bottlenecks, low savings and investment and persistently high circular debt. Additionally, political challenges, bureaucratic procedures, lack of security and the undesirable situation of the domestic industry, due to lack of effective government policy and reforms have constrained ease of doing business in the country and have led to high costs and lack of productivity and innovation in the domestic industry.

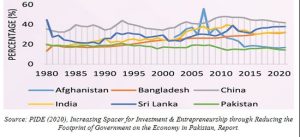

There is government intervention in the marketplace which has strained businesses and has sabotaged their capacity to work at their full potential. The government in Pakistan exercises control through various state-owned enterprises, direct market interventions and mass ownership of land and capital. Industries in Pakistan experience lengthy and time-consuming government regulatory frameworks which result in excessive paperwork, rent-seeking, high transaction costs, trade barriers and overall strain on the business environment in the country, ranking Pakistan low on the ‘Quality of Regulation’ Index. Furthermore, excessive protectionist policies by the government have inhibited the growth of competitive markets, leading to deep-rooted inefficiencies.

An evolving and perhaps the most pressing issue prevalent in the country is that of persistently high energy-related accumulated costs, better known as circular debt. The last 4-to 5 governments have failed to resolve this issue and it has been continuously mushrooming, such that it has now reached an alarming atomic catastrophe level. There is an extremely high circular debt of Rs 2.5 trillion in the power sector and that of Rs 1.2 trillion in the gas sector. Fundamentally, this has arisen because of a skewed energy pricing structure in the country which makes recovery difficult from consumers cross-subsidizing uneconomic supplies. These discrepancies strongly signal the inefficiencies, mismanagement, corruption and inadequate planning exhibited by the government-owned distribution companies and agencies in the country.

The recent Competitive Trading Bilateral Contracts Market (CTBCM) power sector initiative, aimed towards wholesale competition in the power sector, is a classic case study on how to not develop a framework of reforms. The initiative severely lags on practical grounds. With long-term generation contracts in the power sector, there is no place for free suppliers, therefore generation competition is not likely to be achieved in the near future. Renegotiation of all Power Purchase Amending agreements of existing Independent Power Plants is one way to free up some power generation and guarantee 50% of capacity, with the balance traded through wheeling or sold directly from a power exchange on a B2B basis.

Read more: Productivity now, sustainability forever

Wheeling or third-party access in the gas and power sector is the first step towards the development

However, NEPRA has long been unable to implement wheeling, despite repeated directives to DISCOs to implement. Obstructions such as unreasonable and irrational costs in wheeling charges under CPPA’s proposal have hindered the formation of a free and competitive power market.

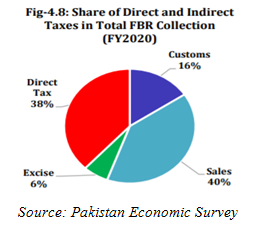

In Pakistan, the government is immersed in almost all major sectors such as agriculture, power and gas sector, banking, construction, as well as daily market activities. Additionally, government regulations carried out by the FBR in the form of Statutory Regulatory orders are a regular source of government intervention and hinder the competitiveness of markets in the economy.

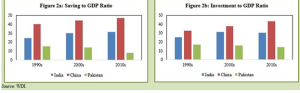

A paper published by Mr. Raja Rafiullah and Dr. Nadeem ul Haque reveals that the government’s total footprint is as high as 67% of the total economy. This confirms the unignorable, dominant presence of the government and the consequent crowding out of the private investment. Pakistan has long been caught in a low saving-investment trap. Factors such as low income, high double-digit inflation, persistent macroeconomic instability and a low growth rate in Pakistan have all led to a historically low savings rate in the country.

A low income denotes that there is not enough money to save and generally, a lower propensity to save, especially in the presence of increasing costs and heightening inflation. Moreover, the country’s growing population and a large degree of unemployment have resulted in a high dependency ratio, which has further put pressure on savings. Other important determinants of saving behavior include culture and preferences which reveal that in Pakistan, people have a higher tendency to spend than save. A low savings rate in turn degenerates the volume of funds available for investment, resulting in a lack of capital accumulation, which is an important prerequisite for much-needed industrialization and economic growth in the country.

Another major reason for low investment rates in the country is the inordinate government regulations in the country which deter the ease of doing business. “Although a range of factors amalgamates together to cause low investment rates, one reason that hinders private investment is the heavy footprint of the government on the economy”, according to a paper published by Mr. Raja Rafiullah and Dr. Nadeem ul Haque. All of these factors, along with the political and economic instability in the country have led to exorbitantly low savings and investment in the country.

Read more: Debunking the relationship between exports and currency devaluation

Investment as a percentage of GDP in Pakistan and Regional Countries

To set foot on the path of sustainable economic growth, it is vital to increase investments in the country by way of enhanced savings which can be brought by encouraging a saving culture within the country through financial schemes and better incentives for saving. Provision of employment opportunities for the large bulk of the unemployed population will reduce the dependency ratio in the country and people will have enough income left to be able to save.

Enhanced savings will lead to higher investment and capital accumulation in the country

Both of which are significant facets of economic growth and prosperity. Furthermore, ameliorating the overall business environment in the country is of utmost importance. There is a need to put an end to the inefficient practices of the government in order to ensure productivity, efficiency, innovation and competitiveness, which would only be possible by way of deregulation, decentralization and privatization in the marketplace and eventually adopting a free market economy.

In a market economy, there is the free interplay of supply and demand which is driven by businesses and consumers, each of whom works towards their best interest, inducing lower cost of goods and innovation, in the absence of disruptions caused by government regulations that artificially inflate costs. Sellers have an incentive to reap the benefits of innovation, in the form of increased profits, by selling creative new products that have an edge above their competitors. Hence, free markets give rise to competition and thereby, induce efficiency, improving the overall state of businesses in the country.

Read more: Vietnam’s journey and lessons for Pakistan

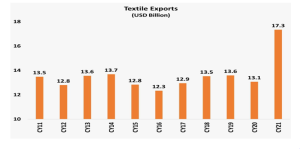

This is evident from the enlightening performance of the textile industry in the country, which is a reflection of a true market, with a large share of goods sold internationally. The bulk of textile products is exported, fostering high innovation, technological advancement and value addition, higher than any other sector in the country.

Innovation can further be attained through better management, which can be ensured through investment in human capital in the form of training programs for employees. Looking at China as an example, the number of workers in the textile industry manning 100,000 spindles is 1/10th that of Pakistan. This reveals a huge gap in the labor force efficiency of the two countries. Therefore, learning from Chinese workers, under the CPEC umbrella, will be especially beneficial for the country’s workers.

Pakistan’s foremen need to be trained in order to adopt Chinese work practices and methodology. In Pakistan, the textile sector provides employment to approximately 40% of the total labor force. In light of proper training by Chinese workers in the country, employed under the China Pakistan Economic Corridor, the textile workers can further enhance productivity and ensure resourceful outcomes at a faster pace, leading to an even larger share of the country’s textile exports.

The provision of such a conducive environment to all sectors in the country is vital for their growth and prosperity, enabling them to increase their export capacity and thereby, rescuing Pakistan’s economy from persistent trade imbalances due to significantly lower exports than imports. Without undue government intervention, firms will move towards open competition and will strive to stay in business.

Read more: Indisputable link between competitive energy and export growth

Free markets precipitate lower costs, innovation, rapid advancement, increased competitiveness, improved productivity, improved brand recognition, new partnerships, increased turnover and through this channel, enhanced profitability. Businesses and industries need to be provided with a growth-enhancing environment that would allow them to flourish and expand capacity thereby, creating a larger market share of Pakistan’s products across the globe.

By: Shahid Sattar and Zainab Malik

Mr. Shahid Sattar, now Executive Director & Secretary General of All Pakistan Textile Mills Association (APTMA), has previously served as Member Planning Commission of Pakistan and an advisor to the Ministry of Finance, Ministry of Petroleum, Ministry of Water & Power.

The views expressed by the writers do not necessarily represent Global Village Space’s editorial policy