Pakistan has apprised the Financial Action Task Force (FATF) of the federal government’s initiative to take complete administrative control over 113 madrassas across the country.

The compliance report dispatched to the global money-laundering watchdog by Pakistan reveals that these madrassas are now being operated under the supervision of assistant commissioners. Each madrassa has been allocated a two-year budget.

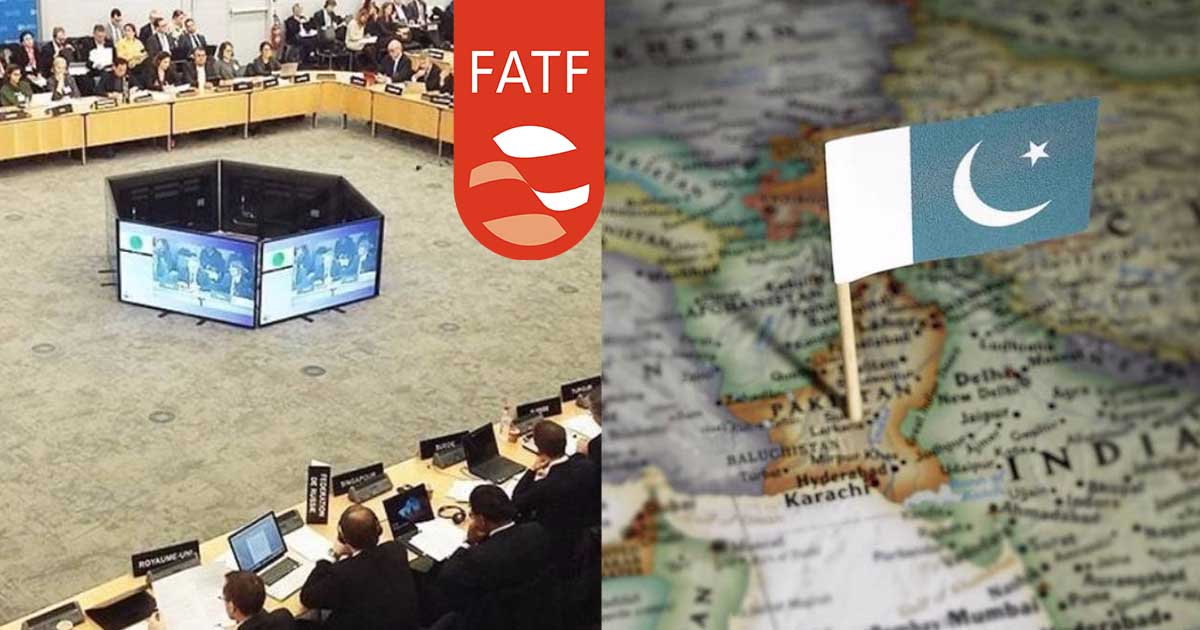

Compliance Report to FATF

The compliance report outlines Islamabad’s response to the remaining 22 points in the FATF action plan. Sources reveal that the FATF will hold a meeting in Beijing instead of Sydney, Australia on January 21. FATF consultations scheduled for the first week of February will determine whether Pakistan should remain on the grey list or not.

The compliance report had been drafted by the ministries of interior, finance, foreign affairs, the Financial Monitoring Unit and the Securities and Exchange Commission of Pakistan. The officials also had assistance from representatives of the National Counter Terrorism Authority, State Bank of Pakistan, the Pakistan Army, Federal Investigation Agency, and the Counter-Terrorism Department.

#Pakistan submits progress report on 22 points to #FATF joint grouphttps://t.co/21ZI9JRvv2 pic.twitter.com/WdelVSo81g

— Yes Punjab Punjabi (@YesPunjab_Pbi) December 7, 2019

The global money laundering and terror financing watchdog had already expressed its satisfaction with Pakistan’s performance over five of the 27 points that had been proposed in the action plan.

Earlier in October, the FATF President had commended Pakistan for achieving some “tangible progress” under the new Imran Khan-led government, welcoming the measures undertaken by Islamabad towards improvement.

However, the FATF President also highlighted that the majority of the challenges underscored in the action plain remained outstanding, including the need to take effective initiatives to curb terror financing. In its official statement, the FATF underscored that since June 2018, Islamabad has made strides towards enhancing its anti-money laundering/combatting financing of terrorism (AML/CFT) measures, including the recent implementation of its money laundering/terror financing (ML/TF) risk assessment.

Read More: Pakistan Fighting On Two Fronts: With FATF & Against FATF

The global watchdog observed that Pakistan must continue working on the implementation of the FATF action plan to rule out its strategic shortcomings, including an appropriate implementation of its adequate understanding of the risk factors of terror financing posed by terrorist organizations. The FATF also advised Islamabad to undertake supervision on a risk-sensitive basis.

The FATF added that Pakistan must also demonstrate that remedial measures and sanctions are undertaken in the cases of AML/CFT violations and that these measures had an impact on the AML/CFT compliance of the financial organization.

In February 2018, the global watchdog on money laundering and terror financing placed Pakistan on its grey list, with effect from June 2018. The FATF gave Pakistan an ambitious 27-point action plan, which required the government to entirely eliminate terror financing and money laundering, disassemble terrorist sanctuaries and establish strict banking and non-banking financial regulations.