ENERGY ISSUE

1. Regionally Competitive Energy Tariff

The Regionally competitive energy tariff of Rs.19.99/kWh notified till June 30, 2023, has been withdrawn effective March 1, 2023. The competitive energy tariffs of regional countries can be seen below. The cost of service for B-3 and B-4 consumers is 9.3¢/kWh as per NEPRA/CPPA-G, attached as Annexure The applicable tariff from March 01, 2023, is 16 ¢/kWh. The new applicable tariff, therefore, includes a cross-subsidy of 7 ¢/kWh. The extra burden of cross-subsidies, taxes etc. cannot be exported and will result in a massive decline in textile exports and large-scale unemployment.

2. The Provincial Disparity in Energy Prices

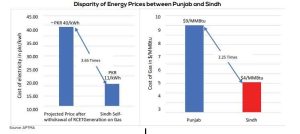

The price differential between effective electricity prices in Punjab and Sindh is more than 3.65 times as EOUs in Sindh can generate electricity at Rs.11/kWh from gas being provided at $4/MMBtu while Punjab gets gas/RLNG at $9/MMBtu.

The gas/RLNG being provided to EOUs in Punjab also comes with the caveat that it will not be used for electricity generation. Therefore, the only available energy for EOUs in Punjab after March 1st, 2023, will be grid electricity at over Rs. 40/kWh. This will necessarily shift available orders to cheaper alternatives internationally and within Pakistan. The grid electricity apart from being uncompetitive is unreliable and substandard, reducing effective production capacity by over 25%.

Read more: APTMA raises alarm over textile sector shutting down

This anomaly is further compounded by the intermittent supply of gas/RLNG to Punjab based EOUs which has been at times nil supply, 25% supply and 50% supply based on average consumption of August, September and October 2021, respectively. Provincial disparity in energy prices is leading to large scale unemployment and closure of Punjab-based industry.

3. Discriminatory Disconnection of Punjab-Based Industry’s Gas/RLNG

The CCoE’s decision to suspend the supply of gas/RLNG to captive generation users is detrimental as running on grid automatically translates to a capacity loss of 25% due to outages and poor quality. As a result, many industries in Punjab rely on gas supply to generate electricity and run their operations. If the gas supply is disconnected, it always has a severe impact on the operations of these industries.

SNGPL has disconnected gas supply to many industries in Punjab, while SSGC has not implemented the CCoE’s decision. This has led to discriminatory treatment of Punjab- based industry.

The industry is encouraged to shift from gas-based Captive Power Generation to the national power grid to save gas, but APTMA maintains that grid electricity is inconsistent and unstable, and can damage production machinery. The moratorium also adversely affects exports, unemployment, and investments, and results in a 40% increase in conversion costs.

As a solution;

• Moratorium on gas supply to captive generation users should be suspended till grid supplied electricity’s quality and continuity is assured.

• Mills should not be disconnected but allowed to use the gas for standby operations irrespective of the tariff to be charged.

4. Weighted Average Cost of Gas

The parliament has passed a bill to adopt the Weighted Average Cost of Gas (WACOG) to price gas in February 2022. The difference in the cost of energy between Punjab and Sindh, resulting in the closure of 50% of the Punjab-based industry.

Read more: Textile sector’s gas suspension to cause $1B loss: APTMA

A level playing field should be created within the country by implementing an industrial-weighted average cost of gas price of $7/MMBtu for the industry across the country.

5. Open Access/Wheeling of Electricity under B2B arrangement

APTMA has recently stepped up its efforts to ensure that the export industry stays operational which is only possible if they get an uninterrupted supply of electricity at competitive rates. To achieve this goal, one of the options under active consideration is, getting RLNG/ Gas power plant(s) dedicated to supplying electricity to the export industry across Pakistan by wheeling. In addition to this, APTMA is also considering setting up or securing supply from the solar power plant(s) and new hydel power plant(s), which are not connected to the national grid to date and have a lower energy tariff. This will bring the energy cost down for the export-oriented units to a sustainable level.

NEPRA has already agreed with this stance of APTMA. Furthermore, as per the revision of the NEPRA Act of 1997 in 2018, the subsidy being referred to originally in the NEPRA Act and Rules, is no longer applicable in the revised dispensation of the amended NEPRA Act.

Cross-subsidy and stranded costs should be waived off to make open access (wheeling) viable.

OTHER ISSUES

1. Moratorium on Debt

It is concerning that the severe supply chain disruptions caused by the economic crisis, leading to curtailed production and operations, compounded by liquidity crises and pending refunds are now the reality of the textile sector. The non-functioning of the new projects and expansions in the textile sector has led to immense pressure on the export-oriented units, which are unable to generate funds to service debt, leading to massive defaults, curtailment of capacity and possible banking crisis. The progress made by the sector during COVID-19 in the form of availing TERF, and LTFF facilities provided by SBP is going downhill towards default. Therefore, a moratorium on debt is necessary to enable the sector to recover from the ongoing crises and ensure long- term sustainability. A moratorium on debt from 1st April 2023 to 30th March 2024 may be implemented to avoid large-scale NPLs and severe negative impact on the banking sector.

2. Letters of Credit for Cotton Import

Pakistan’s domestic cotton production has declined to a historic low this year, dropping to 5 billion bales for the current year mainly due to heavy rains and floods. There is a shortage of 10 million bales that need to be imported in order to sustain exports of $19.5 billion.

Unfortunately, cotton imports have been severely restricted in the country. Banks are not opening L/Cs or retiring cotton imports through CAD. This shortage of raw materials will lead to the closure of the textile industry. Opening of at least $250 million L/Cs of cotton imports per month should be allowed and may be classified as ‘Must Open’.

3. Release of Cotton at Ports

Substantial cotton shipments have already arrived at the port and await to be released. Only the cotton shipments belonging to the direct exporters are being released, however, shipments of the indirect exporters have not been released. Given the structure of the industry, 80% of the textile value chain is classified as indirect and without treating them at par with the direct exporters, the sector will collapse. All cotton at ports must be released immediately.

4. Working Capital/Zero Rating

With the withdrawal of the Zero- Rating (SRO 1125) and the implementation of an 18% General Sales Tax (GST) on export-oriented sectors, the cost of doing business has increased to unsustainable levels as a consequence of increased working capital and the much higher interest rates. Currency depreciation of 60 percent in the last year with no corresponding increase in working capital facilities. Foreign buyers extending payment period against shipments as well as accumulation of “Deferred Sales Tax” which has not been refunded for the last 3 years. It is no longer possible for the industry to pay 18% sales tax on inputs and await refunds 6-8 months later if and when payable as the FASTER system is being routinely bypassed.

Read more: Textile sector fears losing orders due to unavailability of cotton yarn

Sales tax is consumption-based, which inflates inventory and capital costs, serving as an impediment to new projects and the expansion of exports as capital cost increases by 20%, and the refund can only happen after commercial operations. Because of high rates of sales tax, trade volumes outside the Sales Tax System have expanded, resulting in smuggling, outright fraud, and the import of used clothing into the country. Sales Tax should only be deducted at the point of sale. This will subject any product sold domestically from any source to an 18% sales tax, including smuggled goods.

There should be immediate refund of all deferred Sales Tax, Tuff, and other dues. Restoration of SRO 1125, zero rating for the textile value chain.

5. Long-term Financing Facility (LTFF)

SBP has not yet approved the limit for the banks and the banks have categorically refused any indication for approval of enhanced LTFF limits, thereby, forcing the customers to retire their L/Cs for machinery at a prohibitively expensive rate as the mark-up allowed renders the projects unfeasible.

In reference to the recent increase in markup rate of the Export finance scheme (EFS) and Long-Term Financing Facility (LTFF) by 2% to 3% by the State Bank of Pakistan (SBP). The hike is unjustifiable as the ease of doing business in Pakistan is already at an unsustainable level as a consequence of increased working capital requirements and the much higher interest rates. The international buyers are demanding a guarantee of their orders whereby the exporters have literally no working capital. This hike will further increase the cost of export-oriented goods and exporters may face further financial issues due to the higher cost of borrowing even if it is available which at present is not. This will consequently make new projects’ upgradation and enhancement capacity almost impossible hence affecting long-term productivity as well as an increasing gap in the global competitiveness of the textile industry. Increase Working Capital limits in line with exports.

6. Sales Tax Refund System Not Functional

“Deferred Sales Tax” has accumulated as no refunds of deferred amounts have been made in the last 3 years. It is no longer possible for the industry to pay 18% sales tax on inputs and await refunds 6-8 months later.

Deferred refund claims still lying with the tax department which requires a timeline and solution for settlement. A certain portion of refund claims is deferred by the online system due to technical reasons for the cross-verification of buyers’ and suppliers’ data. The FASTER system usually raises typical objections and errors in the data, which can be resolved by refund processing officers for the last several months a huge bulk of deferred claims has been stuck with FBR. A further amount remains unaccounted for. To overcome the technical issues, a number of sales tax standing orders have been issued by the LTUs/RTOs for the guidance of tax officers but they keep deferring claims unnecessarily.

Read more: Why is Pakistan’s textile sector losing international orders?

In the current circumstances when shipments and orders are being deferred and the cash flow situation of the companies is stretched to the point whereby even cash flow for wages and salaries is difficult to maintain. Given that 80% of the textile sector’s products are exported and the nonfunctional refund system, government must reintroduce zero rating.