Amid much public glare, Senate elections on half of the seats took place yesterday wherein the ruling PTI has emerged as the largest single party with 26 seats in the upper house.

That said, crucially for PTI, Minister for Finance & Revenue Dr Hafeez Sheikh has been unsuccessful in his bid to become a senator from Islamabad, losing to former Prime Minister Yousuf Raza Gillani. Dr Sheikh’s loss could potentially result in an ‘eventual’ change of guard at the Finance Ministry given the Supreme Court’s earlier ruling wherein unelected individuals could only be appointed for a period of six months under Article 91(9) of the Constitution.

That said, recall that Dr. Sheikh had been appointed as Federal Minister for Finance & Revenue on Dec 11, 2020 –meaning he can continue to be the FM for an additional 3 months before the expiration of the 6M grace period, as per our understanding. This can give the incumbent PTI government much time to potentially get him elected on a ‘safe seat.

In another development, the Govt. is reportedly filing a motion for a ‘Vote of confidence in the Parliament today. We believe with the motion not being a secret ballot and considering that PTI was announced successful on the female seat in the Capital, the Govt. should be able to turn the vote in its favour, providing much-needed clarity on the political front.

From the market’s vantage, a knee-jerk reaction to FM Hafeez Sheikh’s loss will likely weigh heavily, albeit in the near term due to a perception of possible implication on the IMF program. However, we believe the country would remain in the IMF program as long as performance targets are achieved, keeping Pakistan’s growth story intact. Hence, any possible correction should be taken as an opportunity to accumulate.

PTI largest party in Senate—loses a key vote in Federal capital

Amid much public glare, Senate elections on half of the seats took place yesterday wherein the ruling PTI emerged as the largest single party with 26 seats in the upper house. Crucially for PTI, Minister for Finance & Revenue Dr Hafeez Sheikh has been unsuccessful in his bid to become a senator from Islamabad, losing to former Prime Minister Yousuf Raza Gillani.

Dr Sheikh’s loss could potentially result in an ‘eventual’ change of guard at the Finance Ministry given the Supreme Court’s earlier ruling wherein unelected individuals could only be appointed for a period of six months under Article 91(9) of the Constitution. That being said, recall that Dr Sheikh had been appointed as Federal Minister for Finance & Revenue on Dec 11, 2020 – meaning he can continue to be the FM for an additional 3 months before the expiration of the 6M grace period, as per our understanding.

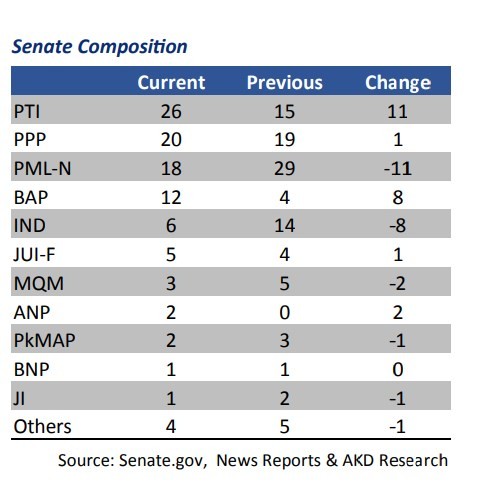

This can give the incumbent PTI government much time to potentially get him elected on a ‘safe-seat’. Overall, the ruling party along with its partners has bagged 43 seats in the senate whereas opposition under the banner of the Pakistan Democratic Movement (PDM) has gained 50 seats. That puts govt.’s ambition of gaining a majority in the senate at rest with Individuals and JI that cumulatively occupy 7 seats.

Read more: PTI wins majority in Senate despite major setback in Islamabad

‘Vote of confidence’ could bring much needed political stability

In another twist, the Govt. is reportedly filing a motion for a vote of confidence in the National Assembly today. As per the regulations, the vote should be conducted after at least three days and within seven days from filing of such motion.

We believe with the motion not being a secret ballot and considering that PTI was announced successful on the female seat in Federal Capital, the Government should be able to turn the vote in its favour. This should bring much-needed clarity on the political front, restoring confidence that Govt. would complete its tenure.

Market likely to be jittery in the near term; long term fundamentals intact

From a macro perspective, there will likely be noise on Pakistan’s program with the IMF with a general perception of Hafeez Sheikh being the architect of Pakistan’s negotiation with the IMF.

We believe the said perception is misplaced where given Pakistan’s recent economic performance, the country will continue to remain in the program as long as performance targets are being met. However, with the upper house likely to be ‘hunged’, the reform process the Govt. aims including legislations that are to be passed in order to remain in compliance with the program could face delay, in our view.

On the market side, a knee-jerk reaction to FM Hafeez Sheikh’s loss will likely weigh heavily, albeit in the near term. In the long run, however, we believe any downward movement is likely an accumulation opportunity with Pakistan’s growth story remaining intact.

Looking at the broader picture, nothing much has changed in terms of Pakistan’s political set-up – PTI continues to be the largest party in the Lower House and has just become the largest single party in the Upper House. On the flip side, a key near term headwind to potentially watch will be the election of the Senate Chairman.

Read more: PM Khan to seek vote of confidence from National Assembly: FM Qureshi

Disclosure Section

Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to transact in any securities or other financial instrument and is for the personal information of the recipient containing general information only.

AKD Securities Limited (hereinafter referred to as AKDS) is not soliciting any action based upon it. This report is not intended to provide personal investment advice nor does it provide individually tailored investment advice. This report does not take into account the specific investment objectives, financial situation/financial circumstances and the particular needs of any specific person.

Investors should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized.

AKDS recommends that investors independently evaluate particular investments and strategies and it encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

The securities or strategies discussed in this report may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. Reports prepared by AKDS research personnel are based on public information. AKDS makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete.

Facts and views presented in this report have not been reviewed by and may not reflect information known to professionals in other business areas of AKDS including investment banking personnel. AKDS has established information barriers between certain business groups maintaining complete independence of this research report.

This report has been prepared independently of any issuer of securities mentioned herein and not in connection with any proposed offering of securities or as an agent of any issuer of any securities. Neither AKDS nor any of its affiliates or their research analysts have any authority whatsoever to make any representation or warranty on behalf of the issuer(s).

AKDS Research Policy prohibits research personnel from disclosing a recommendation, investment rating, or investment thesis for review by an issuer prior to the publication of a research report containing such rating, recommendation or investment thesis. We have taken all reasonable care to ensure that the information contained herein is accurate, up to date, and complies with all prevailing Pakistani legislations.

However, no liability can be accepted for any errors or omissions, or for any loss resulting from the use of the information provided as any data and research material provided ahead of an investment decision are for information purposes only.

We shall not be liable for any errors in the provision of this information, or for any actions taken in reliance thereon. We reserve the right to amend, alter, or withdraw any of the information contained in these pages at any time and without notice. No liability is accepted for such changes.

Stock Ratings

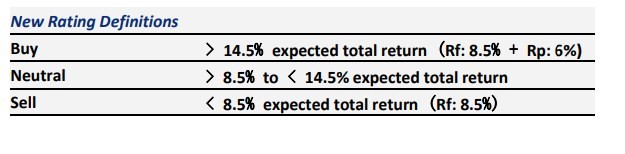

Investors should carefully read the definitions of all ratings used in each research report. In addition, research reports contain information carrying the analyst’s view and investors should carefully read the entire research report and not infer its contents from the rating ascribed by the analyst.

In any case, ratings or research should not be used or relied upon as investment advice. An investor’s decision to buy, sell or hold a stock should depend on individual circumstances and other considerations.

AKDS uses a three tier rating system: i) Buy, ii) Neutral and iii) Sell with total returns (capital upside + dividend yield) benchmarked against the expected one year forward floating (variable) risk-free rate (10yr PIB) plus a risk premium.

Valuation Methodology

To arrive at our period end target prices, AKDS uses different valuation techniques including, the Discounted Cash Flow (DCF, DDM), Relative Valuation (P/E, P/B, P/S etc.), and the Equity & Asset return based methodologies (EVA, Residual Income etc.)

Analyst Certification of Independence

The analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed and that they have not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report.

The research analysts, strategists or research associates principally having received compensation responsible for the preparation of this AKDS research report based upon various factors including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

Disclosure of Interest Area

AKDS and the authoring analyst do not have any interest in any companies recommended in this research report irrespective of the fact that AKD Securities Limited may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently, may make a primary market in issues of, any or all of the entities mentioned in this report or maybe providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment.

Regional Disclosures (Outside Pakistan) The information provided in this report and the report itself is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject AKDS or its affiliates to any registration or licensing requirements within such jurisdiction or country.

Furthermore, all copyrights, patents, intellectual and other property in the information contained in this report are held by AKDS. No rights of any kind are licensed or assigned or shall otherwise pass to persons accessing this information.

You may print copies of the report or information contained within herein for your own private non-commercial use only, provided that you do not change any copyright, trade mark or other proprietary notices. All other copying, reproducing, transmitting, distributing or displaying of material in this report (by any means and in whole or in part) is prohibited for the United States.

Compliance Notice

This research report prepared by AKD Securities Limited is distributed in the United States to Major US Institutional Investors (as defined in Rule 15a-6 under the Securities Exchange Act of 1934, as amended) only by Decker & Co, LLC, a broker-dealer registered in the US (registered under Section 15 of Securities Exchange Act of 1934, as amended).

All responsibility for the distribution of this report by Decker & Co, LLC in the US shall be borne by Decker & Co, LLC. All resulting transactions by a US person or entity should be effected through a registered broker-dealer in the US.

This report is not directed at you if AKD Securities Limited or Decker & Co, LLC is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that Decker & Co, LLC and AKD Securities Limited are permitted to provide research material concerning investment to you under relevant applicable legislations and regulations.

Courtesy: AKD Research