Dr. Omer Javed |

The only sustainable way to deal with the high current account deficit, low level of foreign exchange reserves, and repayment of debt- including lowering the need to raise higher amounts of external debt in the future- all require increase in the quantity and quality of exports, by improving the supporting factors, and by moving towards higher value-adding commodities and services.

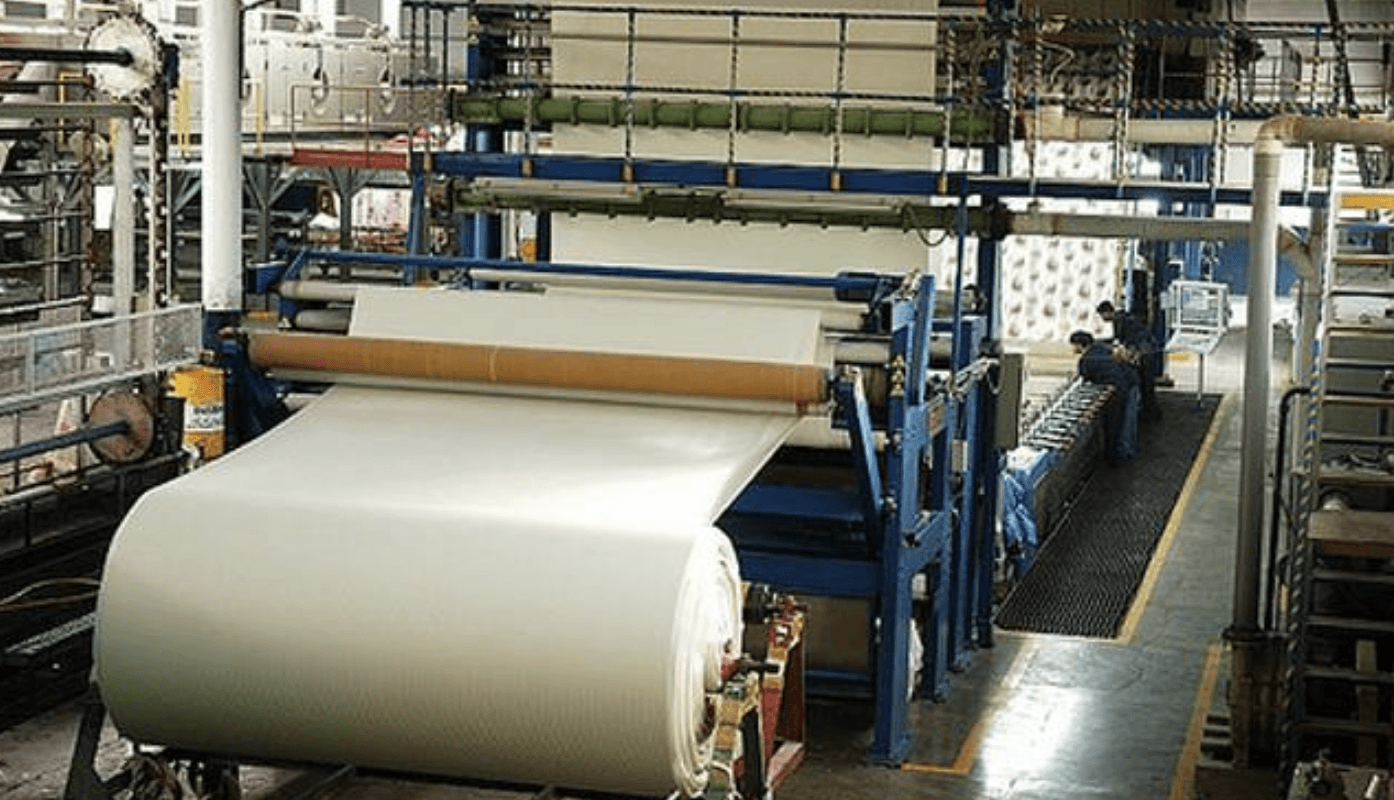

Textile is the main export of Pakistan since many years now; composing more than half of the total exports- hovering around 50-60 percent-, absorbing around 40 percent of the total manufacturing labour force, and a little less than half of the total manufacturing output at market value, along with contributing around one-tenth to the overall gross domestic product (GDP) of the country. Yet, since the national output of the economy is far below the potential output, and the overall export level is also on the lower side- around USD 20 billion average over many years- means that the potential in the textile sector has been far from achieved.

Spinning- which involves converting man-made fibers or cotton into yarn- and the fact that it is fundamental to the quality of textiles produced in the subsequent processes, makes this stage of the overall process very significant.

Composed of a number of sub-sectors, as revealed by the textile-value chain, for better understanding, the textile sector could be illustrated with the help of a flow chart below (see figure 1). Basically, the cotton feeds into the ginning sector and through it to the spinning sector. Thereafter, it ends up in both the weaving and knitting sub-sectors, after which- along with the man-made fibres and filaments that after going through spinning and weaving phases, with no ginning required in this case- pass through to the next stages of a) printing and dying, b) apparel and made-ups, and c) toweling/industrial textiles.

Figure 1: Textile Value Chain

Notwithstanding the huge potential that the textile sector could hold for Pakistan, the ground realities are quite disappointing, since both the quality of cotton fiber could not meet international standards, and also share of Pakistani textiles in world exports has not even gone beyond a meager 5 percent; where the pace of growth has also been slow, since in 1990 it was 2.6 percent, and even 15 years later in 2005, it was 3.5 percent. Some of the reasons behind the underperformance are indicated below:

Read more: “Anti-industry” policies of the government: Textile Association to protest

- Quality of cotton produced is below international standards, at the back of a) unclean picking, poor ginning and ineffective removal of contamination, b) lack of incorporation of modern technologies, c) inadequate supply of water, d) great differential between low and high performing cotton yields, and e) application of inefficient techniques of managing cotton crops. The result of all this and other factors is that cotton fiber has remained well below international standards.

- Efforts by the government to improve the quality and quantity of cotton have left a lot to be desired in terms of implementation, as targets have been missed many times. For example, in 2006, the government launched ‘Cotton Vision 2015’ but targets that were then set for 2015- which included a) production of bales to be around 21 million, b) per acre cotton yield to be 1,060 kg, c) cotton bales exports to be 0.6 million, and d) cotton yarn recovery to improve to 92 percent- could not be achieved. Moreover, the efforts in the past by the government and textile owners have resulted in an increase in low-value adding textiles- cotton yarn and woven fabrics- and not high value-adding textile exports like bed linen and towels; resulting in both the low proportion of share in world textile exports, and also the slow pace at which textile exports earnings increased over time. So while the overall share has increased, the returns in terms of foreign exchange earnings have not matched the increase that would have materialized if adequate shift towards high value-adding textiles could be made.

- The process of ginning- removing lint from cotton seed- is inadequate, for reasons including, a) around two-thirds of the total installed ginning units stand non-operational, b) absence of ginning control and monitoring process, resulting in cotton being virtually totally hand-picked, c) employed level of technology in the ginning process being obsolete, even of the times of 1940s and 50s, resulting in a level of efficiency of a lot less- even to the extent of being one-fifth- than that of for example of USA, and d) lack of standardization.

- Another important reason for the slow increase in textile exports as a proportion of world textile exports is the poor performance of the dying, printing, and finishing sectors; leading to poor quality garments/home textiles produced.

- Spinning- which involves converting man-made fibers or cotton into yarn- and the fact that it is fundamental to the quality of textiles produced in the subsequent processes, makes this stage of the overall process very significant. Yet, spinning capacity is only around 5 percent of total world capacity. The sector suffers from lack of product diversification and low share of high value-adding yarns in its overall production; and requires shifting to both modern processes and skilled labor capacitated to adopt such processes- at both the levels of ‘ustaad’ (or master trainers) and managers.

- Within the weaving sector- textile segment composed of woven fabrics, the power loom sector- labour intensive section of the sector- requires better trained labour force, while the shuttle-less weaving machines- the capital intensive portion of the sector- require shifting to a greater extent of computer-aided manufacturing (CAM), along with trained personnel to better manage and monitor quality and productivity. Such initiatives are important and need to be taken if Pakistan has to move up the current low level in world fabric share of around 7 percent.

- In the past the weaving sector had integrated units, composed of both ginning and spinning facilities, but lack of conducive policies- primarily with regard to taxation, and labor market regulations- the units fragmented, losing, in turn, their economies of scale advantage; with the result of the formation of independent power loom units. This integration needs to return at the back of better formulated and coordinated governance and institutional incentive structures in the fiscal and labor sectors if Pakistan is to compete with other textile exporting giants in the region.

- To enhance export potential in the weaving sector, the textile sector here needs to shift from the traditionally low value-adding export of fabric based on cotton, and rather towards high value-adding blended fabric. For this, the sector needs to plan and the government needs to facilitate a move towards synthetic and artificial staple fibers.

- The next three sub-sectors- fabric dyeing, printing, and finishing- are collectively part of the processing sector of textile. Here too, the share of Pakistani finished cloth in overall world textile trade is only a paltry 3 percent, with underlying reasons being a) inefficient processes, leading to placing the sector globally among countries with high percentage wastages- large proportion of rejection/reworks demanded by international buyers, on account of products being defective at dispatch time, b) absence of a thorough mechanism for holding/applying both in-process and overall controls and monitoring, c) well below capacity utilization; mostly because of the fact that around 50 percent of installed capacity is close to 40 years old, allowing in turn producers recover only break-even costs, and therefore, leaving little incentive for growth in textile production, in terms of both quality and output, and d) inadequate provision of water- both quality and quantity- to the processing sector, where otherwise good quality water, and that too in abundance, is needed in these processes. The government should make a supportive policy, in turn facilitating up-gradation- through an increase in targeted subsidies and favorable tax regime towards the processing sector- to stem both losses on account of under-utilization of capacity and the flight of textile producers to other countries with better facilitation environment.

- In the textile made-ups, there is a need to a) graduate to higher tiers of towels exports, b) improve processing part in the overall bed-linen production, which in turn could be enhanced through i) technology up-gradation to ensure meeting bed-linen quality standards internationally, ii) improving labour quality, and iii) rationalizing the current unjustified inter-industry price competition among the processing manufacturers, which hurts exporters at the individual level, and export earnings overall, c) penetrate to elite bed-linen market levels, by improving on the smallest of margins where betterment is required in the processes, since the competition is steep at these sophisticated levels, and d) gain greater and in-depth knowledge of global fashion/trends demands, to capture higher market share of these high value-adding export earning spheres; which in turn will also be important to remove the traditionally carried tag by the country of a low quality producer.

- The apparel industry- where Pakistan has around 5,000 garments units- captures only 1 percent of the apparel market globally. This needs to change drastically if Pakistan needs to boost its exports, and also cut down on its apparel related imports, in turn saving on foreign exchange reserves, which the country so badly needs to do as the current level of reserves could only support two months of import bill (well below the internationally recommended level of three months). Here, the exporters need to shift from the mostly traditional exports production to modern lines, including those in the category of sportswear. Also, the marketing strategy needs to improve, along with harmonizing the sector with a better understanding of global fashion trends.

Overall, on the supply side, issues range from lack of ease of doing business, including primarily lack of a) well targeted and substantiated subsidy structure, b) fluent level of electricity, and at rates that allow the sector to remain internationally competitive, c) training programmes for raising the level of productivity and compatibility with modern computer-run processes, especially in sectors like spinning, weaving, and knitting, d) programmes to shift the industry to higher value-adding products- currently, the composition of exports is highly skewed in favor of low-value adding cotton and cotton yarn; and even within that low-coarse and medium yarns, and e) technical support at the governmental level to make the textile sector more compliant with World Trade Organization’s (WTO) textile related protocols.

The PTI-led government has talked little, if at all, towards highlighting the issues and coming up with a policy framework, and with regard to short, medium and long term prongs of a textile policy.

Within the subsidy scheme, the government could raise the amount and scope of previous schemes such as a) Research and Development (R&D) related subsidy- increasing the amounts from paltry levels of for example, around Rs. 50 billion during fiscal years (FY) 2005/09; which will also enhance the scope of finding better ways to improve efficiency in the current processes and productivity levels, and will also allow shifting towards more value-adding ventures, and b) mark-up subsidy- given to the spinning sector; where the amounts were not that much, for example during FY 2007/10, at less than Rs. 1 billion in any of the years indicated, and therefore needs to be increased many folds and across the entire textile value chain. Moreover, not much improvement has materialized on these counts over the last few years as well. The volume and extent of subsidy programmes certainly need upward revision, especially when other textile exporting countries in the region have a lot bigger supportive programmes for their textile sectors.

At the same time, advances to the textile sector as a proportion of overall advances by banks, have been historically quite low. Even within it, the concessional lending portion was on the lower side, while the non-concessional lending formed the bigger chunk by a significant margin. Government, in its policy, will have to take up these issues with the banks and will need to reach a policy framework where both the overall levels, and within it the concessional part increase considerably.

Read more: Textile Industry: 100 mills to open as Govt allows subsidy

At the same time, the government will have to reduce its part of raising domestic borrowing so that greater amount, and that is at lower interest rates, could be made available for this important exporting sector. Moreover, the State Bank of Pakistan will have to rationalize the higher levels of banking spread- a difference between lending and deposit rates- over many years now, so that the entire situation of bank finance could be made more favorable for domestic and international investors, in this and other sectors of the economy.

On the demand side, there is no proper taxation regime to shift the undue burden of indirect taxes and withholding taxes on the sector. Here, there is also an issue of zero-rating, at the back of poor design of taxation structure, since refunds/rebates generally outpace actual sales tax returns. The proper way is to implement a well-functioning and rationalized value-added tax and income tax, so that the entire textile value chain a) shares the burden of taxation, b) gets documented, and therefore, comes in the mainstream, and c) comes under an income tax regime that is progressive in nature, and does not rely on regressive withholding taxes. This will also help reduce the ever increasing income inequality between the owners/beneficiaries of various sub-sectors of the textile industry.

Last but not the least, the energy and water-related, and other ease of doing business elements will have to be improved by the government for providing a better overall environment for the textile sector, among other sectors of the economy.

The textile sector has the potential to become the growth engine of export earnings in Pakistan, along with allowing the opportunity to the government to meaningfully cut-down on imported textile products. The PTI-led government has talked little, if at all, towards highlighting the issues and coming up with a policy framework, and with regard to short, medium and long term prongs of a textile policy.

At the same time, the government needs to be creative in its policy by making better planning and utilization of foreign aid towards projects that improve this sector, along with creating a special coordinated section under the overall Ministry of Trade and Ministry of Textile, which advises and helps prepare the sector in becoming aware and compliant of WTO (World Trade Organization) related protocols.

Read more: Boost for Textiles as Indonesia announces concessions for Pakistan

Moreover, the government should prepare the CCP (Competition Commission of Pakistan) to have better management of the industrial price related with collusive practices in the textile sector and involves SBP (State Bank of Pakistan), banks and stock exchanges in coming up with a more efficient and extensive facilitation programme towards this sector. Last but not the least, the energy and water-related, and other ease of doing business elements will have to be improved by the government for providing a better overall environment for the textile sector, among other sectors of the economy.

Dr. Omer Javed holds Ph.D. in Economics from the University of Barcelona, Spain. A former economist at International Monetary Fund, he is the author of Springer published book (2016), ‘The economic impact of International Monetary Fund programmes: institutional quality, macroeconomic stabilization, and economic growth’. He tweets at @omerjaved7. The views expressed in this article are author’s own and do not necessarily reflect the editorial policy of Global Village Space.