International Women’s day just passed on March 8 and much was made of the importance of financial inclusion for Women. In light of this a recent initiative by JS Bank’s should be highlighted which will help to improve access to finance for women entrepreneurs all over Pakistan. In accordance with the policy launched by the State Bank of Pakistan, in December 2017, to finance Small and Medium Enterprises (SMEs), JS Bank revealed its new product called ‘JS Khud Mukhtar – Karobar Mera Apna’.

This is a personalized financing solution for women to help them start and grow their business at the pace they desire.

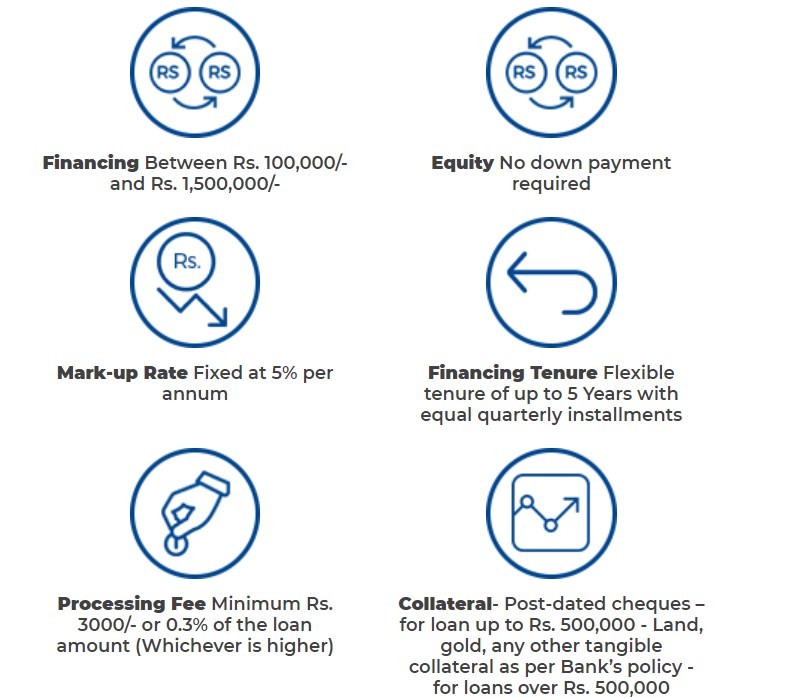

JS Khud Mukhtar is a financing solution for business women of Pakistan, which aims to enable empowerment as well as financial stability. JS Khud Mukhtar provides easy access to finance for fulfilling aspirations with term loan of up to Rs. 1.5 million, at a subsidized mark-up rate of 5% per annum (based on State Bank of Pakistan refinance scheme).

Financing Small and Medium Enterprises in Pakistan

SME financing has been quite an unattainable dream for the Pakistani government due to commercial banks showing reluctance to involve themselves in such a risky business. Let’s face it, there is no guarantee that small businesses succeed as intended – and most of them do not. JS bank has specialized in this segment.

The number of SMEs across Pakistan is estimated to be 3.2 million. They employ 78% of the country’s labour force and account for 30% of GDP and 25% of the total manufactured goods exports. Given their impact on exports, jobs and growth, successive governments made the promotion of SMEs a major plank of their economic plans.

Read more: In a faltering economy, JS Bank forges ahead to become the 13th largest bank in the country

Most commercial banks remain uninterested in lending cash to small entrepreneurs because such borrowers don’t own liquid assets or past credit history – that’s what makes it risky. Apart from considering SME finance a chancy business, banks haven’t made any attempt to develop skill and expertise for clean lending to small enterprises. This is in spite of several policy interventions by the central bank to boost SME finance over the last decade and a half. Lack of access to banking credit remains a major factor hampering the sector’s growth.

It is important to remember that 54% of all microfinance loan borrowers in Pakistan are women. These women entrepreneurs have started making their mark in the workforce in Pakistan. Some exceptionally brilliant Pakistani women entrepreneurs are succeeding in their businesses and become prominent on the global stage. Last year, Fiza Farhan a young social entrepreneur from Pakistan was listed in Forbes 30 under 30 social entrepreneurs list.

As impressive as these women are, the real dramatic changes in female entrepreneurship are occurring far away from the front pages of Forbes. Women of all age, starting work from scratch, are those who need to shine. Women with remarkable skills looking for productive platforms and sponsors, also deserve to shine.

JS bank has taken a virtuous step to support those who have no one else. This is quite praise-worthy, given the current need of financers for local businesswomen anticipating to gain independence and mostly run households.