Dr. Ashfaque H. Khan, Dr. Hafiz A. Pasha, Dr. Salman Shah and Mr. Sakib Sherani|

The speed at which Pakistan’s debt, both domestic and external, has been rising in recent years has attracted considerable attention of several independent economists and analysts. Through their writings, they have been stating that if the pace of debt accumulation remains unchecked, Pakistan’s public debt in general and external debt, in particular, would reach an unsustainable level in the next two to three years.

In recent years, we, the authors of this response, have written extensively also on Pakistan’s emerging debt situation with a view to highlighting the very adverse macroeconomic consequences of accumulating large debt, domestic or external. Our writings appear to have had some impact in different quarters.This may have been one of the motivations for the Finance Minister, Senator Ishaq Dar, to react through his article on Pakistan’s debt (Feb 1, 2017, BR).

He has charged independent economists with being selective in presenting information, misinterpreting the facts, predicting doomsday scenario for Pakistan, and, most importantly, committing disservice to the nation. In his article, he has emphasized that, contrary to what the independent economists are highlighting, the debt burden has, in fact, been reduced.

Read more: Bloomberg thinks Pakistan will be an over-performer next year

The Fiscal Responsibility and Debt Limitation Act of 2005

The speed at which Pakistan’s debt, both domestic and external, has been rising in recent years has attracted considerable attention of several independent economists and analysts.

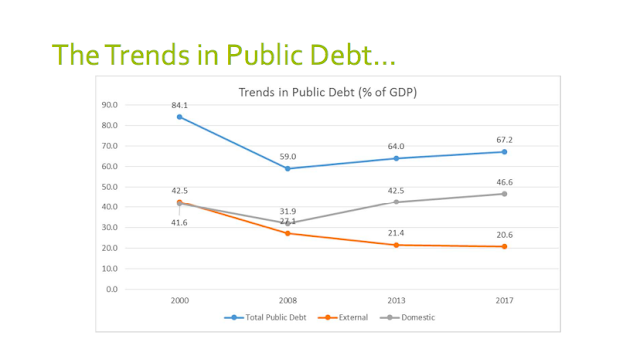

The Fiscal Responsibility and Debt Limitation Act of 2005 defined public debt as federal government domestic and external debt plus debt from IMF and external liabilities. The last item was excluded from public debt in the money bill for 2016-17.Based on the narrower definition, public debt has risen from Rs 6128 billion in 2007-08 to Rs 20542 billion by September 2016. As a percentage of GDP, it was 59.8% in 2007-08 and now stands at 67.7%. The corresponding figure for 2012-13 was 63.6% of the GDP.

The annual increase in this debt ratio is higher in the tenure of the current PML (N) Government than in the previous Government. More importantly, the ceiling on public debt of 60% of the GDP in the Act has been progressively violated since 2007-08. Given this trend, can we say that the debt burden has declined?

The Fiscal Affairs Department of the IMF has emphasized on the need to also use a broader definition of public debt. Ideally, this should include guaranteed debt of public sector enterprises, debt of sub-national governments (like commodity financing) and the other contingent liabilities (like the power sector circular debt). This raises the level of public debt by almost 10%, in relation to the level with the narrower definition, to over Rs 22 trillion. Consequently, the broader estimate of public debt has exceeded 73% of the GDP by September 2016.

Read more: Are Pakistani politicians dancing with Perkin’s hitmen?

We also have serious reservations over the focus only on public external debt by the Finance Minister. All forms of external debt need to be included because their debt servicing liability also falls on the foreign exchange reserves with the SBP. IMF and other IFIs use the broad definition of external debt in the analysis of debt sustainability.

The Finance Minister has indicated that external public debt was $ 51 billion as of June 2016. As opposed to this, the definition of external debt given in 2000 by the high powered Debt Reduction and Management Committee of the Ministry of Finance yields a significantly higher estimate of $ 73 billion. This also includes external debt of public sector enterprises, banks and the private sector. Contrary to the ratios given by the Finance Minister, which show a declining trend, the ratio of total external debt to exports or foreign exchange earnings has increased significantly after 2012-13.

The annual increase in this debt ratio is higher in the tenure of the current PML (N) Government than in the previous Government.

The country has added $12.2 billion of external debt and liabilities in three years as against $14.7 billion in the previous five years. As such, the speed of external borrowing has been somewhat higher in recent years. The PML (N) Government has contracted foreign exchange loans of almost $35 billion since induction into power, out of which $20 billion have been disbursed. Our forecast of the level of external debt is well over $100 billion by end-June 2020, inclusive of debt taken for CPEC projects. In the event sovereign guarantees are given to CPEC power projects then legitimately these should also be included in Pakistan’s external debt. Exports will have to, more or less, double if this large volume of debt is to be serviced.

Developments during current fiscal year

Further, there are a number of developments during the current financial year which are worrying. These include the following:

- The average tenure of domestic debt is on the decline. The outstanding debt in the form of PIBs has declined by Rs 720 billion in the first five months. Simultaneously, short-term debt in the form of MTBs has increased by as much as Rs 1334 billion. This will lead to a significant increase in the refinancing risk. Further, borrowing from the Central Bank has crossed Rs 900 billion, with potential inflationary impact after some lag.

- External borrowing has increased in the form of Sukuk Bonds and short-term loans from international commercial banks. These two sources account for over 40% of gross external borrowing in the first five months. This not only increases the cost of borrowing but implies higher risk due to the lumpy repayments.

- The anticipated big increase in the current account deficit will raise the external financing requirement for 2016-17 to over $13 billion. If there is a shortfall then reserves will come under pressure. Already, they have declined by $1.7 billion since October 2016.

read more: Love letter to Ishaq Dar from a fan

At the end, we take strong exception to the statement by the Finance Minister that independent economists are doing a disservice to the nation. We believe that the right strategy for building a buffer of foreign exchange reserves is not by higher external borrowing but by promoting exports, remittances and FDI and by discouraging non-essential imports. This will contribute to greater self-reliance and sovereignty at a time of greater uncertainty about global developments.

Ultimately, nobody has a monopoly over patriotism. In a functioning democracy, there must be space for open debate on major public policy issues.

Dr. Ashfaque H. Khan is the former Director General of the Debt Office. Dr. Hafiz A. Pasha, Dr. Salman Shah are advisors to the Prime Minister on Finance and Sakib Sherani is Principal Economic Advisor at the Ministry of Finance. The views expressed in this article are the authors’ own and do not necessarily reflect Global Village Space’s editorial policy. This piece was first published in Business Recorder. It has been reprinted with permission.