Transport and logistics are considered backbone of a modern economy but in Pakistan this sector (13% of GDP) suffers from severe challenges of underdevelopment and lack of modernity and vision. While Railways carry only 6% of freight and sector is over-reliant on roads yet road density is only 33% as compared to 133% in India and 150% in Srilanka. Maybe its time that PM Imran Khan takes up this matter like he took up “Ease of Doing Business”

Transport and logistics play a pivotal role in the economic development of Pakistan because physical and human capital rely on the services provided by this sector. Logistics is truly the backbone of a nation’s supply chain network and maintains relationship between inbound and outbound transportation.

The main aim of every business is to minimize the logistics cost and reduce the delivery time by improving transit speeds. Every business thus wants to avail less expensive transport and methods of timely delivery to retain and enhance its customer base.

Even a cursory overview of the global economy shows that economic opportunities are highly dependent on the mobility of people and freight (or proverbial goods and services) along information and communication lines. Transportation and Logistics are derived demands since in an economic system whatever takes place in one sector affects the other.

A high-density transportation system with a well-connected network is thus associated with high levels of economic development. The logistic industry, worldwide, contributes around $4.3 trillion, or 8-10% to the global GDP, creates thousands of new jobs every year and is essential to improving export competitiveness of any country.

For every $1 billion we invest in public transportation, we create 30,000 jobs, save thousands of dollars a year for each commuter, and dramatically cut greenhouse gas emissions. Bernie Sanders

Well-developed “Logistics Industry” delivers important macro benefits to the economy by creating employment, increasing national income and driving foreign investment inflows. Nations that come in the top 20 performers on the Logistics Performance Index (discussed later) – are also among the ten highest performing economies of the world.

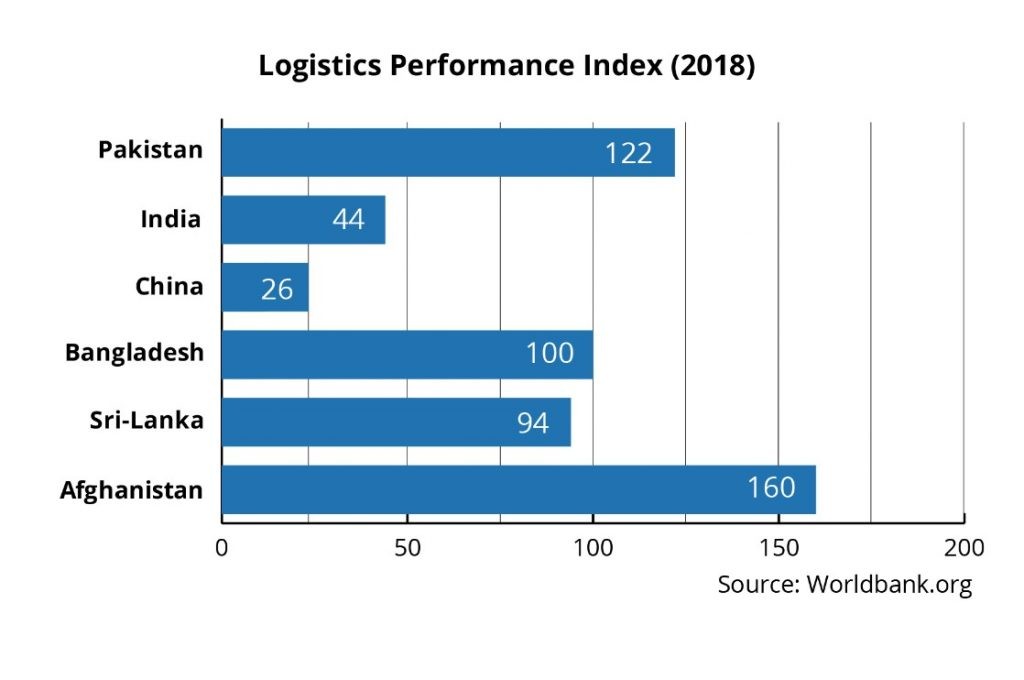

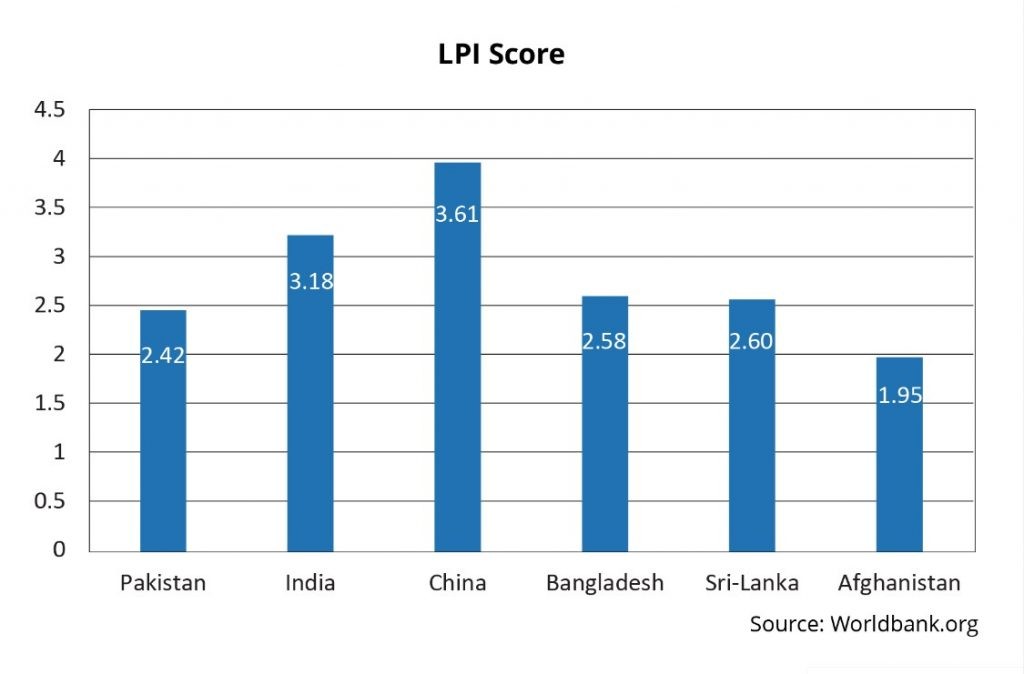

By contrast, Pakistan stood at 122 out of 160 countries on the LPI in 2018. A strong logistics industry is essential to strengthening exports by removing supply chain inefficiencies in bringing raw materials, products and finished goods to market.

Coming to Pakistan, according to the government estimates the official logistics sector as of December 2018, was valued at $34 billion and provides over 3m jobs. But a significant part of Pakistan’s logistic sector may be part of its informal economy that is not very well studied.

World Bank report in 2015 calculated that well thought out improvements in Pakistan’s Logistic sector could be potentially worth $.30.77 billion. Bank’s report required the country to develop integrated road/rail networks (including air, sea & dry ports) to improve connectivity between the rural and urban markets, and among regional trading partners.

Supply Chain process start from the stages of production and distribution from manufacturers and suppliers and terminates with consumers utilizing the final finished products. Logistics encompasses a series of decision making that includes: transportation, custom authorization, effective packing, cold storage, warehousing, inventory control, insurance, and so on.

Read more: National Logistic Cell: Ready to embrace new challenges of Pakistan’s evolving industrial and trade…

Transportation is used twice in the system once for the supply of raw materials for the production and manufacturing process and secondly to supply the finished goods to the consumers. Most important is decision making in selection of mode of transportation. Optimization use of roads or sea routes can decrease transit time and shipping cost.

One major factor hindering the sector, in Pakistan, is that it is fragmented and unregulated. This deficit has been made more difficult due to a complete lack of government strategy on how to develop the sector and its constituent parts in the value chain.

This means, in real terms, that despite the large gross domestic capital investment that has been absorbed by country’s roads and transport network, logistics and communication sector of Pakistan has not seen commensurate returns. Pakistani policy makers have to grasp that the strategic element in logistics is transportation.

Investment in this segment stimulates both internal and external trade. Furthermore, an efficient transport system ensures through the multiplier effect greater fruits of economic and social openings and advantages. It enhances market accessibility, increases employment opportunities and income levels and creates incentives for investment.

The government is also constructing motorways and national highways to link cities, towns and villages, and provide easy and accessible means of transport to the common man close to his doorstep

On the contrary, if the transport system is not working at a desirable rate then job opportunities will be lost and less income will be generated and masses will be compelled to survive with lower quality of life and poorer standard of living.

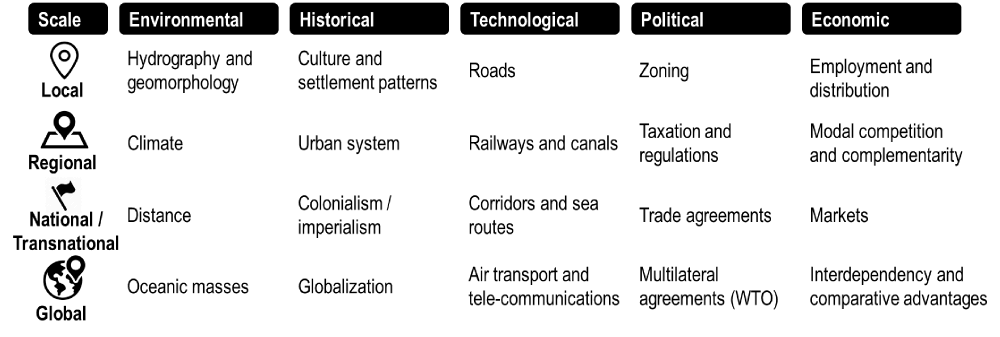

In short, the transport sector carries significant social and environmental burden, and has direct, indirect and induced economic impacts. Fig. 1 gives an overview of environmental, historical, technological, political, and economic factors that impact development of transport systems.

Figure 1: Factors behind the development of transport systems.

According to the Vision 2025 of the Ministry of Planning & Development of Pakistan, there should be an efficient and integrated transportation and logistics system that will facilitate the development of a competitive economy. It sees the establishment of industrial parks and developing Special Economic Zones as an important part to strengthening the transportation network and logistics infrastructure along the China–Pakistan Economic Corridor (CPEC).

(GVS Magazine is developing an informed focus on SEZs and CPEC in view of these realizations) And Investment in railway projects was an important part of CPEC for the same reason. Goals of Vision 2025 for TLC sector include:

• Road Density should be doubled from 32 km/100 km2 TO 64 km/100 km2.

• Increase the share of rail in transport from 4 percent to 20 percent: and

• Increase annual exports related to the transportation sector from PKR 2.9 trillion ($ 25 billion) to PKR 17.5 trillion ($ 150 billion).

Pakistan’s Logistic & Transport Sector

Pakistan’s logistic and transport Sector relies upon Railways, Roads, Ports and Air Cargo. Railway – despite its failure to grow – is still the single major mode of transport for public sector. Pakistan Railways comprises of total 470 locomotives (458 Diesel Engine and 12 Steam Engines) for 7,791 kilometers length of route.

However, due to the lack of sufficient railway track coverage and old relatively slow trains with poor quality freight containers, rail freight today makes up only 6 percent of all goods carried in Pakistan. Roads by comparison cover the whole area of the nation state.

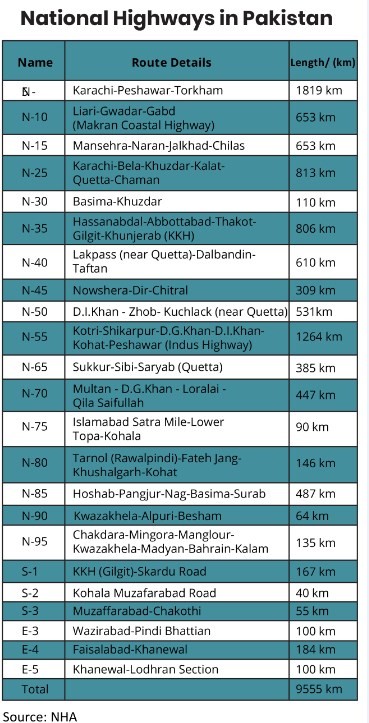

Whether it be Motorways, (M1, M2 & others) National Highways (like N5) or smaller roads. The famous GT road (N5 between Peshawar & Lahore lies on old Grand Trunk Road) goes back to era of Sher Shah Suri, ruler of Northern Hinudstan in 16th century) and has been one of the country’s major road since Pakistan’s independence.

Read more: PM Imran Khan unleashes a dream: First CPEC SEZ takes off!

According to the Economic Survey 2018-19, the present NHA (National Highway Authority) network comprises of 47 national highways, motorways, expressways, and strategic roads. Current length of this network is 12,743 Km. Overall the NHA records show that Pakistan has over 264,000 km of roads – most of these are secondary and tertiary roads connecting small towns.

Given failure of railways to expand and absence of water bourne freight traffic, road transport has played main role in Pakistan’s economic development. Trying to capitalize on this historical asset, the Government of Pakistan is continuously investing in the construction of new roads and maintenance of the existing roads.

The government is also constructing motorways and national highways to link cities, towns and villages, and provide easy and accessible means of transport to the common man close to his doorstep. Yet despite all these efforts, a report by the European Union, points out that Road density in Pakistan falls at 33 % per square km, which is amongst the lowest even in the region.

Air travel is expensive due to high freight charges, cumbersome custom procedures, plus inadequate cargo facilities at airports, so it plays little role in the overall logistics sector of Pakistan

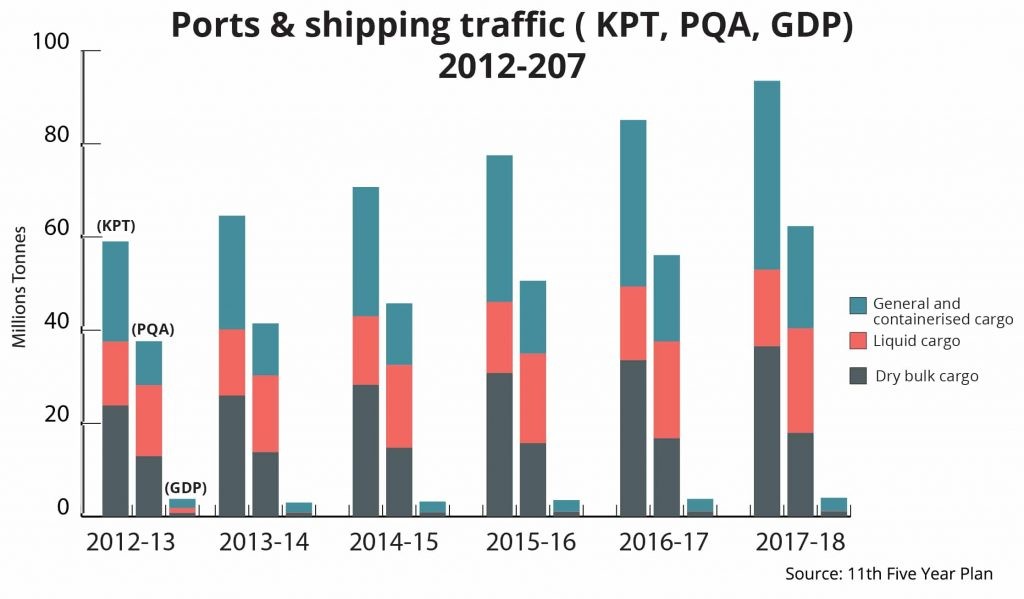

Road Density of India is 133 % and it is 150 % for Sri Lanka. Pakistan’s sea trade is mostly handled by Karachi Port & Port Qasim; over three quarters of the total volume of trade is handled by Karachi port itself; a negligible amount enters via Gwador Port.

However, going forward, with the progress of CPEC, more trade is expected to be picked up at Gwador. Both Karachi ports suffer from congestion due to limited infrastructure development over time. The ongoing development of the Gwador Industrial Estate adjacent to the port will ensure that sufficient warehousing, and other facilities are set up.

As the connectivity and linkages improve, this port will emerge as one of the major transshipment hubs in the region – handling onward transmission of goods to China and Central Asian countries. Pakistan also has an extensive canal system set up since colonial period, based on its five rivers, but there has been no development of inland water transport.

Pakistan has 46 airports, but almost half of these are out of operation for one or the other reasons. Most airports are owned and operated by the Civil Aviation Authority (CAA), though now private operators are also setting up, such as in Sialkot.

Currently country has four private airports; Sialkot is being used for international and domestic flight whereas other three are used only for chartered aircraft operations. Of the 24 airports currently operated by CAA, 13 are used for international and domestic operations and 11 are only used only for domestic operations.

PIA, the national carrier, handles 87% of passenger and freight traffic along with other airlines. Air travel is expensive due to high freight charges, cumbersome custom procedures, plus inadequate cargo facilities at airports, so it plays little role in the overall logistics sector of Pakistan.

Contribution to Economy

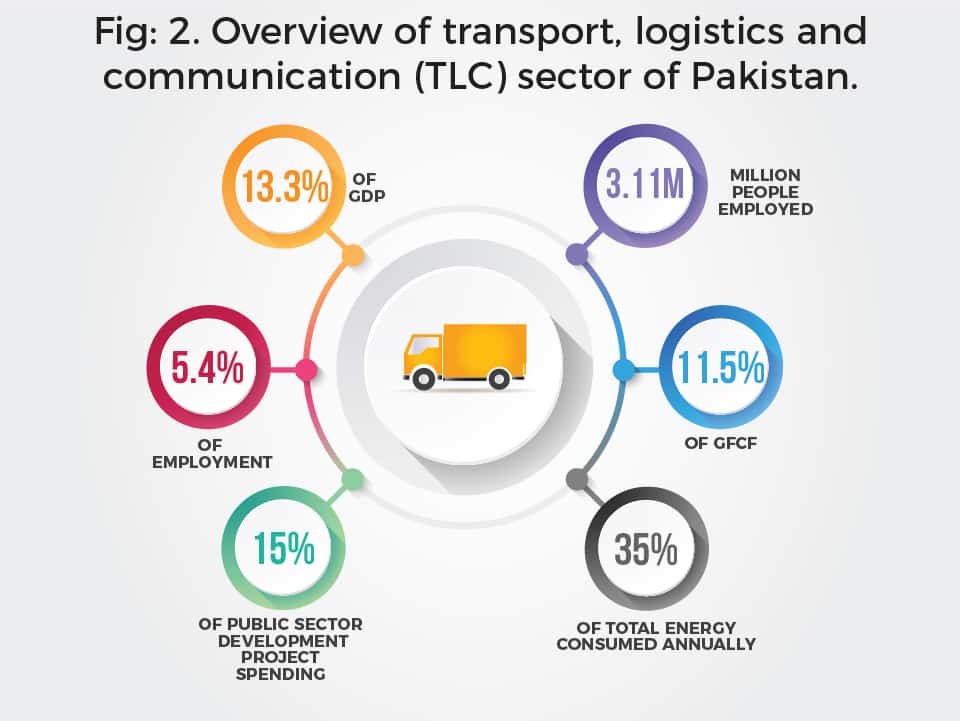

The transport, logistics and communication (TLC) sector of Pakistan consists of multiple mediums of travel – roads, rails, air and water (rivers, sea and oceans). As per Pakistan’s Economic Survey 2018-19, this sector contributed 13.3 percent to Gross Domestic Product; however it’s disproportionately dependent upon roads (almost 62%), which must change.

Fig. 2 shows share of transport sector in various macroeconomic variables in the country. It contributes 13.3 percent to GDP (roads contribute 62% to TLC sector’s contribution), 5.4% of employment estimated at around 3.1 million people, 11.5 % of Gross Fixed Capital Formation and it consumes 35 % of total energy.

Despite its limitations and many weaknesses, Transport sector is still a major player of Pakistani economy. A comparative analysis of Transportation & Communication, Agriculture and Construction sectors shows that Transport sector is contributing a significant share to GDP.

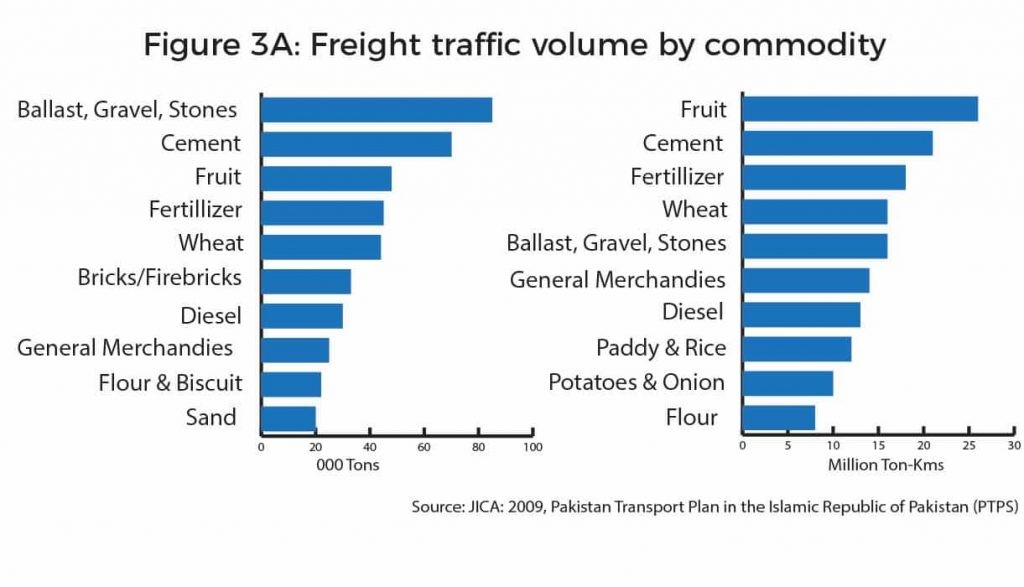

This contribution on average has remained around 13 % for the years 2012 – 2018, as compared to agriculture at 20% and construction sector which has contributed around 2.5% over the same period. According to the Pakistan Transport Plan Study (PTPS) by Japanese International Cooperation Agency (JICA), trucks carrying major commodities in tons are shown in the graph.

Majority of trade as already discussed is carried on roads and in this we have seen a 6% growth in the quantum of truck loads carried in the past two decades. The second graph in Figure 3A shows the freight ton kilometer.

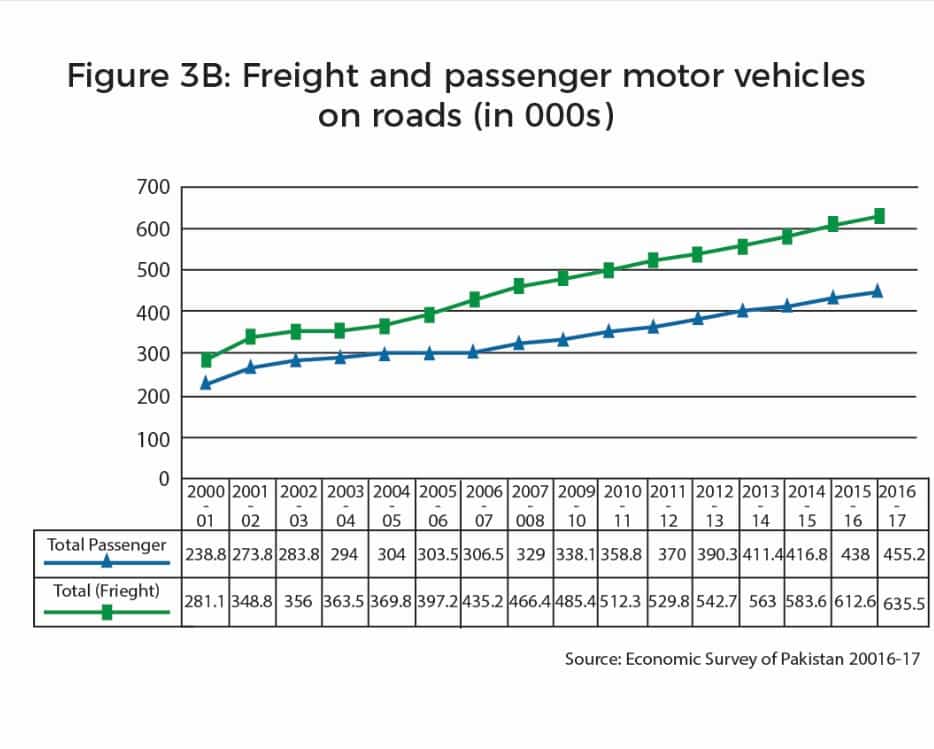

The graph in Fig. 3B, by Economic Survey of Pakistan, 2016-17, paints an interesting scenario. It shows the trajectory of both Freight and Passenger Motor Vehicles on roads for the 15 years starting from 2000-01 to 2015- 16. Both the variables are moving upward. However, the growth rate of freight vehicles is growing faster than passenger vehicles.

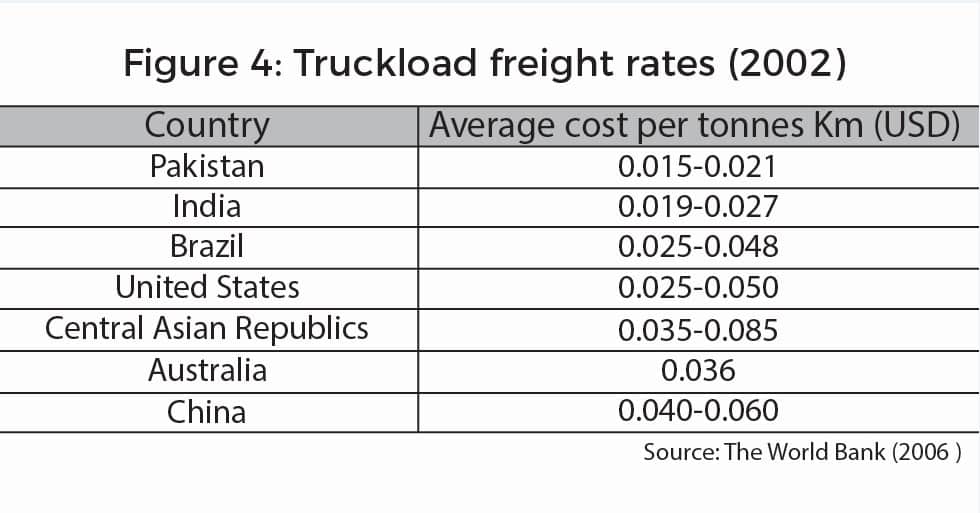

Motor cab was the fastest growing vehicle and delivery vans are the fastest growing Freight Vehicle. Freight charges are comparatively cheaper in Pakistan than neighboring countries – as shown by a World Bank Study. The average cost per tons km, in US dollar, or Truck load Freight rate for Pakistan is within the range of $ 0.015 – 0.021.

Challenges to the Transport & Logistics Sector

1.Logistics Performance Index

The 2018 Logistics Performance Index (LPI) ranking by the World Bank is a global benchmark for measuring the logistics performance of a country. It looks at 6 factors including customs clearance, timeliness, infrastructure, ease of arranging shipments, quality of logistics services, and tracking and tracing.

Pakistan ranks 122 out of 160 countries with a score of 2.92. This is because of its poor performance in custom clearance, tracking, tracing and timeliness. Pakistan is not unusual in the conditions it faces as a developing country – similar political, industrial and financial difficulties – are faced by other countries in the region, including Bangladesh, India and Nepal.

Read more: Implementation of Axle Load Limit Regime: When and How?

However, India has significantly better logistic performance ranking of 44, Bangladesh has 100, Nepal at 114, and China with 26 ranking. Germany is enjoying the highest score of 4.23. While Pakistan has generally improved in the past one decade it is clear that there is no long term government plan to develop transport and logistic value chain for the country to improve its long term standing.

Due to loopholes in the working of transport system and its inefficiencies the economy is estimated to lose around 4 – 6 % of GDP every year. The recent improvement in the ease of doing business index after specific attention given to it from the PM downwards – suggests similar attention is required for the logistics index.

2. Roads carry majority of traffic

According to the National Highway Authority (NHA) Pakistan has around 264,000 kilometers of road networks across the country, on which 90 percent of all inland freight movement takes place. Roads carry approximately 94 percent of the freight traffic in the country while Railways carry around 6 percent, and airports are insignificant.

This heavy burden on road has resulted in traffic congestion, pollution and, wear & tear of roads which is compounded by overladen old trucks used by the majority of truck owners. Road based traffic is a huge cost to economy, due to imported fuel. Almost 35% of the fuel is consumed by the transport sector.

Read more: State implementation of axle load policy mandatory: Awais Chaudhry

This has occurred as a result of the unfortunate shortsighted policy by the government to spend more on roads and less on railways over time. The Government’s Economic Surveys show that railway routes have seen a 0.5% decline since 1990 from 8,775 km to 7,791 km versus roads that have grown over the same period from 171,000 km to around 266,000 km.

This has seen a corresponding rise of vehicles on the road – 4.4% rise in passenger vehicles and 5.7 percent rise in freight vehicles. Pakistan Railways is perpetually running at a loss due to low freight traffic and subsidized passenger traffic. According to the World Bank one freight train can carry as much commercial load as 100 trucks.

Similarly, using the rail system almost a ton of goods can be transported over a distance of 250 miles in a gallon of fuel as compared to 90 miles by road. Internationally 50 percent of cargo is carried through the rail system. Private sector engagement is required in rail stock so that high quality containers and cold storage containers can be introduced in trains.

3. Quality of trucks

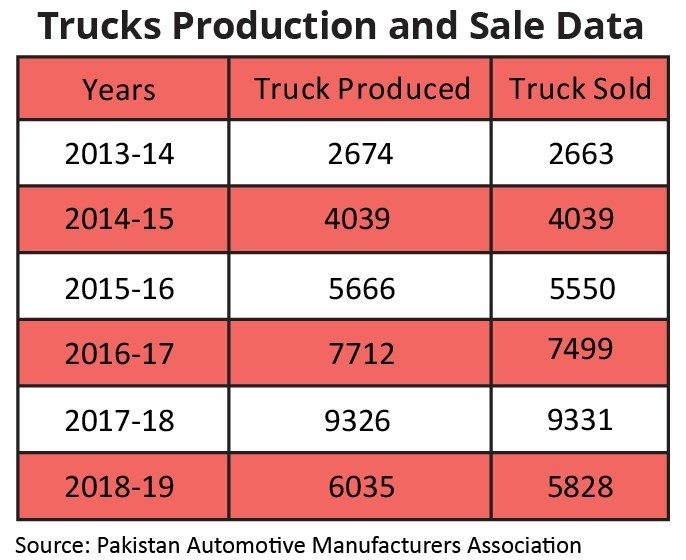

There are over 300,000 trucks operating in Pakistan; majority of these are obsolete old trucks with rigid suspensions, limited speeds, and are heavy on fuel consumption which makes them highly inefficient in terms of time & cost. Most of the truck owners have undocumented trucks who do not meet required regulations, and furthermore owners are used to overloading trucks.

This increases the risk of road accidents and spoilage due to time lags and causes damage to roads, bridges, and highway infrastructure which costs around 2 percent of GDP on average. This substandard quality of fleet trucks and absence of a comprehensive regulatory system has not only decreased exports but has resulted in a poor ranking of Pakistan’s Logistic Performance Index (LPI).

Since Pakistani trucks do not comply with international standards so local logistics companies are automatically disqualified from regional road freight trade contracts. A 2016 National Highway Authority (NHA) report stated that international regulations overseeing long-haul traffic specifies that articulated trucks (trailers) should constitute at least 50% of the truck fleet, in Pakistan articulated trucks comprise only 12% of the total fleet.

This is because of the need of massive investment which may not be possible for small & medium transporters to undertake. Regional trade is hindered as Pakistani trucks that are significantly overloaded as compared to regional peers are told to stop at international border terminals and offload into two or more trucks on the other side of the border.

Pakistani trucks often carry weight as much as 100 tons when recommended legal weight is 58 metric tons per axle in Pakistan, 55 in India and 49 metric tons per axle in Afghanistan.

4. Unfragmented small size players in industry

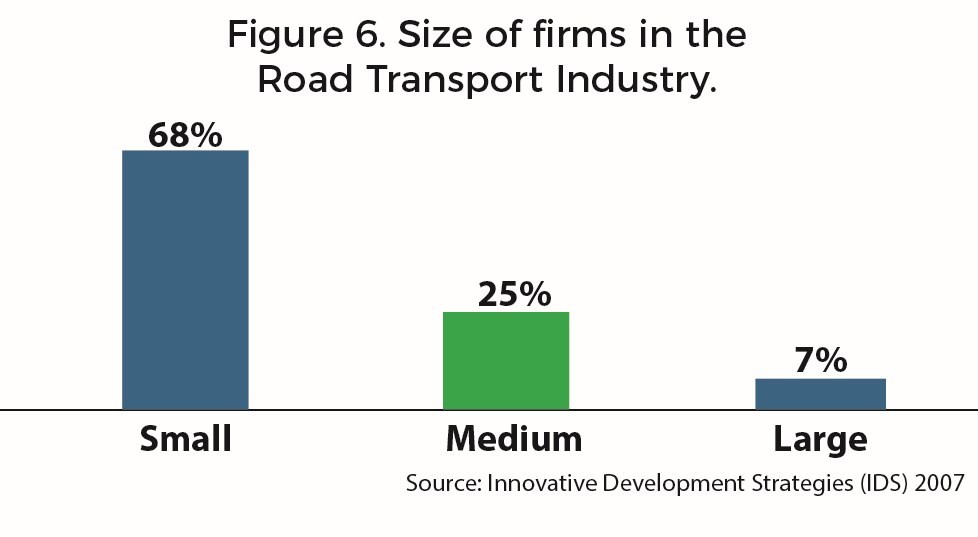

The local logistics industry is under-developed and does not provide integrated logistics services, to some extent the gap is being filled by a few international companies. Similarly, fleet carriers are dominated by small firms. The relative size of firms in the road transport industry is 68 % for small, 25 % for medium and 7% for large size firms.

The local logistics industry is under-developed and does not provide integrated logistics services, to some extent the gap is being filled by a few international companies. Similarly, fleet carriers are dominated by small firms. The relative size of firms in the road transport industry is 68 % for small, 25 % for medium and 7% for large size firms.

Read more: Reforming Pakistan Railways

The list of major players in the freight segment for the public sector shows that the National Logistic Cell (NLC) is the biggest corporation in the trucking industry. It has 800 large vehicles and has a 10 % market share in freight transport. Unless a process of acquisition, integration and expansion takes place leading to bigger trucking companies modernization of fleets will not happen.

Sabiha Abid is an economist, ex-banker and an educationist. She has taught in Institute of Business Administration Karachi, Quade-Azam University Islamabad and SZABIST among others.

The views expressed in this article are the author’s own and do not necessarily reflect Global Village Space’s editorial policy.