News Desk |

The Qatar Investment Authority (QIA) has announced its universal reopening to attract new deals for investments according to the chairman of QIA and also the foreign minister of Qatar, Sheikh Mohammed bin Abdulrahman al-Thani.

The state’s sovereign wealth fund has assets worth $320 billion through its far-reaching influence in the investment circles. The assets include its acquired investments such as Harrods and Shard in London; it is also a major stakeholder in Volkswagen, Barclays Bank and has limited holdings in Tiffany and Co., Rosneft and Credit Suisse.

The QIA after the blockade in 2017

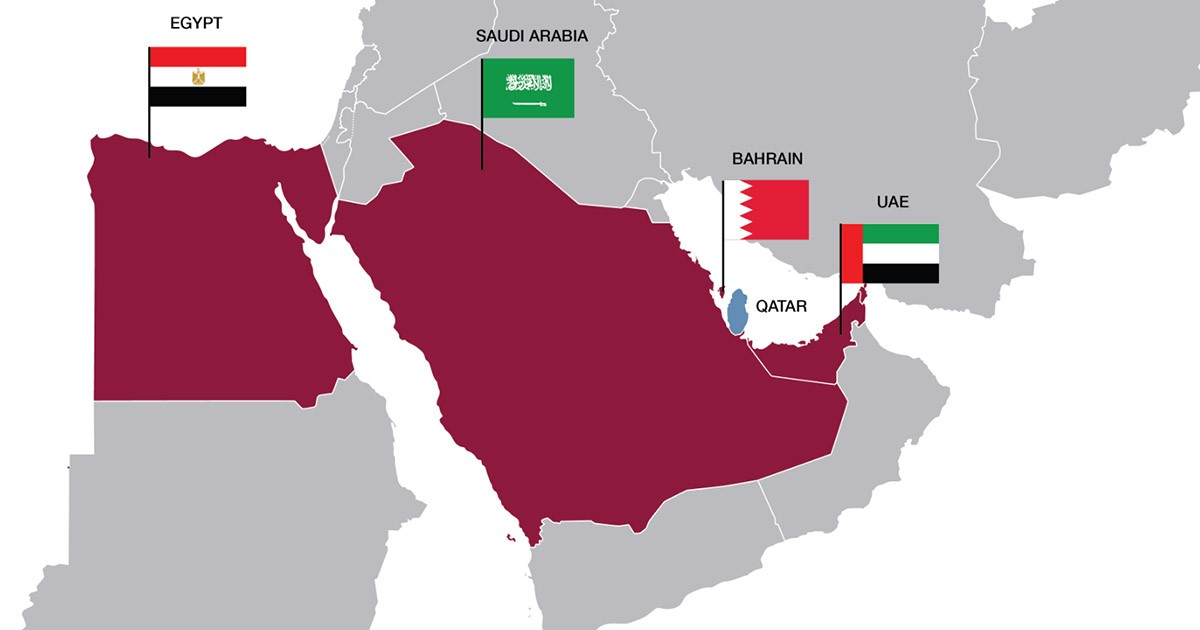

In June 2017, the Saudi-dominated gulf-bloc imposed an economic blockade and political boycott on the tiny Peninsula for alleged support to Islamic militia groups. While Qatar has remained impartial in its policy towards groups such as Hezbollah, Muslim Brotherhood and Hammas; and has maintained cordial ties with its Gulf neighbour Iran, it has denied allegations of funding terrorism.

The state’s sovereign wealth fund has assets worth $320 billion through its far-reaching influence in the investment circles.

While the investment activity had slowed down since 2017, top Qatari officials claimed that it was part of the risk management strategy that Qatar had always adopted in times of a crisis situation.

“We are not liquidating anything. What we have done is taken some of our liquidity from outside to inside. This is through the Ministry of Finance and the QIA, which is very normal in this type of situation,” the Qatari Finance Minister Ali Shareef Al Madi explained in an interview to Financial Times in 2017. He further went on to claim that Qatar had previously adopted such strategies to make the economy shock-proof from any internal or external mishap such as the Global Financial Crisis in 2008.

Read more: Deep rooted mistrust in the Gulf: Qatar’s blockade continues

How Qatar’s sovereign wealth fund prevented it from an economic shock?

The QIA, Qatar’s top acquisitive investment entity, had partially halted its investment endeavours due to the economic blockade imposed over it by the Saudi-dominated Gulf bloc. In what is also known as the worst crisis in the Gulf, Qatar suffered an outflow of capital worth $30 billion due to the withdrawal of capital investments from Qatari banks by the blockading states.

The Saudi-dominated gulf-bloc imposed an economic blockade and political boycott on the tiny Peninsula for alleged support to Islamic militia groups.

Subsequently, as a preemptive measure, Qatari government utilized the sovereign wealth fund’s deposits to prevent its economy from further shocks. The buffer created through QIA deposits led to immediate liquidity of capital in Qatari banks, the decline in inflation rates and a stable trade balance.

At present, it is believed that Qatar has overcome one of the worst financial blows to its economy and so it is prepared to reclaim its market place in the global investment sector. Al-Thani, Chairman QIA, in an interview to Financial Times asserted that Qatar is now focusing to invest in direct investments.

Read more: Pakistan’s balancing act in the Gulf, Qatar to invest heavily in…

New goals set for the QIA

Qatar has reportedly expanded its investments to North America and now plans to further its investments in Asia. It is also expanding its focus in technology investments and is expected to rise as the third largest Gulf investor in the tech-industry after Saudi Arabia and the UAE. With its recent $500m equity financing for SoFi, a US-based digital bank, QIA is said to be in competition with its Gulf rivals.

The buffer created through QIA deposits led to immediate liquidity of capital in Qatari banks, the decline in inflation rates and a stable trade balance.

Qatar has also introduced reforms for foreign investments in the country that allow a 100 percent ownership of projects to foreign investors active in Qatar. The reforms are expected to attract more investments in the country that will subsequently lead to the diversification of Qatari economy, a major goal of the country under the Qatar National Vision 2030.

Qatar has also entered the US real estate markets with its acquisition investments in New York, estimated to be worth $5.6 billion. Qatar also invested heavily in the upcoming FIFA World Cup 2022 which is being hosted by Qatar.

Read more: Qatar blockade just strategy to maintain hegemony over Middle East?

Despite several challenges to host its first World Cup, Qatar is committed to bring a world-class tournament to the world through newly constructed football stadiums, state of the art hospitality infrastructure and a rapidly developing transportation sector. It was recently revealed that Qatar has planned to spend $6 billion on construction projects for World Cup alone.

Qatar Continues to defy its Regional Competitors

The economic blockade imposed on Qatar aimed at crippling the tiny Gulf state has in fact backfired with Qatar rising from the ashes like a Phoenix.

According to a recent report published by the IMF on June 3, 2019, Qatar is said to capable of containing “the adverse macro-financial implications of downside risks in view of considerable buffers”. The report further analyzed Qatar’s economic performance and concluded that it has successfully maintained its GDP growth and has recovered fast to develop a hydrocarbon economy.

The report touched upon QIA’s preemptive measures and stated that the “Availability of buffers has enabled Qatar to successfully absorb the adverse shocks from the 2014–16 decline in oil prices and the 2017 diplomatic rift.” And further talked about the “resilient” nature of the economy despite being put in a difficult economic position by its neighbouring Gulf States.