Dr. Pirzada: No government in Pakistan’s history had ever taken such an initiative on low-cost housing as has been done by the current government. Gen Anwar Ali Hyder (Retired), I would like to understand what compelled government towards this initiative?

Chairman NAPHDA: There is a serious shortfall of proper built housing in Pakistan, and the underprivileged segment of the society is most affected by it. There was a dire need for low-cost housing as a measure of socio-economic uplift, particularly for the underprivileged segment of the society. Hence, Prime Minister Imran Khan took this initiative of affordable housing to help realize the desire of low and middle-income people to own houses within their limited income and resources.

Dr. Pirzada: NAPHDA was developed in 2019 with an ambitious agenda, two years have passed since then and many criticize the slow pace of development; what are the challenges that you have faced that you or the government didn’t foresee before embarking on this ambitious plan?

Chairman NAPHDA: There were many issues, systemic weaknesses, bottlenecks and impediments, which we had to deal with. A lot has been done; however, we are still endeavoring to further improve the system. The fundamental challenge was the absence of a housing ecosystem or an organized structure around which we could construct low-cost houses and deliver these to the deserving underprivileged people. When I say there was no organized structure, it also includes the absence of housing finance or mortgage facilities. And linked to this, there was the more significant issue of foreclosure law.

Dr. Pirzada: When you talked about the absence of an ecosystem for low-cost housing, you mentioned the absence of foreclosure law and how that was a very big challenge for this scheme. What have you been able to do about that?

Chairman NAPHDA: Basically, banks all over the world don’t do any sort of mortgage financing in the absence of foreclosure laws. Banks or financial institutions do not feel secure unless they have the right to foreclose the property in case of nonpayment of installments/default without getting involved in protracted litigation. Understandably, banks were only convinced to partake in housing finance after the successful enactment of the foreclosure law. Actually, Financial Institutions (Recovery of Finances) Ordinance was promulgated in 2001 but it could not be implemented because of several petitions filed against it in the courts.

On the adverse decision by the courts, in 2015, the government amended the act and added reserve price to address the observation of the courts. However, the amended act was again challenged in the courts. Finally, after a lot of efforts and pursuance by the Prime Minister, we got a favorable decision, first by Lahore High Court and then by the Supreme Court of Pakistan in March 2020 and October 2020, respectively.

Read more: Pakistan’s Failure to promote Low-Cost Housing? A Historic Overview

Dr. Pirzada: Why have we been unable to develop mortgage markets in Pakistan? When we look around the world, we see all the developed countries have around 60 to 70% of GDP in the mortgage market; even in India, housing mortgage constitutes 11% of GDP.

Chairman NAPHDA: Yes, you’re right, and this is what I wanted to explain; the absence of housing finance was the main challenge, which always existed in our country. There was never any real focus on this in the past. Housing finance for the low-income segment of the society is an even bigger challenge because the policy rate in our country has generally been on the higher side. Hence, in the absence of any form of housing finance, making housing finance affordable for the common man, which is NAPHDA’s priority, was a huge challenge.

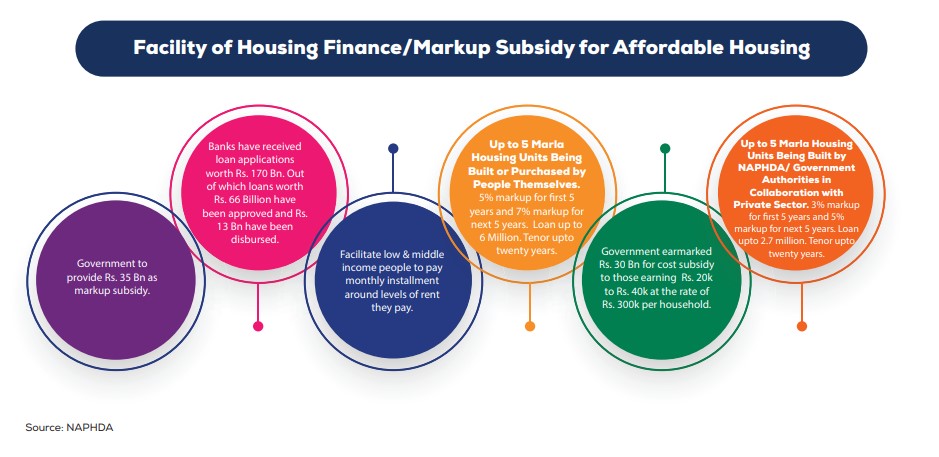

Markup rates ranging between 13 to 17%, after including the intermediation cost / spread of banks were simply unaffordable for the people who were our priority. It was for this reason that the government had to introduce a markup subsidy scheme (GMSS) for the low-income people.

Dr. Pirzada: Markup subsidy? What does it mean?

Chairman NAPHDA: Let me explain! It is a scheme through which the government offers significant subsidies on the markup of housing loans to the low and middle-income people. For example, if someone wants to get a 5 Marla House financed through banks (termed as Tier 2), then, for the first five years, he or she will be charged only 5% markup, including the intermediation cost of banks.

In actual fact, the markup combined with the spread of banks ranges between 12-13%, out of which the client would only pay 5%, the remaining amount would be provided by the government to the respective banks. The government has allocated Rs. 35 billion for this scheme.

Similarly, if the tenor extends beyond five years, the client would have to pay 7% markup for the next 5 years (years 6 – 10); after which market rate would be offered for the next 10 years (years 11-20). You can get a maximum of 20 years mortgage plan under this scheme.

For the houses built by NAPHDA or other federal or provincial government housing departments/development authorities (termed as Tier 1), the markup would be 3% for the first five years and 5% for the next five years. Now, with the introduction of Kamyab Pakistan Programme (KPP), which includes Naya Pakistan Low-Cost Housing component (NPLCH), the markup subsidy period has been enhanced from 10 to 15 years with reduced customer pricing.

Markups are offered at as low as 2% per for the first five years, 4% for years 6 to 10 and 5% for years 11 to 15. Another big advantage of KPP is that now subsidized housing loans would be easily available through micro-finance institutions such as Akhuwat, with minimal paperwork. In line with the Kamyab Pakistan Programme, we have moved a summary for approval of ECC and Federal Cabinet to enhance the markup subsidy period from 10 to 15 years for the Tier 1 of government’s markup subsidy scheme (GMSS), with reduced customer pricing of 2%, 4% and 5% as being offered in Kamyab Pakistan Programme. Hopefully, we would get it approved soon.

Read more: Role of Banks in Mortgage Financing

Dr. Pirzada: But banks in Pakistan are used to giving loans to the governments. They had never been eager on the housing market, so how were you able to convince them that this is something they must get into?

Chairman NAPHDA: We got a lot of support from the State Bank of Pakistan. The State Bank created a standing committee where all the major banks came together to discuss how they could help in end-user financing and even project/development financing. Prime Minister himself chaired several meetings attended by the bank presidents to encourage commercial banks to support this initiative and address banks’ concerns.

Finally, the State Bank of Pakistan made it obligatory for all banks to allocate 5% of their domestic-private sector credit for financing of housing and construction projects. Accordingly, banks would be financing projects worth Rs. 378 billion by the end of Dec this year.

Dr. Pirzada: So, this means it’s also a catalyst for the national economy as it provides support to many other allied industries.

Chairman NAPHDA: Our main priority was obviously housing, but yes, the project also aims to boost the construction sector in Pakistan. Especially in Covid environment when our national economy was faced with several challenges and the low-income people, particularly the daily-wagers were faced with the specter of losing jobs, the Prime Minister decided not to close down the ongoing construction activities and announced a significant incentive package for the construction industry, including a fixed tax regime and significant reduction in federal and provincial taxes.

A National Coordination Committee on Housing, Construction and Development chaired by the Prime Minister was also constituted, which has been regularly meeting on a weekly/bi-weekly basis since. This committee has played a pivotal role in several important policy reforms needed for the growth of the organized construction industry.

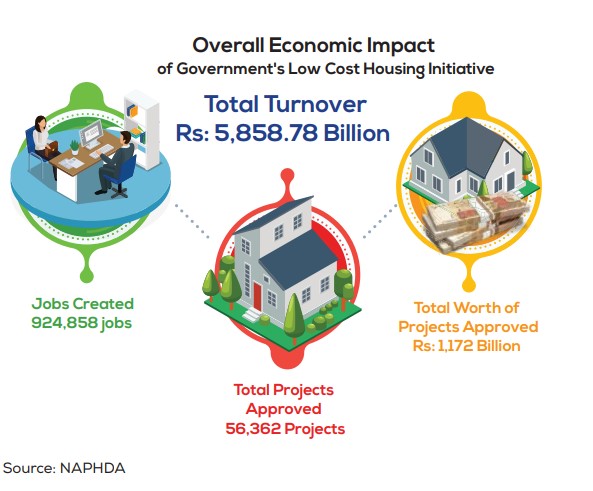

Apart from monitoring the progress of construction project approvals through digital portals in all provinces, the committee also oversees the efforts to conserve green areas, digitize cadastral land records, and master planning of urban areas. Resultantly, there was a significant growth in the construction industry, which rejuvenated a large number of allied industries, created large-scale employment opportunities, particularly for the blue-collar workers/daily-wagers, and contributed to the overall growth of the national economy.

Dr. Pirzada: The construction sector admits that the government’s initiatives helped them through fixed tax regimes and amnesty schemes, but they demand it be extended for another two years. What do you have to say about that?

Chairman NAPHDA: I’m in favor of this fixed tax regime which is in place till the end of December this year; whether it will be extended or not I really don’t know; that would be a decision by the government/ministry of finance. Till now, projects worth Rs. 493 billion have been registered in the FBR. These projects have contributed to enhanced construction activity in Pakistan.

Dr. Pirzada: Is there any way the government could negotiate with the IMF to extend the amnesty scheme for another two years?

Chairman NAPHDA: the ministry of finance would have to see whether it is possible or not. It is my considered opinion that the fixed tax regime was beneficial to the economy. Till now, projects worth Rs. 493 billion have been registered in the FBR because of this fixed tax regime. And all these projects have contributed a lot to the construction activity in Pakistan.

Dr. Pirzada: Some builders argue that most of the construction activity in Pakistan takes place in Karachi and this dense urban megalopolis was adversely affected during this pandemic, approvals have always been slow, and these were further affected because the lockdown in Karachi by the provincial government was very strict. If Karachi is given an amnesty scheme with fast approvals, then that would really pump up the construction activity in Pakistan and make room for numerous projects. Do you agree?

Chairman NAPHDA: Absolutely, we are aware of this, but this question concerns all Pakistan, and is more related to the process of project approval, which has never been easy in our country. It takes a lot of time and at times the delays are deliberate for reasons well known. Project approvals through One Window Digital Portal with back end automation and automated tracking system is the solution.

Development and approving authorities have made significant progress in this regard. The purpose is to minimize personal interaction between the clients and concerned officials and to get the projects approved in a transparent manner through digital portals as per laid down timelines.

Read more: Construction sector builds the economy but needs attention

Dr. Pirzada: From the time you took charge of NAPHDA, where have you found most success, and on the contrary, where did you face most challenges?

Chairman NAPHDA: I’d rather only look at the positives. Three major areas that we have focused on include structural reforms to facilitate construction of low-cost or affordable housing by NAPHDA and all concerned federal and provincial departments / development entities, creation of enabling environment with requisite incentives for the private sector so that they could be facilitated in building affordable housing in their schemes / projects and to create a comprehensive and workable system of housing finance to deliver the houses so build to the deserving people.

We have achieved significant success in all three areas. Not only has the construction of low-cost houses started, but now because of incentives offered by the government the private sector is willingly participating in affordable housing projects. We have hundreds of applications from builders and developers which we analyze every day and refer to the banks for financing. The system of housing finance through banks is also in place now.

Dr. Pirzada: The federal and provincial departments are making around 50,000 houses. What are your expectations from the private sector, how many housing units do you think they will deliver?

Chairman NAPHDA: It could possibly be a large number, perhaps in hundreds of thousands, but it all depends on the support they get from the banking sector. As per the model approved by the ECC and Federal Cabinet, we analyze the legal aspects of the proposals by the private sector.

We also look at the cost of the housing units and livability conditions such as road connectivity and availability of basic services and amenities etc. If deemed feasible, the projects are then referred to banks for their appraisal and financing.

The main incentive that we are offering to the private sector is the availability of enabled end-users. In simple terms, what we are telling them is that you construct low-cost housing, and if you do it within a certain cost in livable areas, we will arrange a subsidized mortgage facility for the low-income people willing to buy the houses.

Dr. Pirzada: What is the debt burden ratio right now?

Chairman NAPHDA: 50 percent, so if your household income is Rs. 50,000 per month, the permissible monthly loan installment would be up to Rs. 25,000. Banks will not sanction a loan if the monthly installment on the loan amount exceeds Rs. 25,000.

Dr. Pirzada: Let’s talk about housing finance. A long time ago there was this House Building Finance Corporation, are they your partners as well?

Chairman NAPHDA: Yes! They too, have done a lot of work to provide housing finance to society’s low and middle-income segments. Now with the help of the State Bank of Pakistan, all commercial banks are participating in this effort. We basically started from zero, and now the banks have received around Rs. 219 billion worth of applications for housing finance, applications worth Rs. 88 billion have been approved, and around Rs. 23 billion has been disbursed so far under the low-cost housing initiative.

Dr. Pirzada: What sort of mortgage financing facility do you have for middle-class people?

Chairman NAPHDA: Under this program, our focus is on addressing the housing needs of the underprivileged segment of the society; however It does include the middle- class people as well. If someone wants to get a 10 Marla House financed (up to Rs. 10 million) through banks (known as Tier 3), then, for the first five years, he or she will be charged only 7% markup, including the intermediation cost of bank.

If the tenor extends beyond five years, the client would have to pay 9% markup for the next 5 years (years 6 – 10); after which market rate would be offered for the next 10 years (years 11- 20). You can get a maximum of 20 years mortgage plan under this scheme.

Read more: What are the issues with Pakistan’s housing market! Expert Views

Dr. Pirzada: Do you think that the rise in steel and cement prices and the rapid appreciation of US$ against a depreciating Pakistani Rupee would be a setback for your program?

Chairman NAPHDA: This is a challenge, you’re absolutely right, but we’re not the only ones affected by this. This is a global phenomenon, and we are trying to deal with it.

Dr. Pirzada: Builders and developers strongly complain that since 2015 there is a continuing regulatory duty of around 30% on MS steel bars, which is responsible for domestic price escalation; has the government given any thought to get rid of that duty?

Chairman NAPHDA: We are aware of their complaint, but it’s not merely regulatory duty as being described but several kinds of taxes; we are looking into these issues to find the best way to prove some relief to the builders.

Dr. Pirzada: But the prices of steel and cement are bound to affect you since you’ve set the cost of a housing unit very low; for example, in urban areas, it’s around Rs. 27 lac, and in peri-urban, it’s around Rs. 18 lacs?

Chairman NAPHDA: That’s the loan that would be given on the housing unit. Not only has the government given markup subsidy but also cost subsidy for this segment of the society. The government provides Rs. 3 lac cost subsidy for every house built by NAPHDA or other government entities. The government has allocated Rs. 30 billion for the purpose of cost subsidy.

Dr. Pirzada: You must have made a report on the total economic impact that NAPHDA was able to create.

Chairman NAPHDA: As per the data which we get from provinces in the National Coordination Committee on Housing, Construction, and Development, the overall construction sector has generated economic activity of over Rs. 6 Trillion and created over 9,58,000 jobs.

Dr. Pirzada: is it more than in previous years?

Chairman NAPHDA: Yes, much more. Most of it is because of the incentives given by the government to the private sector such as the new approvals regime. Previously, people wouldn’t get their projects approved for years but now with the one window digital portal system the development / approving authorities present monthly reports on the number of projects approved and the reasons for pending cases/non-approvals in the national coordination committee on construction, housing and development. This has also facilitated large-scale construction activity in the country.

Dr. Pirzada: How big of an impediment do you think an unclear title of land is?

Chairman NAPHDA: People face a lot of issues in banks if the title of land is not clear and so we have introduced a system, which has already been implemented in Punjab, whereby a portal has been introduced through which the banks can get the titles verified within 15 working days from respective development/ approving authorities.

Read more: Steel and Cement Cartels: Risk To Prime Minister’s housing Scheme

Dr. Pirzada: Last question, do you think that the successive government would own this project as their own and take it to its desired outcome?

Chairman NAPHDA: Definitely, they should, because it is focused on the socio-economic uplift of the underprivileged segment of the society. Without the government’s support, it would always be hard for this segment of the society to own a house for them-selves.