Political sloganeering of Roti, Kapra aur Makaan has won hearts and minds ever since Zulfiqar Ali Bhutto, founder of Pakistan People’s Party (PPP) rallied support from poor workers and farmers in the 1970 elections that ultimately made him country’s first directly elected Prime Minister in 1973. But once in power he did little to give effect to this political slogan and the goal to have “Makaan”- owning your own home – has remained a pipe dream for most Pakistanis to this day.

Imran Khan government, that came to power in August 2018, has for the first time in seventy years of country’s history initiated a well thought out structured plan to make this possible but will the reality change, for country’s teeming millions, in near future remains to be seen.

Pakistan today with an estimated population of around 220 million is the fifth largest country in the world – after China, India, United States and Indonesia (as per United Nation’s data). With a median age of 23, with 65% of its population below 35, and a poverty rate close to 39% it ranks low on all human development indices. Economic downturn, on the heels of expensive energy contracts, beginning from 2017 and made worse by the Corona Pandemic (2019-20) and global disruption of supply chains has thrown millions more below the poverty line and exact figures may not be available.

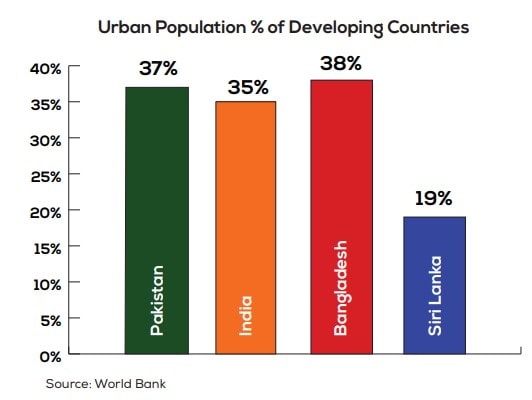

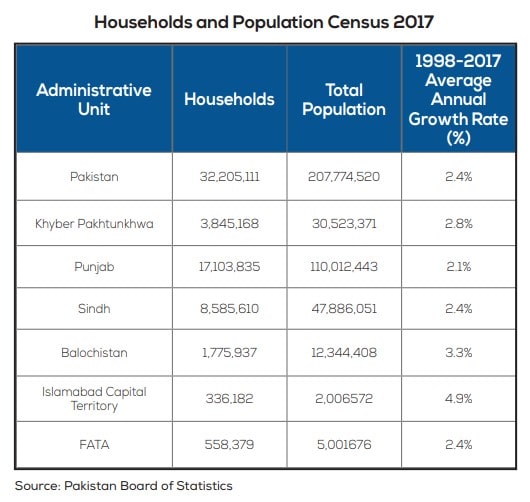

With an annual population growth rate of 2.4 percent according to the 2017 census it has a growing demand for houses. Like other developing countries it is seeing a massive urbanization growth as people move from the villages into cities, unfortunately housing has not kept pace with this growth.

Read more: Pakistan’s housing market is leading the economy: What has changed?

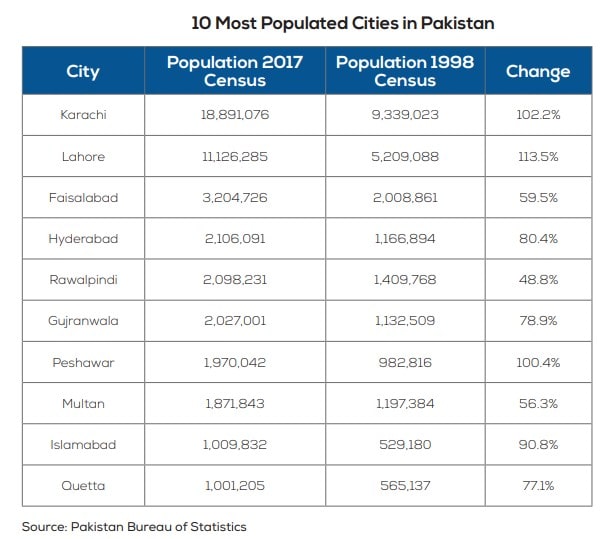

Over 36 percent of the population lives in urban areas. The country’s two largest cities, Karachi and Lahore, alone house 60 percent of all people living in urban areas; which has caused huge infrastructural problems from sanitation to education to health.

Social sciences literature shows that improved housing helps to reduce crime rates, increase school attendance, and reduce diseases faced by the populace. Ensuring access to adequate, safe, and affordable housing and basic infrastructure is part of the Sustainable Development Goals (SDGs) goal 11 on creating resilient communities. This bigger picture is both a nightmare and inspiration to prime minister’s team in Islamabad – but they are confronted by a difficult history.

Low-Cost Housing: A Historic Failure

Since 1947, it is believed that Pakistan has only added around five to six million houses to its total stock of around 32 million houses (Urban: 20 million & Rural: 12 million) and the country faces a 10 million shortfall in housing needs. Over the next 20 years, the annual urban population increase is expected to be about 2.3 million per year (around 360,000 households at 6.35 individuals per household).

Exact scientifically determined figures are hard to obtain, data from different sources often conflict. However, it is believed by government departments and Association of Builders and Developers (ABAD) that against an annual demand of 700,000 housing units, the country constructs between 250,000-300,000 houses, leaving it with a shortfall of 450,000 houses per annum – that keeps on adding to the unmet need.

However, in 2019-20, when NADRA conducted a need assessment for low-cost housing on behalf of Naya Pakistan Housing Development Authority (NAPHDA) it only received around two million applications. So, all statistics can be relied upon only for rough assessments – and may not be reliable for policy decisions as per UN or internationally accepted standards.

This situation has further complicated the challenge faced by Naya Pakistan Housing Authority (NAPHDA) that has been mandated to provide sustainable solutions for poor Pakistanis. Anyway, it is believed that urban areas face a shortage of over 40% and the remainder is in the rural areas. Over 47 percent of urban households live in katchi abadis (temporary settlements – 8m in Karachi and 1.7m in Lahore) and in overcrowded situations. In Pakistan, 3.5 people on average live in a room versus the world average of 1.1 persons.

According to Ansaar Management company (estimations, 2019) only 1% of all housing units built yearly cater to 68% of Pakistan’s population (which earn < Rs.30,000) and 56% of housing units are constructed for a market that represents at maximum 12% of Pakistan’s population (i.e. those earning above Rs.100,000).

Read more: The Supreme Court’s verdict on Nasla tower is setting unsettling precedent

The State Bank of Pakistan defines a low-cost house as one priced below Rs 2.5 million. An acute dearth in housing persists in the price range of Rs 1 million to Rs 3 million ($7,000 to $21,500) in urban centres where incomes range between Rs 30,000 to Rs 100,000.

While previous governments have made ad hoc efforts of creating low-income housing schemes such as “Apni Basti” under the Junejo government in 1987 and Mera Ghar under Nawaz Sharif in 1996, a coherent and comprehensive low-income housing policy has never been attempted – till the current government that established NAPHDA in Jan 2020.

A policy framework that holistically looks at the challenges faced by the housing demand and supply market as well as the equity of the need to provide clean and respectable accommodation for the poor was thus badly needed.

The development of a housing market faces a number of challenges that I look at in this piece and it revolves around the different players in the market. How easy is it to buy for the individual or family, why bank financing is not easily available, what limitations do the construction and allied industries face and what role is the regulator playing to ensure the development of the housing market.

The government’s challenge is to work on creating a housing eco-system that works for the developer, financier, and the home buyer. Currently, there are severe historic cracks in different parts of this cycle, which include lack of clarity on titles to give ease to the mortgage provider, little financial access to both the developer and the home buyer, and a challenging environment for developers’ ease of doing business. NAPHDA is struggling to fix these gaps – with mixed results.

Mortgage financing was almost impossible in Pakistan

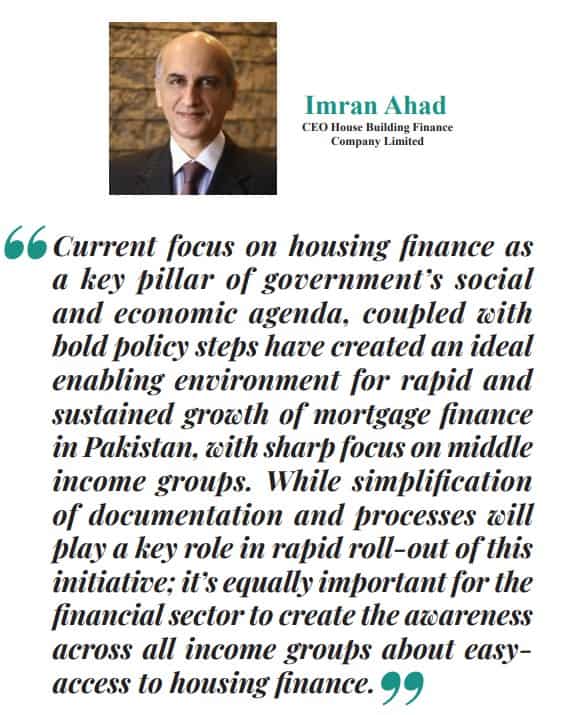

People wanted to live in their own abodes, but it was not happening for several reasons. The major problem was and perhaps is that people do not have access to cheap long-term stable mortgage financing. It is the easy access to mortgage financing which throughout the world drives people’s ability to buy houses; currently, in the United States almost 80 percent of people construct houses through loans, it stands at 33 percent in Malaysia, 11 percent in India, and 3 percent in Bangladesh.

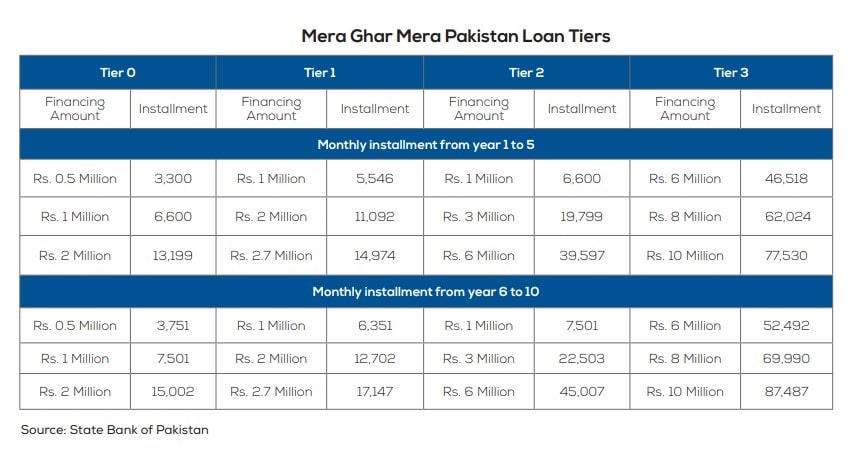

By comparison, Pakistan has mortgage financing at 0.5 percent which is way lower than its regional peers. In Pakistan where the average income is around Rs.42,000 per month (per household), it is not easy to finance a house. Rental yields are low in Pakistan at around 3 percent; it can cost around Rs. 6,000/month to rent a house worth Rs. 2.5 million.

A person living on Rs. 15,000 to Rs. 20,000 can bear this amount, but not many individuals falling under this income bracket will be willing to pay an amount more than Rs. 10,000 to pay for a mortgage to own the house.

Read more: Ravi Riverfront: Pakistan’s First Planned City of this Century

Pakistan currently has 68,000 mortgage borrowers and the average loan size in 2016 was Rs. 6.1 million, with a loan to value (LTV) of around 48% – which means the house buyer has to put a substantial amount of savings as a down payment when applying for a loan. Additionally, the average mortgage rate charged by banks is a variable rate that is on average 3.5% + Kibor (currently Kibor is at 7.5% – means the house buyer is paying an interest rate of 11 %). Internationally housing loans rates are mostly fixed and are generally between 4% – 5%.

In any housing policy for the poor, the government has to ensure that the tenure of mortgage is long enough and the average rate low enough so that mortgage cost is close to the monthly rent people would otherwise pay. In India, the Reserve Bank of India (RBI) had assigned priority sector lending targets to banks which includes poor people housing and in Brazil commercial banks had been directed to lend R$0.65 for every R$1 received for deposits in savings accounts to housing finance.

NAPHDA has now coordinated with State Bank of Pakistan to make it mandatory for banks to keep 5% of their loan portfolio for housing mortgage.

Pakistan Mortgage Refinance Company (PMRC): Support to the banks

Pakistan’s financial sector assets stand around 70% of GDP and private sector credit to GDP is just 15%; as compared to the regional average of around 48%. Pakistan has around 46 commercial and micro-finance banks and they account for 75% of total assets of the financial sector.

Banks generally receive short-term deposits and thus prefer keeping their liabilities short-term. Hence the maximum mortgage finance loans available are generally 10-15 years at variable rates making them risky and uncertain for consumers.

Unlike, other countries in the region – especially India – Pakistan has very shallow capital markets, small amounts and few people are invested in pension and mutual funds, which otherwise would encourage long-term capital liabilities. In 2016, the government had introduced a mortgage refinance company Pakistan Mortgage Refinance Company (PMRC) Limited, to remove the mismatch of funding banks had by providing medium and long-term funding to mortgage lenders, through their long-term credit lines and by raising funds from the capital debt market at cheaper rates than they would have otherwise been able to access.

This is supposed to allow banks to on-lend at fixed rates and for a longer tenure. PMRC after start of its operations in 2018 has built this momentum with a refinance portfolio of PKR 21 billion with 18 partner banks for tenors ranging from 3 to 20 years and has raised fixed rate funding from the market of PKR 12 billion.

Although the federal government had initially exempted the Bonds and Sukuk issued by PMRC from income and capital gains tax for five years, this exemption was removed in 2020 due to IMF conditions. Such incentives are necessary in nascent markets like Pakistan and for organizations like PMRC so it can play the desired role of making mortgage finance accessible and affordable for the middle and low-income people.

Land registration and titles: Challenges of Non-Transparency

Pakistan still has centuries-old land registration system managed under the patwari system – that introduces non-transparency into the titles and ownerships. This creates uncertainty for banks when they wish to extend loans to potential home buyers.

In some parts of the country, the situation has improved due to donor funding such as from the World Bank, which in 2012 started a project in Punjab – digital Land Records Management and Information System (LRMIS) that has helped to remove uncertainty over title deeds in many parts of the province.

Read more: What are the issues with Pakistan’s housing market! Expert Views

In recent years, many private companies like Zameen.Com are developing new apps like “Plot Finder” to help their clients with exact locations of land parcels and plots and things may gradually become more transparent.

Many large housing schemes still provide buyers with an allotment letter instead of a sale deed which saves the societies from paying government transfer fees and capital value tax; however, it means banks will not provide mortgage finance on such plots or homes.

The government needs to outlaw such practices by private societies to evade taxes and to improve transparency of titles for banks and financial institutions.

Foreclosure laws: Seventy years struggle ended in 2020

Pakistan for a long time, after its independence from British India in 1947, did not have laws which allowed banks to reclaim properties where the homeowner had defaulted on a bank loan. The introduction in 2001, under Musharraf government, of the Financial Institutions (Recovery of Finances) Ordinance (FIRO-2001) allowed financial institutions to foreclose the property of a defaulter without the courts intervening.

However, in 2013 the Supreme Court declared Section 15 of the Ordinance – which empowered financial institutions to sell mortgaged property without recourse to court – as being “ultra vires” to the constitution of Pakistan.

Given the tortoise pace at which the courts decide cases, it created reluctance in the banking industry to consider new mortgage loans; especially since these were among the largest segment in their non-performing loan portfolios.

In order to protect the banks and encourage the housing market finance to take off, in 2016 the then PMLN government introduced FIRO with a new amended section 15, which allowed banks in Pakistan to opt for one of four options when confronted by a case of wilful default: (1) foreclose under the new section 15 of FIRO; (2) file a recovery suit in the banking courts; (3) employ recovery agents to persuade defaulter to honour his/ her payments; (4) file a criminal case with the NAB.

However current PTI government had to fight in the courts to get legal validity and acceptance for the re-enacted section 15 of FIRO that was finally achieved in Lahore High Court’s landmark judgment of March 2020 when a four-member bench headed by Chief Justice LHC disposed of the Writ Petition 33872 of 2016 (Mohammad Shoaib Arshad & others versus Federation of Pakistan).

Access to funds: Challenge for Pakistani developers

Pakistani banks – used to lend money principally to the government – have historically not provided funding to property developers to start projects for many of the reasons mentioned above.

Builder finance is very important to encourage development in this sector. Expensive and difficult to obtain finance is a major cause why private sector developers target middle-income and higher-income households – through advanced selling – of land and houses.

It is estimated that the return on investment (ROI) for these projects (tailored for higher income households) for real estate developers fall in the range of 200% to 300%, whereas in the low-cost housing segment, ROI is as low as 15%. It is important for the government to provide incentives for the developers to engage them in such projects.

One example to consider was the Ansaar Management Company (AMC) model – they build houses on 60% of the buildable area and sell them at cost, on the condition that the buyer moves into the house within 60 days, and cannot sell it, rent it or leave it empty for a period of 4 years, to avoid it becoming a ghost housing scheme.

The rest of the 40% of the buildable area is sold as plots at premium market rates. These plots, unlike the houses, don’t have any conditions attached and deliver a major part of AMC’s returns. Private Public Partnership policies have been adopted by NAPHDA to encourage private builders to become part of government’s initiative – as discussed elsewhere in this issue of GVS.

Regulatory framework & courts: Antiquated & Archaic

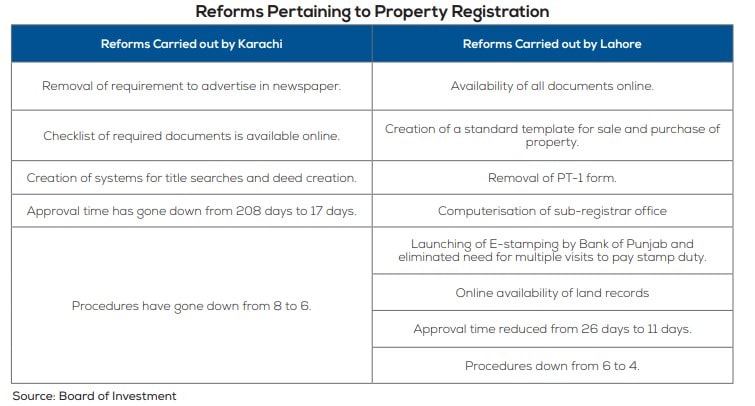

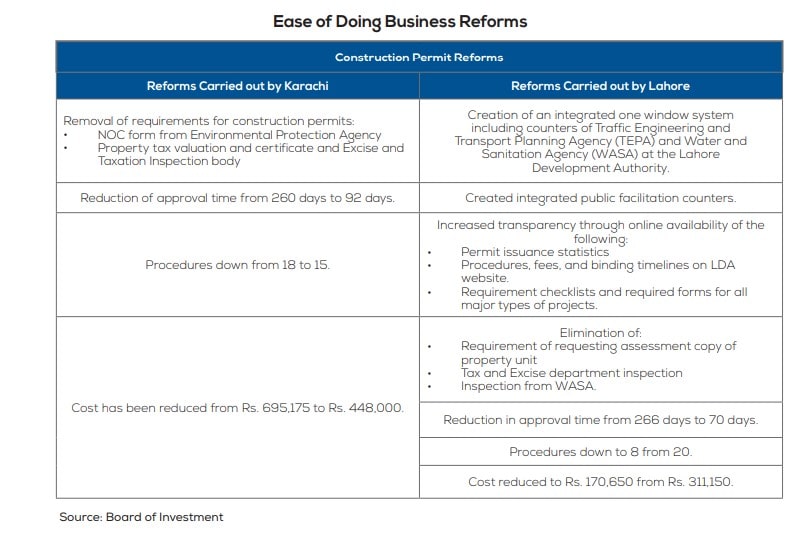

Land titling issues as discussed earlier preclude many private developers from launching schemes – this has continued despite Pakistan moving towards digitalizing land titles. Furthermore, even after Pakistan’s improvement on the World Bank’s ease of doing business –private developers must apply for and get over 19 NOCs, on average, for approval for any housing scheme; the process often takes over 3 years and lots of grease money.

Read more: Construction sector builds the economy but needs attention

Additionally, archaic zoning laws need to be amended on ‘housing use and density’ especially on the construction of high-rise buildings. Pakistan’s planners (the babus and now the courts) have antiquated notions of what type of layout housing schemes should represent.

Modern urban planners suggest that the most economically efficient use of resources require high rise buildings with community spaces, where the intermingling of residential units with industry and businesses create thriving economic centres. Islamabad is a classic case of what not to do.

The city has a centre that has prime areas being used by state and government buildings, then the next layers are residential (large houses using up lots of lands) and industry has been placed on the outskirts.

Holistic planning on low-income housing requires that government use professional urban planners that devise mixed use and even better a mixed-income housing plans in which good transportation links exist, employment opportunities are created, social community needs are fulfilled (including the provision of civic services like water, utilities, and solid waste management) and that set out needs for smart cities with green and cheap houses for individuals.

They need to impose a regulatory framework that sets standards of housing type to set up as well as the quality of housing. This includes business use and height of buildings.

Government actions creating lazy banks looking for easy money

In the past decade, the government has crowded out the private sector from access to liquidity as banks have found it easier to make risk-free money by investing in government paper – short-term-bills offering high returns with zero risks. Banking careers are thus made out of lucrative contacts with decision makers in Islamabad and Pindi and not through learning strategies of modern finance and marketing.

This is an issue the government can reduce when it gives incentives to the banks to provide mortgage finance. The government needs to launch pre-qualification criteria for developers and licensing those with whom it will work. They should be required to submit an occupancy plan, how they intend to continue to maintain and develop public buildings, etc.

Singapore is considered the world’s best example of public housing provided by the government. It is a success story showcasing mixed-income housing with access to high-quality public transport and education. 82 % of Singapore’s population lives in publicly leased accommodation.

Public housing is managed by its Housing & Development Board – leased out for 99 years. The government awards ‘merit stars’ to contractors who perform well; for every merit star earned they enjoy 0.5% bidding preference when tenders are evaluated.

A core contractor scheme also exists where contractors who have S$500,000 level of capital and minimum of 5 merit stars were guaranteed annual workload for a fixed number of years.

Read more: Role of Banks in Mortgage Financing

Summing up, Imran Khan government has initiated a much-needed process, it has worked with diligence, but such are the challenges of inertia built in the system of banks, bureaucracy, courts and media that it may take several governments to remain steadfast before the results will reach the teeming millions who are waiting for “Makaan” since 1970.

Najma Minhas is Managing Editor, Global Village Space. She has worked with National Economic Research Associates (NERA) in New York, Lehman Brothers in London and Standard Chartered Bank in Pakistan. Before launching GVS, she worked as a consultant with World Bank, USAID, and FES and is a regular participant of Salzburg Forum. Najma studied economics at London School of Economics and International Relations at Columbia University, New York. She tweets at @MinhasNajma.