One of the discourses sparked during the recent federal budget of Pakistan for the financial year 2021-22 is the ‘burden of pensions’ on the national exchequer as the federal government for the first time has announced that the pensions shall be taxed.

Keeping this in mind, Finance and Health Minister of Khyber Pakhtunkhwa Taimur Khan Jhagra went on Twitter to explain the whole thing. The minister used data to explain why pension reforms were needed and how the burden of pensions is one of the biggest problems faced by the provincial government of KP.

Firstly, Mr. Jhagra talked about how over the last 17 years the pension as a percentage of provincial budget for the KP province had gone up from being 1.13 per cent to 13.4 per cent in the outgoing fiscal year 2020-21(FY21). The pension expenditure increased 95 times from costing Rs0.87 billion in 2003-04 to Rs83.1 billion in FY21.

1. A thread on pension reforms; why it is one of the biggest issues facing govt. & why we had to act now to reform pensions.

Pension costs have increased more than any other budget line across Pakistan; 95 times in KP from 2003-4 till today – from 0.87 bln to 83 bln / year. pic.twitter.com/qnZSCDWPn7— Taimur Saleem Khan Jhagra (@Jhagra) June 24, 2021

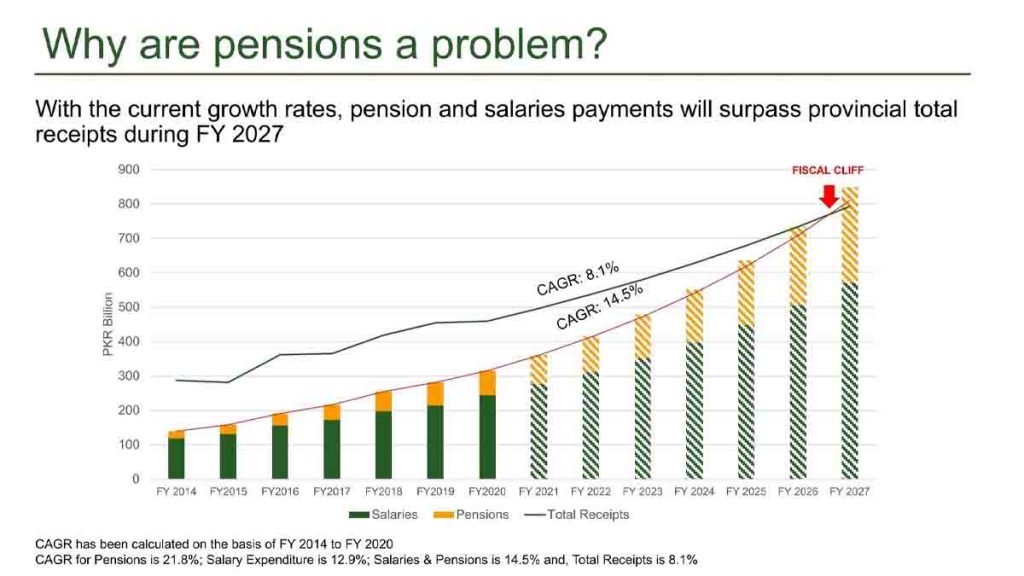

With such a high growth rate of pensions compared to provincial revenue, the minister mentioned that KP’s pension expenditure would surpass its revenue in “just 6 years”.

Thus, the minister wrote about the need for solving this problem today rather than delaying it for later. He wrote, “This was not a problem for tomorrow. This is today’s problem. No action puts the pension payments of existing and future pensioners at risk.”

Read More: KP to build 2100 schools, allocates 300% high budget for Sports, Tourism

The graph by the minister shows that the compound annual growth rate (CAGR) of the receipts/revenue of the province is 8.1 per cent, while the CAGR for the pensions and salaries is 14.5 per cent, and according to the current scenario, it is forecasted that the expenditure would surpass the revenue in FY2027.

The minister mentioned that with the current growth rate of government employees and current pension structure, the pensions are forecasted to reach Rs460 billion by 2030, from 86 billion today.

Why is this happening?

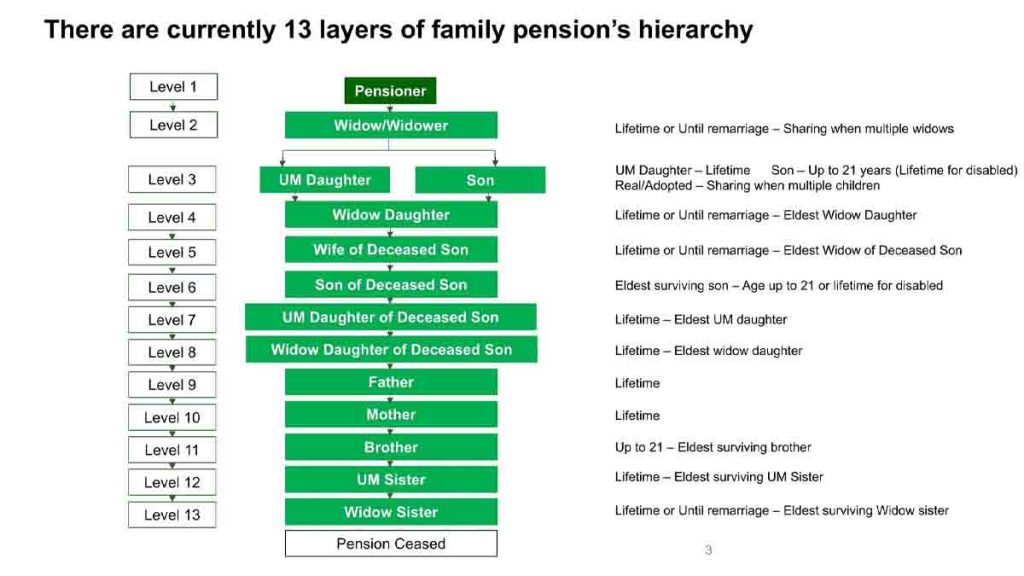

The first problem according to the minister lied mainly in the excessive 13 layers of pensioners receiving family pension prior to the recent reform.

This included the pensioner, widow, son or unmarried daughter, widowed daughter wife of a deceased son, son of a deceased son, unmarried daughter of a deceased son, the widowed daughter of a deceased son, father, mother, brother, unmarried sister, and widowed sister.

Minister Jhagra said that pension ceased, unless any of the previous set of relatives’ status changed, in which case the pension could be revived.

The second issue was with the structure of the current system that allowed 1935 individuals to draw two pensions, and 738 active employees to take a salary plus a family pension.

Read More: Did PTI present a pro-people budget?

Additionally, in the old system, 5000+ employees took early retirement at age 45, mostly teachers, drawing a full pension plus working in the private sector as teachers.

The mechanism was “unworkable”, according to the minister. It is because the growth of pension fund was slower than the growth of pension expenditure demand. According to the data shared by him, the fund stood at Rs56 billion with an average growth rate of 10 per cent while the pensions stood at Rs83 billion, with an average growth rate of 22 per cent. This meant that in itself the fund was unsustainable in the long run.

8. The pension fund mechanism in place was completely unworkable. In current form, the pension fund (Rs. 56 bln, ave growth 10%) would never fully fund pensions (Rs 83 bln, ave growth 22%); the fund itself was further depleting govt resources rather than resolving pension issues. pic.twitter.com/Is9djcuqXN

— Taimur Saleem Khan Jhagra (@Jhagra) June 24, 2021

The minister remarked that to utilize the pension fund as an endowment to fully fund pensions, the fund size today would need to be over Rs. 1,000,000,000,000 (one trillion).

The elephant in the room was that Pakistan is one of the only countries worldwide with a completely unfunded pension program.

Thus, the government had to bring reforms under the recent budget, hence making the pensions sustainable.

Reforms

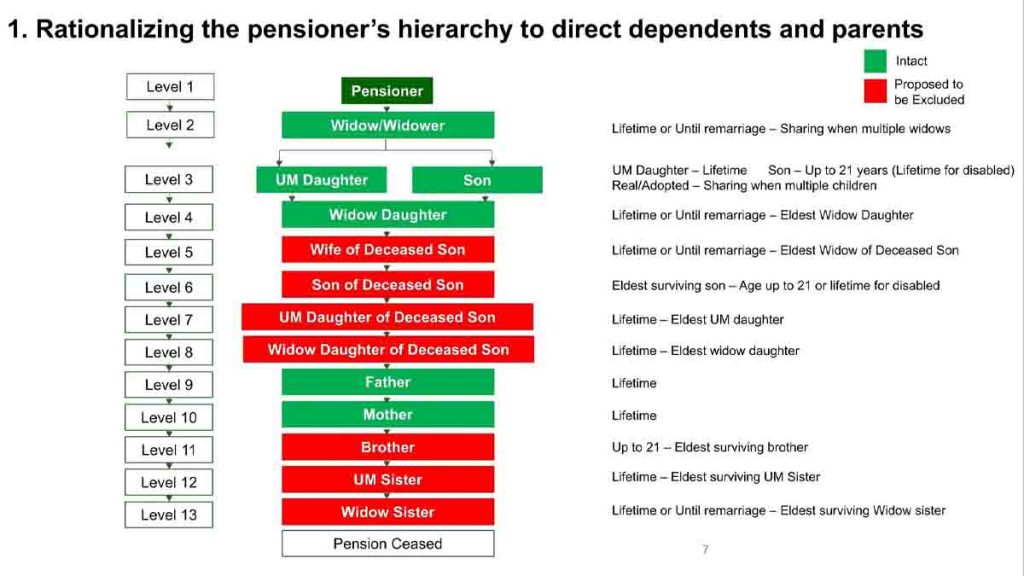

First, the incumbent government of KP has changed pension rules to reduce tiers in the pension hierarchy to dependent children, in line with international standards, and parents, and used the savings to increase the pension payment prospectively to widows from 75% to 100% as announced in the budget.

The government has increased the minimum early retirement age from 45 to 55, which saves over Rs. 12 billion in the first year, and over Rs. 150 billion in ten years.

KP government has also disallowed the withdrawal of dual pensions, or pensions being drawn by active employees, deterring the abuse of public funds.

The provincial cabinet has approved the introduction of a defined contribution pension system, and the establishment department will move an amendment to the civil servant’s act to make all new employees liable to participate in the new contributory pension programme.

The contributory pension programme, which we will try to enact within 2021-22, will be compulsory for new employees, and optional for existing employees. It will give pension cover to over 100,000 public servants (in companies, authorities, MTI hospitals) without cover today.

To lighten the annual pension burden on public taxpayer money, the cabinet also approved a policy to utilize the profits earned on the pension fund to partially pay annual pension liabilities, allowing the use of the existing pension fund for its intended purpose.

Read More: Former FBR chairman comments on the new Budget 2021-22

The minister lastly thanked the PAS & PMS officers of the province, for graciously agreeing 20% of their pay raise would be contributed towards annual pension payments, creating the first pay-as-you-go pension mechanism for existing employees in Pakistan.