Pakistan’s economy is bouncing back and it is being recognized by overseas investors. Since last year, Pakistani start-ups have attracted millions of dollars from abroad. The Fintech industry has also emerged as a promising avenue for international investors. The benefits of Fintech can be availed by a large variety of sectors and so it is expected to expand in the coming years.

Fintech is the application of technology for delivering financial services and is a rapidly growing industry worldwide. Fintech providers are involved in improving existing services and creating alternate solutions to maximize benefits. They are quickly filling the gaps left by the traditional banking sector.

Read more: These 3 startups are here to disrupt the traditional systems of Pakistan!

Businesses across the world are turning expeditiously to Fintech for managing their finances and to deliver their products and services. Digital payment facilities have become essential as they can better cater to consumer behavior in the digital era.

Due to the restrictions imposed on traditional economic activities by COVID-19, the importance of digital financial services has been widely realized. The fintech industry is not only helping businesses to adjust their operations but is also contributing to relief activities. The adaptability of this industry in such a challenging era is a major source of confidence for investors.

Read more: The future of banking; a lethal phenomena

Financial inclusion is important

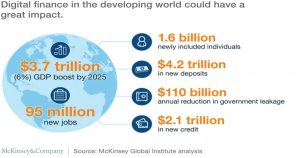

Emerging economies in particular have seen a rapid rise of digital financial services in recent years. The traditional financial institutions in these economies have not been swift to adapt to technological innovations which have allowed Fintech companies to secure customers through their less complex services.

Major segments of the population in developing countries have remained unbanked but now they have access to a range of financial services through their smartphones.

Financial inclusion is considered a crucial component of a thriving economy. Affordable and practical access to financial products and services boost economic activity and support poverty eradication.

Read more: PM Khan to launch Ehsaas’ Mobile Saving Wallets initiative

In 2017, a study by World Bank revealed that 100 million adults in Pakistan did not have a bank account which is more than half of the adult population of the country. Lack of cash and income resources, using a relative’s account, unwillingness to pay bank charges, religious reasons, not possessing required documents, and geographical barriers are some of the reasons why so many people in the country remain unbanked.

There have always been concerns regarding the low number of people using banking facilities as it reflects poorly on the overall state of the economy. It is also a reflection of income inequality and gender disparity.

Empowering women

Not surprisingly, the majority of the unbanked adults are women who have to face societal barriers as well. With better access to financial tools, women can play a major role in uplifting their households and eliminating poverty.

In Kenya, M-Pesa has been a very popular initiative that has helped in increasing financial inclusion rates considerably. It has helped users to lift themselves out of poverty and has enabled women to upgrade their professions.

Read more: President Alvi: Economic independence important for women empowerment

Similarly, the growth of Pakistan’s fintech industry has already helped in overcoming a number of barriers to financial inclusion. The constraints which keep women out of labour force are also now more likely to be stamped out.

Females constitute a major chunk of the much-feared youth bulge in the country. Accommodating an ever-growing number of labor force participants each year is a daunting challenge.

However, the talented youth of the country which can capitalize on digital financial services is an asset and the government should back the Fintech sector with enabling policies.

Read more: Motivation is the key to Pakistan’s rise

Fintech taking over

The impressive rise of the Fintech sector in a sluggish and COVID-hit economy in recent years shows that it has a critical role to play in the future. The government should look to strengthen the industry by encouraging innovation and supporting financial education initiatives.

Some of the key economic policy targets have been made easier to achieve due to technology-backed financial services and this should encourage all the stakeholders to carry forward this momentum.

Apart from achieving policy targets, government departments are extending digital payment facilities to citizens. Online Payment of utility bills, fines, and processing fees has enabled citizens to save time and travel costs.

Read more: Digital payments flourish in Pakistan

On the other hand, this mechanism is supporting public institutions to enhance their efficiency and tackle malpractices. The use of physical cash in high volumes is vulnerable to leakages and these transactions are also difficult to trace.

There is strong evidence from different parts of the world that digital payments significantly cut down leakages. In India, the Direct Benefit Transfer scheme helped in saving billions of dollars by eliminating fake or duplicate beneficiaries.

Transparency and security offered by digital payment systems are helping developing countries to overcome long-standing issues while improving the perception of public institutions. The revenues of government-run projects have also increased after digitization.

Read more: Digital payments, step toward cash-free society

The advantages of Fintech in Pakistan are wide-ranging and there is a huge potential for growth. The economy which used to suffer from a lack of diversity and opportunities now has a bright future ahead because of digitization and financial inclusion.

Author, Ali Haider Saleem has worked with the Institute of Strategic Studies Islamabad (ISSI) and National Defense University (NDU). His research interests lie in sustainable development, regional integration, and security cooperation. He has studied public policy at Queen Mary University of London and economics at NUST, Islamabad. The views expressed in the article are the author’s own and do not necessarily reflect the editorial policy of Global Village Space.