State Bank of Pakistan went to Twitter today to announce that the capital inflow via the government’s Roshan Digital Account has crossed the $1 billion mark. The tweet said, “An event to thank our Overseas Pakistanis for their extraordinary response is being planned soon.” Central Bank announced, “Exciting new products will also be announced.”

Similarly, the Prime Minister of Pakistan, Imran Khan also went on Twitter expressing his gratitude towards the “overseas Pakistanis for their overwhelming response.” The premier also thanked the State Bank of Pakistan and the commercial banks, “for achieving this significant milestone in such a short period.”

Alhamdulillah, funds received through #RoshanDigitalAccount have crossed $1bn. I would like to thank our overseas Pakistanis for their overwhelming response; also appreciate the efforts of SBP & banks for achieving this significant milestone in such a short period. #1billionRDA pic.twitter.com/YNksGLXzpM

— Imran Khan (@ImranKhanPTI) April 24, 2021

The State Bank’s latest initiative Roshan Digital Accounts (RDA’s), in collaboration with commercial banks operating in Pakistan, launched on September 10, 2020, has managed to captivate the attention of the overseas Pakistanis by offering much higher returns on deposits compared to the returns in developed economies.

The initiative was introduced to allow the Non-Resident-Pakistanis (NRPs) to use banking, payment, and investment activities while still staying in their respective host countries.2

Read More: Moody’s says remittances growth is credit positive for Pakistan’s Banks

The SBP website mentions all the features and steps to access and use the accounts in great detail for the people to use.

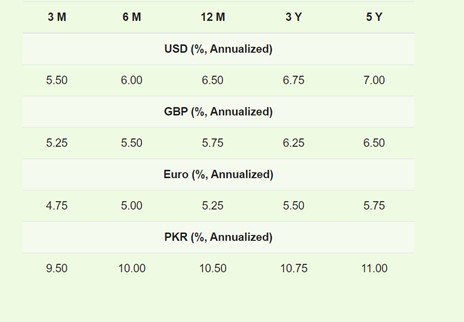

The RDAs are also Enabling investment by non-resident Pakistanis in Naya Pakistan Certificates (NPCs) issued by the Government of Pakistan, in USD, GBP, EURO, and PKR at very attractive risk-free rates and in both conventional and Shariah-compliant forms.

On NPC, only a 10% withholding tax on profits is applicable that is full and final. No filing of tax return is required. Resident Pakistanis who have assets abroad declared with FBR can also invest in USD/GBP/EURO denominated NPCs. To do so, they can open a Roshan Digital Account in foreign currency by visiting a bank branch in Pakistan. The latest rate of return on the foreign currencies are given below:

RDAs will also provide NRPs with digital access to all conventional account services including funds transfer, bills, and fee payments, and e-commerce. It also enables investment in the Pakistan Stock Exchange and real estate in the country.

According to an analysis done by different organizations and early reports by GVS, it is said that the Roshan Digital Account has been launched at an appropriate time, during the pandemic, when people cannot use unofficial sources like hawala and hundi to send money to Pakistan.

The State Bank had previously predicted this rise in capital inflows during Ramadan as people are sending money to charities in the country and to their families as Muslim Eid Festival approaches.

As mentioned, another reason for RDA being attractive to people abroad is because the rate of return being offered by the SBP is much higher than that of other countries’ central banks.

Read More: FDI declines by 35 percent in 9 months

Usage of RDA by the NRPs has contributed hugely to increase Pakistan’s foreign reserves and thus making the net capital flow in the country better than before.