State Bank of Pakistan has announced two new initiatives to facilitate the introduction of digital financial products and services by financial institutions to benefit all segments of society.

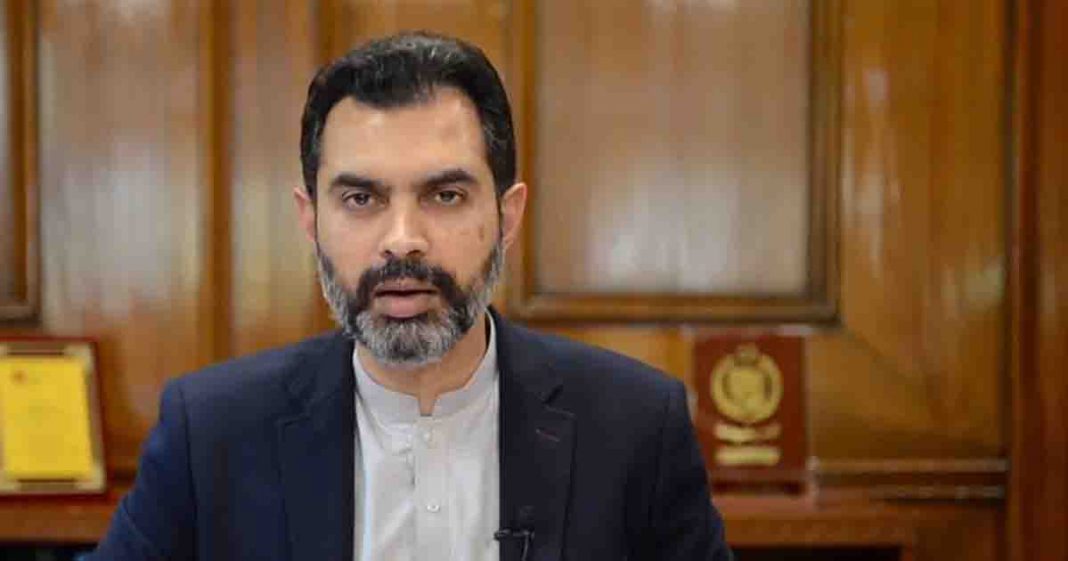

According to the statement released by the SBP, this happened at the 5th Stakeholders meeting on Digital Financial Services held on Monday, 2nd August 2021, when Governor State Bank of Pakistan, Dr. Reza Baqir announced these new steps.

The meeting was attended by a wide range of stakeholders including Chairman PTA, Major General (R) Amir Azeem Bajwa; Chairmen FBR, Asim Ahmed; Chairman NADRA, Muhammad Tariq Malik; Country Director of the World Bank, Najy Benhassine; and a representative from Bill and Melinda Gates Foundation. Representatives from the Accountant General of Pakistan Revenue (AGPR), Controller General of Accounts (CGA), Ministry of IT and Telecommunication (MoITT), Ministry of Commerce were also present.

The financial sector was represented by CEOs of Banks, Microfinance Banks, and Electronic Money Institutions (EMIs), PSOs and PSPs as well as several other digital financial services stakeholders.

These initiatives are the introduction of digital cheques clearing and a unified QR code for

payments.

During the meeting, Dr. Baqir also shared that SBP is actively exploring the development of Open Banking, which allows sharing and leveraging of customer-permissioned information among financial institutions to facilitate consumer choice, promote competition and efficiency in the financial sector, and encourage the introduction of innovative products and services to benefit consumers, the statement read.

The goal of these stakeholders meetings that were started by Governor SBP in October 2019 is to bring key players from the public and private sector together to share information and co-ordinate the resolution of cross cutting issues in a collaborative manner to accelerate the digitalization of financial services and promote the vision for Digital Pakistan.

According to the statement, The initiatives announced by Governor Baqir are targeted towards the overarching objective of accelerating digitalization and financial inclusion. The digital cheque clearing initiative will replace physical presentation and clearing of cheques thereby reducing the time involved substantially.

The second initiative, the introduction of a unified QR code, will allow payments by users from any digital application eliminating the need to use separate apps.

Read More: State Bank to introduce collateral-free loan scheme to promote businesses

Raast and Joint Task force

During the meeting, Dr. Reza Baqir said that SBP will continue to promote innovative digital financial services and is ready to facilitate these endeavors by resolving issues as far as possible.

Governor Baqir appreciated stakeholders’ support in facilitating the digital initiatives of SBP,

particularly by FBR, NADRA, and FBR in moving forward the drive for digital financial services.

The forum was briefed about the significant progress made on issues identified earlier by the industry including removal/reduction of taxes and duties by FBR on import of Point of Sale (PoS) machines used for accepting payment cards; facilitation of remote account opening by NADRA; and a review of the pricing mechanism for verification of mobile SIMs by telecom industry with the help of PTA.

During the meeting, SBP and PTA announced the formation of an SBP-PTA joint task force to work towards the prevention of digital financial services frauds.

In addition, SBP and FBR have also agreed to form a joint committee to collaborate on a regular basis to increase digitization in the economy. These and other initiatives have led to 30 and 20 percent growth in internet and mobile banking respectively in Q3, FY21 compared to the same period last year.

Briefing the participants on the progress made on SBP’s Raast payment platform, Governor Baqir said that the 2nd phase of person-to-person payments would be launched by October 2021 for which banks are being integrated with Raast.

Read More: State Bank considering launching digital currency in Pakistan