New Electric Charger Faces Major Quality Issues as Owner Calls It Practically Useless

2026 Jeep Cherokee Returns as a Hybrid SUV With Impressive Efficiency and Fresh Appeal

Jaguar Land Rover Rolls Out AI Scanners for Next-Level Vehicle Quality at US Ports

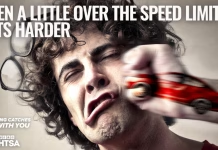

Why Rethinking Speed Limits Starts With Smarter Street Design

How Toyota Outsmarted High Import Taxes to Bring Trucks to America

Corvette Z06 Review: American Supercar Thrills Rival Europe at a Fraction of the Price

Why Brake Drums Could Make a Surprising Comeback Under New Emissions Rules

Toyota Yaris Ativ Hybrid Debuts with Sporty GR Trim and Impressive Fuel Efficiency

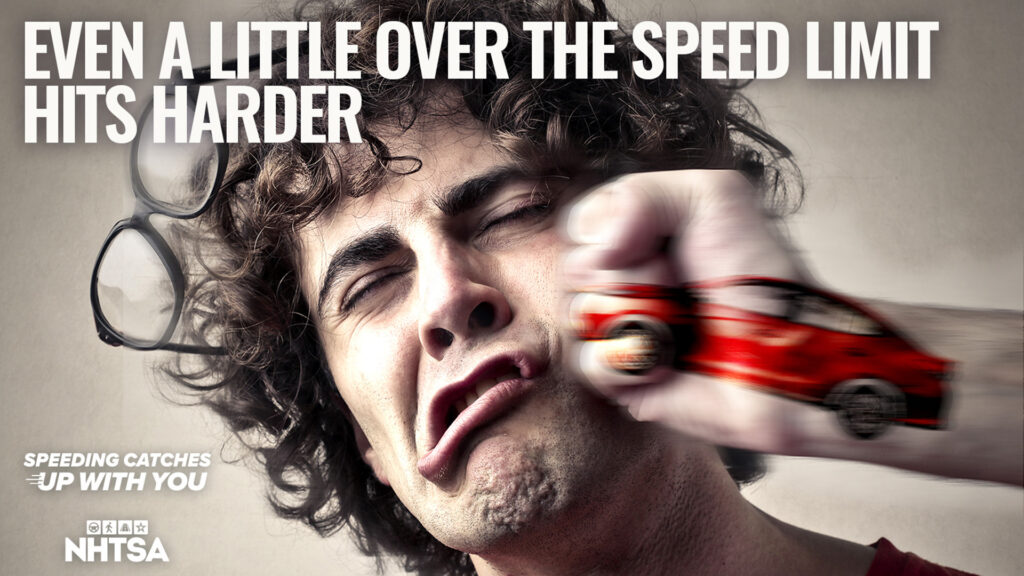

Chasing Aliens and Legends on the Extraterrestrial Highway in a Hyundai Santa Cruz

America's most mysterious mailbox is useful as aliens lack internet accessWe drive a Hyundai Santa Cruz to the top secret base – and find the US's most mysterious postbox

A lone black mailbox alongside the Extraterrestrial Highway is stuffed with letters addressed to aliens the American government supposedly keeps captive inside Area 51, the world’s least secret secret military base.

Bathed in the summer heat alongside Nevada’s highway 375 – officially renamed the Extraterrestrial Highway in 1996, because why waste a tourist opportunity? – you can see why the military would pick this part of the country to build a secret airbase, whether for holding aliens or ‘just’ to test new jet technology.

There is mile upon mile of nothing save for a circle of impenetrable hills made for concealment.

In the distance, a vehicle kicks up dust, heading our way. One of the base’s gates, and said to be how most civilian workers arrive for their shifts, bussed in from a town nearby (though distances are relative), is a good 20 minutes’ drive off the highway, along a dirt road.

The indistinct cloud of dust becomes a large white SUV as it nears, and eventually arrives at the roadside mailbox. A large sticker on the side reads ‘Scenic Photographic Tours’. A family emerges and starts taking photos.

The gate is about eight miles away, along two dirt tracks, the tour guide tells us, and if you want to go for a look, “they know you’re coming”. ‘They’ is used in the manner everybody does to describe a faceless, perhaps sinister, bunch of people in authority. Them. They. Not us. Among online Area 51 enthusiasts, base guards are often dubbed ‘camo dudes’.

Anyway, ‘they’ have got “seismic meters and cameras”, the guide says, which seems like overkill given that a camo dude wouldn’t even have to lift his aviator shades to spot the plume my Hyundai Santa Cruz would kick up.

But if we do go to the gate to take some pictures, even simply standing there might leave ourselves open to remote digital interrogation, I’m warned. “I’ve had people who’ve had camera phone pictures automatically deleted,” the guide says.

“I had a woman with a digital SLR camera who got back into the car and found all her images of the gate had disappeared.”

I’m here, and in a Santa Cruz, because I’m looking for a better way to end the historic Route 66 driving tour, which runs from Chicago to Los Angeles, loosely following the passage taken by early pioneers travelling in search of a better life. I drove it a few years ago and enjoyed it but had wondered if there was a more interesting path from one side of the US to another, particularly as local enthusiasm for Route 66 feels like it wanes the further west you get: there’s a bit more going on than in America’s quiet middle, where the road is often the biggest show in town.

I’d been in Santa Fe, New Mexico, to preview the new Hyundai Santa Fe and interview its designer. So I picked up the Santa Cruz, and then picked up Route 66, just down the road in Albuquerque.

We don’t get the Santa Cruz in the UK, but it’s the car that Hyundai UK most gets asked about importing. I understand the appeal. Based on the Hyundai Tucson, it’s a good-looking lifestyle pick-up truck that is a smidge under 5m long, making it a compact truck in the US. It comes with a five-seat double cab and a relatively short, 1.3m load bay.

And a reputation for not being a ‘proper’ truck, at least in the eyes of those who like their pick-ups bigger, burlier and more separate of chassis and body.

The unitary-bodied Santa Cruz is a family-friendly alternative to an SUV, then, which would be considered perfectly capable if it ever arrived over here. In this upmarket spec, it has four-wheel drive, and a 2.5-litre turbo four-cylinder petrol engine making 281bhp and 311lb ft, which one American review says is “better suited to urban driving” than the non-turbo base model. Different world.

Anyway, it definitely feels more car-like than the brasher, more rugged and much, much larger trucks with which it shares the highway west out of Albuquerque. In large parts, the road that constituted historic Route 66 has been supplemented by four- or six-lane highway parallel to it, because after all there’s plenty of space to keep both.

So if you want to drive the totally authentic original, you can, but it’s no more interesting and most of the time you’d be within sight of it, plus there’s an exit for every town so you can get the full Radiator Springs experience: bypassed ranch towns that, as trains became longer and trucks able to drive faster and further, slowly became forgotten.

At this point on the route, the most interesting things to see are off the highway. The Navajo Nation’s Window Rock. The Petrified Forest. The Grand Canyon. Las Vegas?

If Vegas isn’t quite your cup of tea, not far before it is the Hoover Dam. What a thing. The numbers are so vast as to be almost incomprehensible. It’s constructed from 3.36 million cubic metres of concrete; the artificial lake behind it stretches for 115 miles; its 17 turbines produce 2.08 megawatts of power; and there are spillways vast enough, with drops tall enough, to make your correspondent feel decidedly queasy. If a train of Santa Cruzes poured one load bay of water into the reservoir every 30 seconds, it’d take 38,860 years to fill it.

It is an astonishing piece of engineering, and from its completion the federal highway drove straight across the top of it. Only in 2010 was it finally bypassed. It feels bonkers, driving over its slow single-lane road now, that this was the main highway.I don’t doubt there’s more concrete in Las Vegas – certainly the city lights use their share of 2.08 megawatts. And there’s a fairly straightforward route to Los Angeles directly from the city, which is packed at weekends, on Fridays with cars heading out of California, with the opposite exodus on Sundays.

Our route, though, is the less travelled northern one, towards empty highways, the tiny town of Rachel, its alien-themed cafe (the Little A’Le’Inn) and the myths of Area 51.

I’m enjoying the Santa Cruz. It’s got a decent ride that doesn’t have the crashy, basic agricultural vibe of even the best separate-chassis pick-ups we get in Europe. For the most part, you can forget it’s a pick-up at all and think of it like an SUV you can take fishing or hunting or surfing without the cabin smelling on the way home.

It steers with heft but accuracy, rides with a firm composure, and has digital dials and a big touchscreen. If it weren’t for radio stations featuring adverts for nasal vacuums (“clean nose, healthy life!”) and ‘prostate secrets’ (.com!), and playing songs like ‘I’m rednecker than you’, you could almost convince yourself it’s a European experience.

The roads, the space and the emptiness are all pure Americana, though. A wide, sweeping set of bends leads downhill towards the Extraterrestrial Highway, whose quirky, digital-font signage is covered in stickers from all parts of the world.

For all of the seriousness of there being an actual secret active military airbase nearby, they ham up the alien mythology with a knowing wink. When, in 2019, there was an “Area 51 Raid” organised online on the basis that “they can’t shoot all of us”, additional policing was drafted in.

But ultimately the event had all the threat of a village fete, the most risky activity being selfie-taking in front of the ‘don’t take photos here’ signs outside the razor-wired gate, to the shrugging permission of by-standing guards.

So we go too, off the main highway and onto the dirt track, which you don’t strictly need a pick-up’s 4x4 system to navigate, but which isn’t unhelpful in deeper sand. One suspects this is as hard as most Santa Cruzes will be worked but there’s plenty of terrain like this in the US, and it deals with it nicely, slipping around entertainingly.

Do they notice us with their spy drones and seismometers? We’re probably not worth the trouble. On an average day, there must be a dozen cars and tours that turn up to peer over the gate at a remote sentry camera, which is all overlooked by a white pick-up on a low hillside – ‘camo dude’ presumably aboard.

We stay a few minutes. On the return leg, a white Chevy Suburban with darkened windows passes us but, let’s face it, it’s more likely that a shift manager than Paul the alien is on board.

Back on the road, we swing a left towards the restaurant, and then drive on another six hours towards California, through the desolation of Death Valley, past an aircraft graveyard, and eventually out onto the busy highway that runs down into Los Angeles.

This is a cooler, more intriguing, end to Route 66. And an interesting car to do it in. I check my phone to see if any pictures have been deleted. No. No, they haven’t been.

Subaru Powers Factory Robots With Breakthrough Solid-State Batteries Before EVs